Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

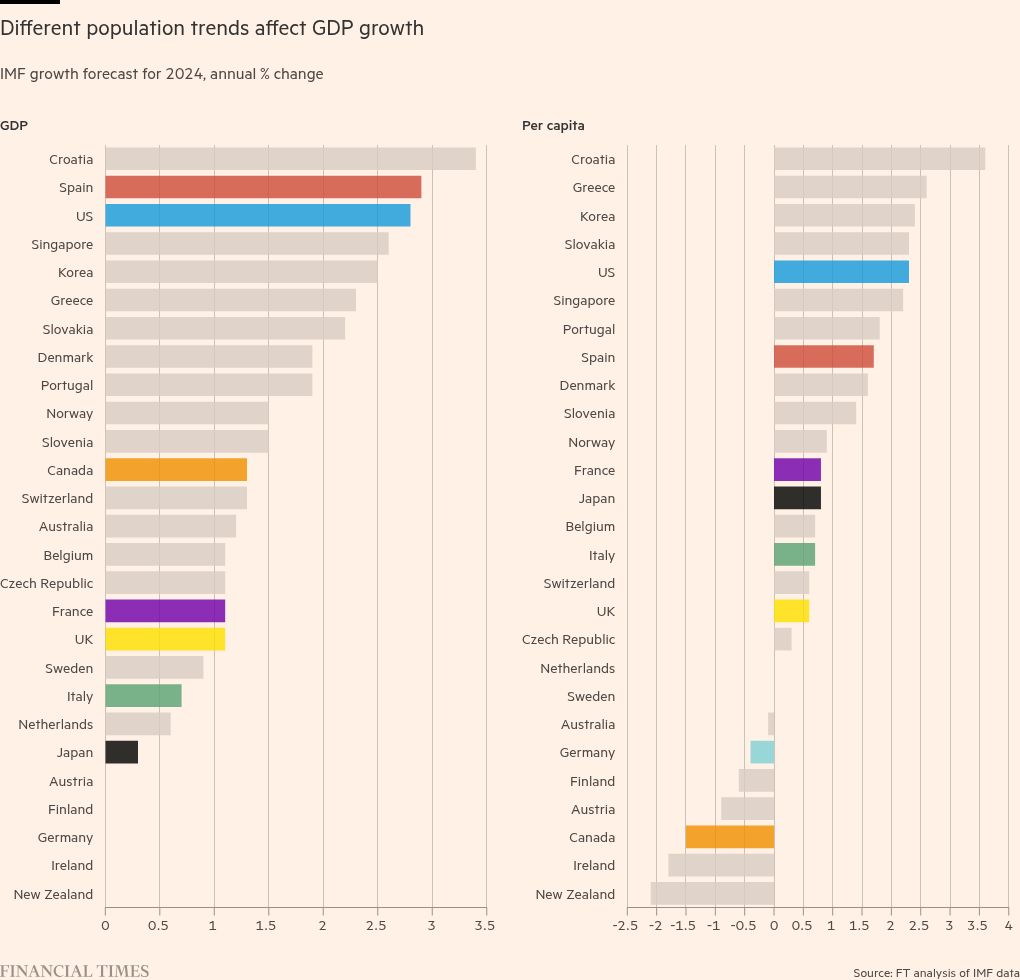

The recent flurry of economic data has consistently showed that some economies are doing better — notably the US, Canada and Spain — while the likes of Germany, Italy and Japan are struggling.

However, the reality is that starkly differing demographic pressures can make headline growth rates a poor measure of the underlying economic performance.

Let’s take Spain, for example. The eurozone’s fourth-largest economy grew by 0.8 per cent quarter-on-quarter in the three months to September, the fastest of any major eurozone economy, according to official figures published this week.

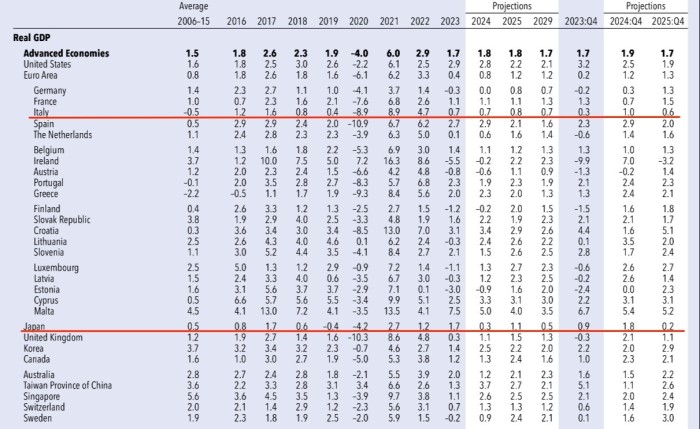

That’s no one-off either. The IMF expects Spain to grow at 2.9 per cent this year, the fastest of any major advanced economy and even faster than the 2.8 per cent expected for the US, according to the IMF October projections.

However, in the third quarter of 2024, Spain registered a nearly 5 per cent annual increase in migration, keeping the country’s population on a healthy growth path. As a result, per-capita GDP growth is only expected to hit 1.7 per cent this year.

While this is still a solid pace, it makes the country slip from second place in the 2024 GDP growth ranking terms to eighth place in GDP-per-capita terms among large advanced economies. It’s also a lot slower than the 2.3 per cent expansion for the US.

Headline GDP growth is obviously a good thing for a host of reasons — such as improving a government’s financial health — but GDP per capita growth matters much more for living standards than headline GDP growth. After all, there’s little advantage of increasing, say, apple production from 10 to 15 if the number of people eating them rises by the same amount.

And as said T Rowe Price economist Tomasz Wieladek notes, growth in living standards is mainly driven by growth in labour productivity. The volume of output per hour of work reflected in GDP per capita trends “allows firms to pay employees better in real terms, which in turn leads to higher living standards,” he points out.

Canada is an even more extreme example of how population trends can distort economic accounts.

International migration boosted the largest population growth in decades last year, pushing up working hours and consumption. As a result, the country’s economy grew at a healthy pace of 1.2 per cent in 2023, which the IMF expects will be surpassed this year with a 1.3 per cent expansion.

However, Canada’s GDP per capita fell sharply in both years, placing the country near the bottom of the performance league of large, advanced economies. As the IMF said in its latest report on the country:

While Canada grew faster than other G7 economies except the United States, much of this relative strength was explained by strong immigration. In fact, a small negative output gap has opened, and income per capita shrank by 1½ percent in 2023, more than in peers, reflecting the mechanical effect of immigration but also echoing Canada’s longstanding problems with productivity growth.

On the other hand, population declines help Italy and Japan look like the ugly ducklings of the 2024 GDP growth league table.

The IMF’s latest forecasts indicate stagnation and yet more stagnation for Italy, with only 0.7 per cent growth expected this year, 0.8 per cent in 2025, and 0.7 per cent in 2026. Japan’s outlook is similar.

However, the population shrank by more than 2 per cent in both countries over the past decade, and the GDP figures in part reflect that there are fewer people working and spending. In per-capita terms, both countries are expected to perform better than the UK and Canada this year, expanding at a similar pace to France.

Of course, demographics affect growth beyond the difference in GDP and GDP per capita, as ageing populations mean a shrinking share of the working-age population, hitting per-capita-GDP.

But keeping it simple, there’s little difference in performance between the performance in terms of GDP and GDP per capita for the US (or Croatia, which tops the table on both measures).

That’s because the world’s biggest economy is supported by a similarly strong productivity expansion, helping the US on both measures.

In contrast, the German economy is struggling on both measures. That reflects the challenges posed by increasing competition from China in Germany’s auto industry, an ageing population, the impact of fraying globalisation on its export-driven economy and now the war in Ukraine, according to Carsten Brzeski, economist at the Bank ING:

In a world in which, at least in manufacturing, China has become the “new Germany”, Germany’s old macro business model of cheap energy and easily accessible large export markets is no longer working.