Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Almost 80 per cent of Americans who said “the economy” was their number one priority at the exit polls in Tuesday’s US election voted for Donald Trump. That might perplex outsiders. After all, the recent performance of America’s economy is enviable: growth is solid, inflation is easing and the jobless rate is low. But national strength belies local pockets of weakness. Households have been stretched by the 20 per cent rise in price levels since January 2021. Rent and healthcare costs are harder to cover. Credit card debts are mounting.

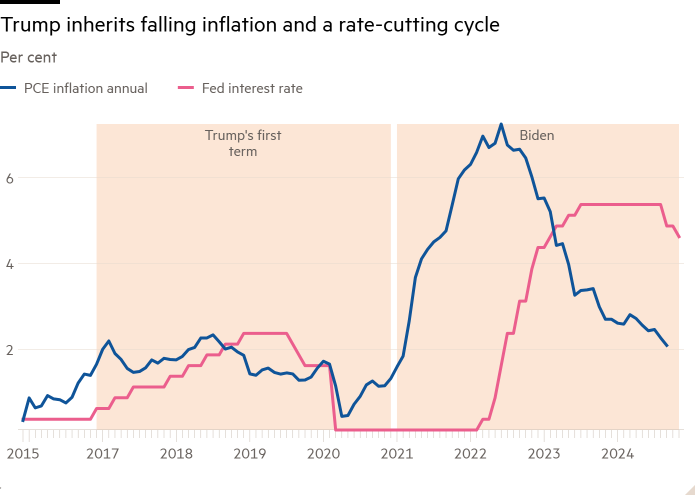

The over 70mn Americans who voted for Trump are optimistic that their fortunes will now be turned around. The stock market is rallying, too. The president-elect’s plan to cut taxes and his courting of the tech “bros” has Wall Street and Silicon Valley — twin engines of the US economy — salivating. Trump has vibes on his side. He also inherits an economy in good nick: the US Federal Reserve has embarked on its interest-rate cutting cycle and price pressures are easing.

He could, however, jeopardise the optimism and favourable economic backdrop, depending on how much he actually follows through with his proposals. His plans emulate his first term, but on steroids. He wants to extend the tax cuts he enacted in 2017, and slash levies on business and pay. On tariffs — the “most beautiful word” in the dictionary, he says — there could be a 10 to 20 per cent bill on all imported goods, with 60 per cent for Chinese imports. The “largest deportation operation” in American history is also on the agenda.

Whatever form it takes, the gist of Trump 2.0 is that inflation, borrowing costs and national debt will be higher, relative to the baseline. Tax cuts could support growth, but would also raise the deficit. Tariffs will feed through to retail prices and a lower labour supply could also nudge up price pressures. Such is the irony of voting for Trump in anger over the high cost of living.

How will it pan out? In one scenario Trump keeps to all his pledges, as he said he would in his acceptance speech. If so, he will dent confidence and the economy. Full-throated tax cuts could blow out US Treasury yields and destabilise financial markets. Tampering with the Fed’s independence would worsen that. And bumper, quick-fire tariffs risk igniting a trade war, which would raise domestic prices, hurt US exporters and crunch global demand.

In a second scenario, Trump’s most extreme plans might be curbed or delayed, for instance by advisers, lobbyists or other lawmakers (if the Republicans do not, in fact, take control of the House of Representatives). This would be better for animal spirits and less harmful to the economy. In this scenario, Trump’s less radical tax and regulatory cuts prop up investors, while the impact of import tariffs are less intense, as businesses have time to enact contingencies or because they are diluted. Wall Street is currently pricing in this more restrained forecast.

Then there is the most sanguine script. Here, Trump’s tariff plans turn out to be mostly a negotiating device. A transactional approach might see import duties imposed more selectively. His administration may also better target and prioritise his tax-cutting and red tape-slashing agenda towards the lower and middle class and investment. This might mean vibes and economic fundamentals are intact, or even stronger, come 2028.

In all scenarios, Trump’s impulsive nature will mean uncertainty — and market volatility — will be a fixture. That will act as a drag on economic growth. But it is a sign of just how topsy-turvy US politics have become that the rosiest outlook may be the one in which the president-elect fails to enact what he promised voters.