Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

US markets met president-elect Donald Trump’s victory with jubilation. In Asia, the mood is less celebratory. Asian stock markets were untroubled on Thursday but some blue-chip stocks have tumbled: the Trump trade has become synonymous with selling out of sectors related to cars, especially electric vehicles and batteries. Investor concerns there are not overdone.

The future of electric cars sales is a key market concern. Trump has said that if he were re-elected he would, on day one, end what he calls a mandate to sell EVs to save the US auto industry from “complete obliteration”. Trump’s victory brings a higher likelihood of cuts to current subsidies to EV battery makers and fewer federal tax incentives for EV buyers. Vice president-elect JD Vance has supported repurposing those credits for gas cars instead.

EV and battery makers had been some of the biggest beneficiaries of the Biden administration’s aggressive push for an EV transition. Current US targets mean that about two-thirds of all new cars and trucks sold will need to be electric by 2032. That would mean unprecedented demand for millions of new vehicles and batteries in the coming years. EV sales are forecast to hit about 73mn units in 2040 with 14mn sold in the US alone, according to Goldman Sachs forecasts.

For Chinese automakers facing a saturated market at home, chances of breaking into the lucrative US market will inevitably shrink with Trump in office. Shares of Chinese automakers including BYD, Li Auto and Nio have fallen in recent days reflecting these concerns.

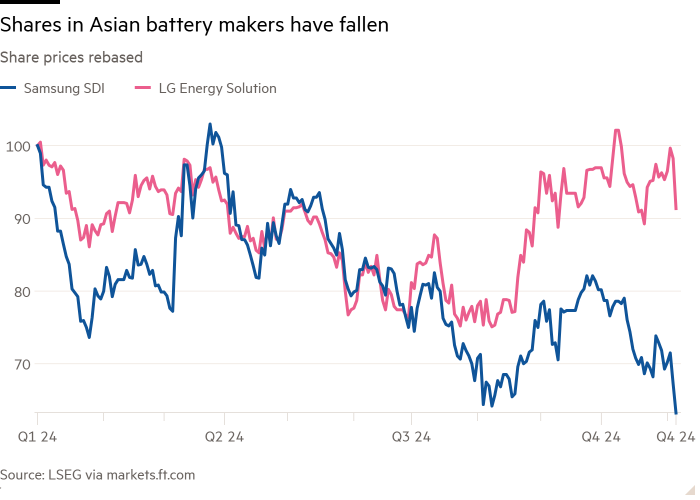

But while Chinese makers sell more EVs and batteries in terms of global volume, their share of the US auto market is negligible compared with Japanese and South Korean peers. Shares of South Korean EV battery makers Samsung SDI and LG Energy Solution have fallen a tenth since the election results were announced.

The two countries’ automakers, already struggling as Nissan’s job losses and tumbling profits demonstrated on Thursday, also have much at stake. South Korea and Japan’s car exports to the US last year exceeded $32bn and $40bn respectively. The US is the largest market for car exports for both countries.

Trump has regularly said he would increase tariffs on new cars from China, Europe and Mexico. The latter, where Japanese automakers including Nissan have set up manufacturing hubs, is a particular issue. Honda, for example, produces about 200,000 cars in Mexico annually, with about 160,000 of them shipped to the US.

That leaves them exposed to rises in tariffs: Trump has pledged to drastically increase tariffs on imports of up to 20 per cent on goods from countries other than China and has even suggested imposing tariffs higher than 200 per cent on vehicles imported from Mexico. The process of pricing in rising protectionism risks in these sectors has barely begun.