The owners of Selfridges are targeting regional cities, potentially paving the way for the retailer’s first new UK stores in two decades as they look beyond what is likely to be a period of difficult trading.

The luxury department store group operates from its iconic Beaux Arts building on London’s Oxford Street, plus one store in Birmingham and two in Manchester. It has not opened a new store in the UK for almost 20 years.

“Our strategy is not to stay only in capital cities with stores of 20, 30 or 50,000 square metres, but also to be present in second-tier cities or even small cities like St Gallen [in Switzerland],” said Stefano Della Valle, chief executive of Central Group Europe.

The Thai-owned company, controlled by the Chirathivat family, is one half of the venture that bought Selfridges from the Anglo-Canadian branch of the Weston family for £4bn at the end of last year. Austrian property group Signa is the other partner.

“We don’t have any plans as of today for new stores in the UK, but we are always alive to opportunities, like we were in Germany,” Della Valle told the Financial Times.

The venture is working on a new store in the German industrial city of Düsseldorf to complement KaDeWe in Berlin and Oberpollinger in Munich.

High-end department stores have traditionally traded from only a small number of sites in premium cities, reflecting the relatively narrow customer base for their expensive wares and the high operating costs of large opulent stores.

Harvey Nichols has four large-format UK stores outside London, while Harrods, Liberty and Fortnum & Mason have none outside the UK capital.

But the closure of many mainstream department stores has created gaps in some large cities.

“We think we are the only viable solution for luxury brands in terms of distribution, so we are interested in being present not only in capital cities but in regional cities,” said Della Valle, pointing out that the group operates nine Globus stores in Switzerland and nine Rinascente outlets in Italy.

The department store group is undeterred by Oxford Street’s well-documented problems; it is choked with traffic and its footfall has yet to recover to pre-pandemic levels as travel restrictions and sanctions keep Chinese and Russian tourists away.

In recent years there has also been a proliferation of tacky American candy stores on Oxford Street, sullying its image as a premium shopping destination.

“Yes, we have these problems right now, but I’m pretty sure London will remain one of the great centres of the world as it has been for centuries,” said Della Valle.

A more immediate priority for the venture is the refurbishment of the Oxford Street food hall, which could take two to three years.

Managers are also evaluating options for the former hotel and car park behind Selfridges’ vast main store building, which form part of the property but have remained largely unused since the hotel closed in 2008.

Dieter Berninghaus, executive chair of Signa, said the intention of any refurbishment would be to “upgrade the whole area of Oxford Street to make it more vibrant, more exciting and more diverse than it is now”.

“We need a good understanding not only of the building but of the whole environment . . . how will this area develop, what is the best concept over 10, 20 or 30 years?” he added.

Selfridges is located across the road from Marks and Spencer’s Marble Arch store, which is the subject of a planning inquiry after the retailer submitted proposals to redevelop the site into a mixture of office and retail use. Further east, John Lewis is also evaluating whether to convert the upper floors of its London flagship to office usage.

But Berninghaus stressed any Selfridges blueprint was more likely to increase retail space and integrate it with hotels and restaurants than to reduce it.

“In Selfridges, we really have the chance to take over and integrate a very, very healthy, highly innovative and very modern business . . . from my experience it is one of the very best retailers in the world,” he said.

Della Valle added that there were only limited synergy opportunities between its subsidiaries. “Our network is a collection of stores. We cannot copy and paste what we do in the UK to Italy, or from Italy to Denmark”.

But some aspects of the Selfridges model may be exported elsewhere, notably its commitment to sustainability, which Della Valle described as “one of the pillars of our strategy”.

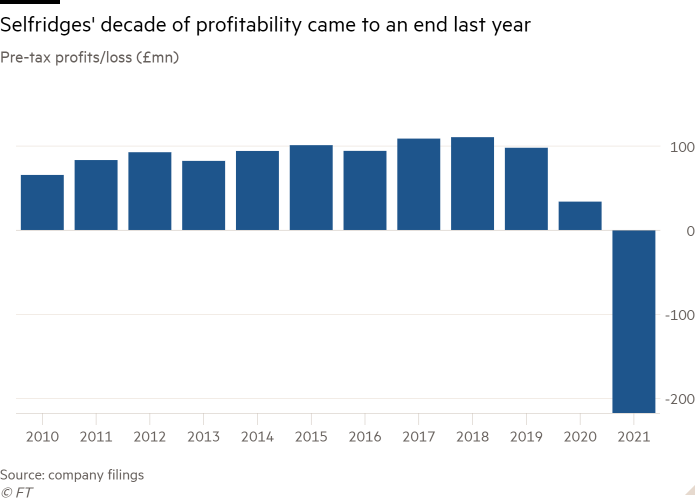

He and Berninghaus acknowledged that the aftermath of the pandemic had been challenging. An absence of affluent tourists had been largely mitigated by efforts to increase domestic shopper numbers, but soaring energy costs have started to put pressure on local consumers.

“But, again, being a long-term investor and a robust group, we think we can face and pass this tough period,” said Della Valle. “For the luxury consumer, the crisis is there — but probably they are a little bit less sensitive.”