Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

Through most of the 21st century, a rare bipartisan consensus had emerged in Washington: the US federal government should, more or less, let corporate America, Silicon Valley and Wall Street do whatever they wanted. Then Joe Biden moved into the White House.

One of the hallmarks of his administration will have been his empowerment of forces critical not so much of commerce, but of concentrated corporate power. That has been evident not just in high-profile antitrust and securities law enforcement agencies. But the mood also changed at the Consumer Protection Financial Bureau and even the Department of Transportation, which has harshly cracked down on airline abuses towards passengers.

Biden has worried about the long term, where it may be healthier for new innovators to support vigorous competition in an era of multiple juggernauts now worth more than $2tn. The backlash from executives, bankers and corporate lawyers has been intense, with even Kamala Harris signalling that the C-suite would be more warmly greeted in an administration run by her.

But the criticism of Biden’s approach is curious. The S&P 500 is up nearly 70 per cent in the past four years and American economic growth remains the envy of the world.

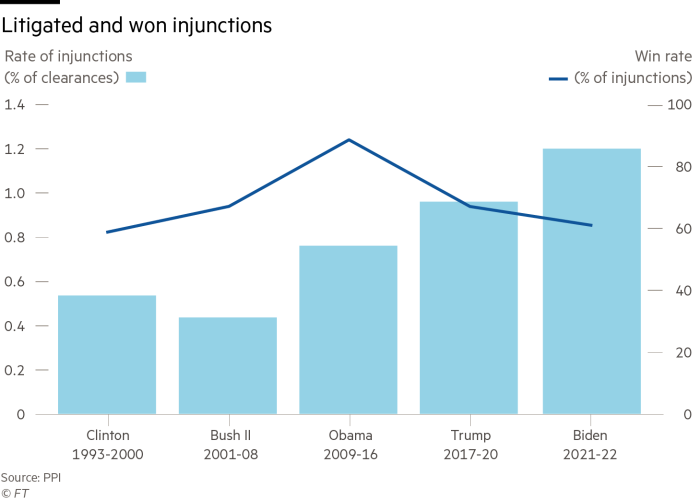

On the mergers and acquisitions front, the deals community has undoubtedly been spooked. The actual proportion of investigations the Federal Trade Commission and Department of Justice have pursued under Biden is not that different from historical norms. But there is a crucial difference: the current regime has been less willing to strike settlements that allow mergers to go forward.

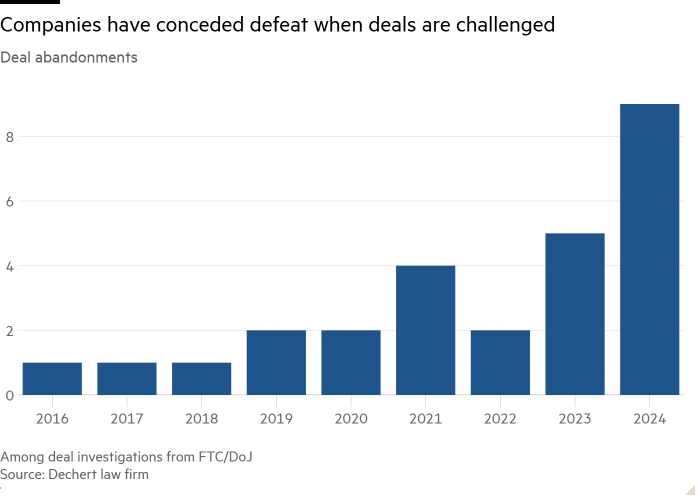

As such, an unusually high number of deals — nine in the first nine months of 2024 according to figures tabulated by law firm Dechert — have been abandoned by buyer and seller in the face of regulatory resistance, well above usual levels. Separately, the government has a decent record at trial (just last month a federal judge blocked the handbag merger between Tapestry and Capri Holdings).

2025 is shaping up for a strong rebound in M&A — with both large and boutique banking stocks rallying in anticipation of a long-awaited recovery. Financing costs have stabilised, the risk of a deep recession has passed and most importantly, the strategic imperatives of companies have only intensified amid a transaction slowdown. Big Media and Big Pharma are itching to consolidate. Private equity firms want to keep rolling up industries.

The Biden era of regulatory activism may just prove to be a historical interlude, with its protagonists perhaps soon exiled to universities and think tanks. But his administration took a merited swipe at the banal corporate deference that long defined public policy. Whatever the election outcome, the power brokers of Wall Street and corporate America will be glad to close the book on that era.