Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors are warning of a lingering “risk premium” in UK government borrowing costs after Rachel Reeves’ Budget sent gilt yields close to their highest levels since the 2008 global financial crisis.

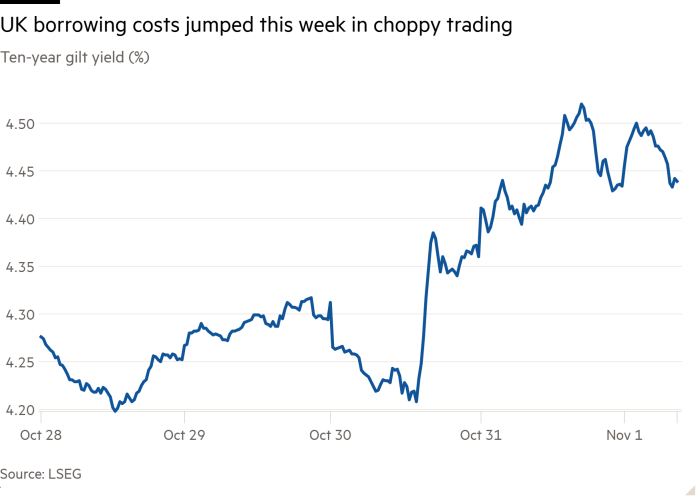

The chancellor’s plans to significantly scale up borrowing sparked two days of choppy trading, and by Thursday afternoon sterling was also falling — echoing the reaction to then prime minister Liz Truss’s ill-fated “mini” Budget two years ago, which sparked a pension fund fire sale and full-blown gilts crisis.

The 10-year gilt yield, which moves inversely to prices, climbed as high as 4.53 per cent on Thursday, close to the 4.63 reached in 2022. It fell back to 4.42 per cent as markets steadied on Friday.

Most investors played down comparisons with the much steeper gilt sell-off two years ago, which also saw the pound crash to an all-time low. But they nevertheless said Reeves’ plans would have a lasting effect on the government’s cost of borrowing.

“The move is the market kind of rejecting the Budget itself, introducing a new fiscal risk premium into the UK,” said Mark McCormick, head of FX and EM strategy at TD Securities. The government had “really tried to push the needle” with its spending and borrowing plans, he added.

The surge in yields confounded many traders’ hopes for a rebound in gilts once the Budget was out of the way, and suggested the start of a new period of antagonism between bond investors and the Treasury.

“There’s a risk premium there, even if the environment now is vastly different to what it was two years ago,” said James Athey, a rates investor at asset manager Marlborough Group.

Bond investors had fully expected Reeves’ first Budget to include higher borrowing. But they failed to anticipate both its scale — about £30bn extra a year — and that it would push up expectations for interest rates and bond yields.

Nick Hayes, a portfolio manager at Axa’s investment management arm, said any comparison with Truss’s mini-Budget was “night and day”, but added: “It turned out to be option three. Neither Truss nor good.”

The Office for Budget Responsibility warned that “the full extent of discretionary fiscal easing in this Budget was unlikely to have been anticipated by market participants at this time.”

The result on Wednesday was a “total rollercoaster”, according to one investor. Gilts initially rallied as the chancellor spoke, before selling off sharply as the scale of the borrowing — and the potential for slower interest rate cuts — became clear. Rate-sensitive two-year gilts were particularly hard hit.

The selling continued on Thursday, as investors pored over the Budget details. They questioned whether some of Reeves’ assumptions for how much she could raise through tax increases and the degree to which future spending can be reined in were too optimistic, and whether she would have to come back to the bond market as early as next year.

With market anxiety also hitting the pound and stocks, Reeves stressed that economic and fiscal stability was her “number one commitment”. She received votes of confidence from some of the UK’s biggest financial institutions including Barclays and insurance group Phoenix, which said it had bought £100mn of gilts in the sell-off. Investors privately joked that Reeves had “spooked” the market on Halloween.

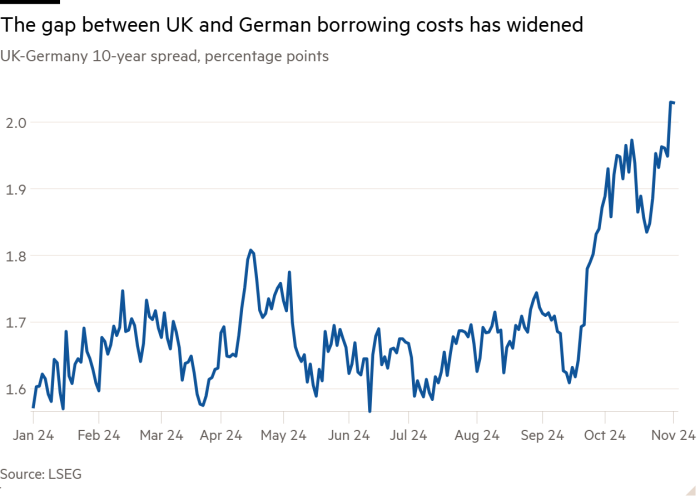

Bond markets around the world have sold off in recent weeks, as stronger US economic data and growing expectations that former president Donald Trump will win next week’s election pushed up yields on US Treasuries, which set the risk-free rate for the world’s asset markets.

But the sell-off has been more pronounced in countries such as UK and France, where investors have become more concerned about debt issuance or fiscal policy.

The gap between UK and German bond yields rose above 2 percentage points this week, at around its highest levels since Truss was in Downing Street.

Even when US political certainty recedes, investors said it was unlikely that global bond yields would head back to the lows seen in previous years, as tensions between the west and countries such as China and Russia reverse globalisation and create an environment where inflation, and rates, are structurally higher.

“It’s a regime change,” said Axa’s Hayes. “We are in a world now where interest rates are going to be higher than they have been for the past 10 or 15 years.”

The rise in yields prompted fresh warnings that higher borrowing costs will give Reeves even less room for manoeuvre as she strives to “fix” the public finances. “The affordability of government debt . . . will remain weaker relative to before the pandemic,” said Moody’s analysts.

The OBR already forecasts that the UK’s annual interest spend on its debt will reach £122bn by the end of the decade.

“You’re rolling a lot of debt over at higher interest rates,” said Rob Burrows, a bond fund manager at M&G Investments. “That is going to take away from the government’s ability to spend on more productive things.”