This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning and happy Halloween. Meta beat earnings expectations but forecast a jump in capital expenditures. Its stock price fell in after-hours trading. Microsoft beat earnings expectations, but perhaps not by enough; its shares were down 4 per cent in late trading. Are people getting antsy about Big Tech valuations?

Meanwhile, in a Halloween surprise, Reddit posted profits for the first time in its history, and its stock jumped more than 40 per cent. Boo! Email us with your favourite Halloween-related sub-Reddit: [email protected] and [email protected].

Sentiment

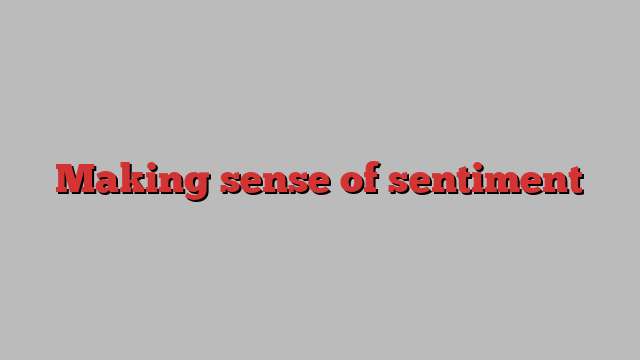

Sentiment surveys are perking up. The University of Michigan headline survey rose from 67.9 to 70.1 in September; the Conference Board’s index rose from 99.2 to 108.7, its biggest jump since 2021. Both surveys remain far below pre-pandemic levels, however. For many observers, including this newsletter, this has presented something of a puzzle. Two key determinants of sentiment — inflation and employment — are at or near their pre-pandemic levels. But sentiment is far from fully recovered. Below are some charts we have looked at before. First is the Michigan sentiment index plotted against CPI inflation (the CPI axis is flipped, so the grey line rising shows inflation falling). Note that inflation in below its long-term average, but the sentiment level is still weak:

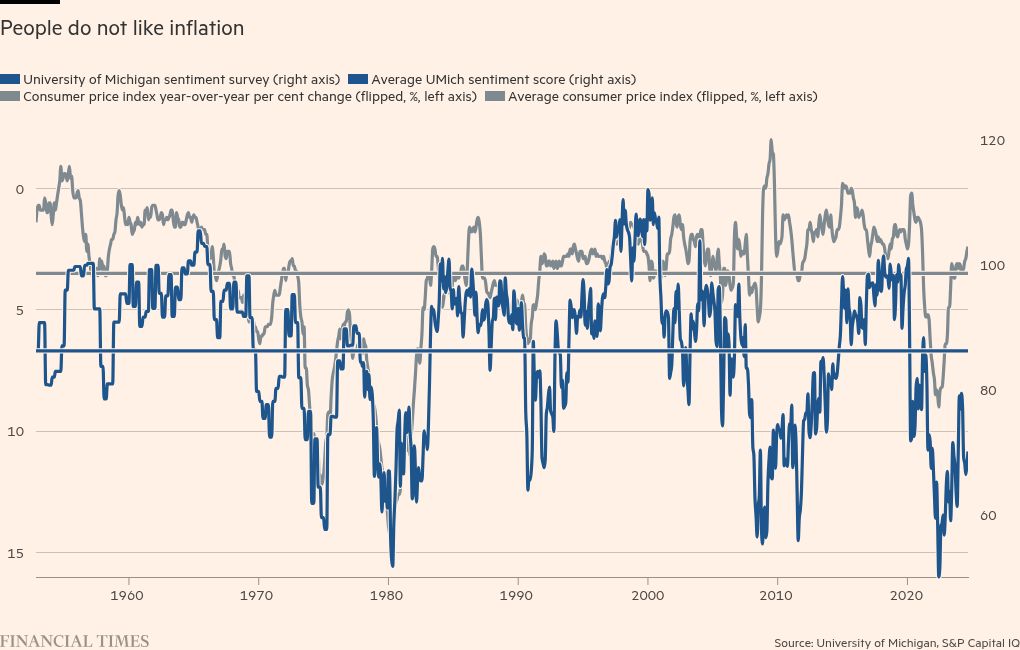

Now here is sentiment and the unemployment rate. Again, the unemployment rate is flipped (the grey line rising shows joblessness decreasing). Unemployment is very low, but — breaking the historical pattern — that has not pushed sentiment up.

I spoke to professor Joanne Hsu, who leads the Michigan survey, about this. “People talk about levels, but it is much more meaningful to talk about trends. Levels are subdued, but [consumers] think things are getting much better.” She notes that sentiment is 40 per cent off its lows of summer 2022.

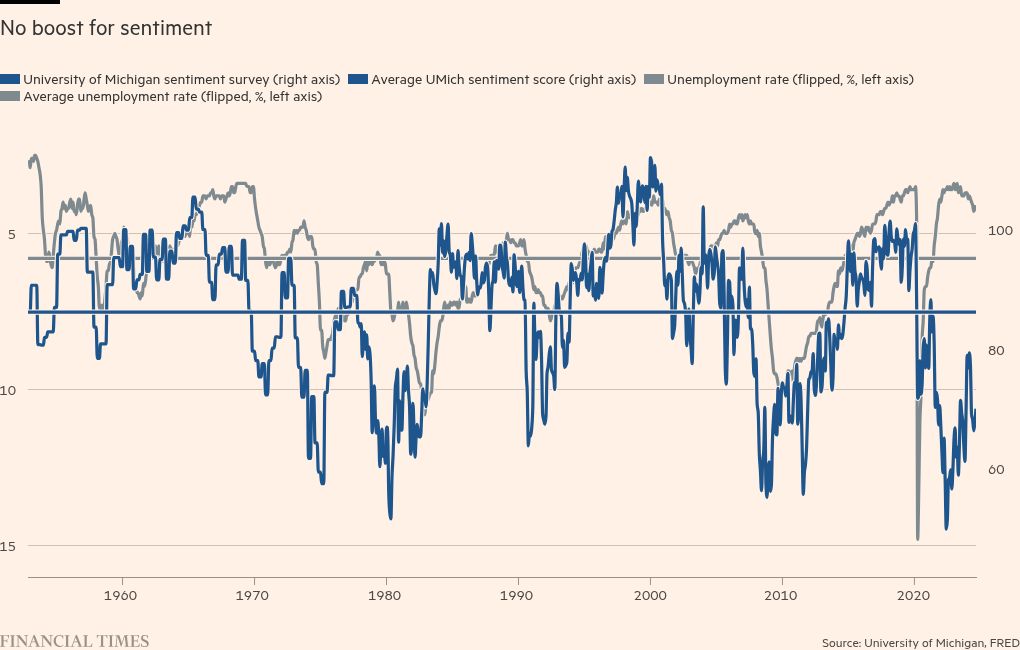

Hsu also points out that the sub-components of the survey show that consumers know perfectly well that the rate of inflation is back to normal. The issue is that they think the change in the price level in recent years is still having a negative impact on their welfare. Below is a chart from Hsu that shows that, though respondents’ expectations for inflation are back to normal, the number who cite high prices as a problem is as high as ever. Inflation remains an open wound:

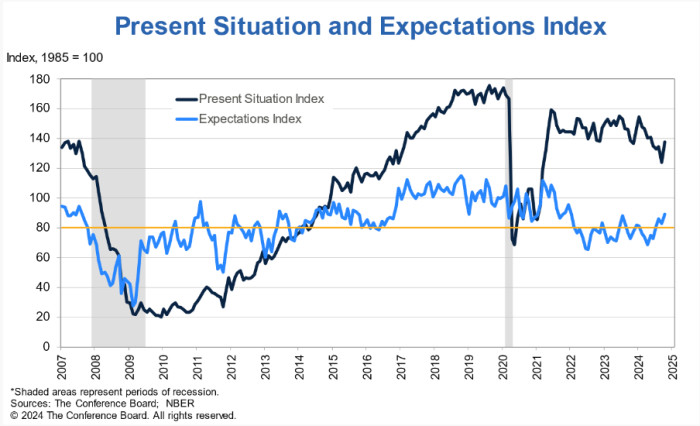

The Conference Board sentiment survey is split into two components: present conditions and expectations. Their divergence tells an interesting story:

Stephanie Guichard, the economist who runs the board’s index, points out that the present situation index rebounded quickly when pandemic lockdowns ended. That component is scored with one question about business conditions and one about the labour market. Very strong responses on the labour market question led to the post-lockdown rebound. She thinks that the simultaneous decline of the expectations measure suggests that consumers knew that, job market-wise, things couldn’t get any better. In the reopening, “people [knew] they had never had it so good, and that it couldn’t last”, she says. The decline in present conditions consumers reported this year is a decline from that very high level.

Another important point is the difference between the two surveys. The Conference Board’s numbers (both present and expected conditions) are closer to pre-pandemic levels than Michigan’s. Guichard says this is because the board survey’s questions lay the emphasis on the labour market, whereas Michigan’s questions pay closer attention to inflation. When consumers are prompted to think about their current jobs and current incomes, they say things are pretty good.

The relevance of all this for investors is that sentiment is not just in a positive trend — its level is probably better than a quick look at the Michigan survey might suggest. That latter point is a bit bearish, because it means there is less room for consumers to feel better than they already do.

Election equity trades

Yesterday, we wrote that a Trump narrative has taken hold in the bond market, explaining some of the surge in Treasury yields. But we have not heard much about a Trump trade in equities.

This makes sense on two levels. While the prediction markets are leaning towards Donald Trump, the polls are neck and neck. Prediction markets, with all their problems, may only be totally convincing to traders. Second, the impact of the candidates’ agendas on specific industries is hard to parse. Trump has been known to backtrack on campaign commitments, and many of his proposals lack detail. Kamala Harris is easier to predict inasmuch as she represents the status quo, but there are open questions about personnel in a Harris administration.

Consider tech stocks. It is unknown if Harris will keep the tough antitrust regulator Lina Khan, who has drawn the ire of Wall Street and Silicon Valley, in place as chair of the Federal Trade Commission. Trump has criticised tech companies in the past and has floated cracking down on social media platforms. Recently, and somewhat confusingly, his running mate JD Vance has even supported Khan. But Trump has recently praised the leaders of Google and Apple, and is supported by tech moguls such as Elon Musk.

Energy next. Trump is a “drill baby drill” guy and would seem to be good news for explorers and producers. But, as Bill Weatherburn of Capital Economics points out, oil and gas production has already risen to record highs under Biden-Harris. Any Trump boost may be marginal. And, though Trump has been seen as less supportive of electric vehicles than Biden and Harris, his bromance with Musk could change that. In any case, slowing global oil demand and Saudi Arabia’s intention to raise production may matter more to the industry than US politics.

Banks and utilities may be a different story. A Trump administration would probably be more lenient on the banks on the Basel III regulatory endgame. And if you buy that under Trump deficits and tariffs will lead to persistently higher rates, that helps banks’ earnings (so long as the rate increases are moderate). On the same assumption, utilities, which are hurt by rising rates, could see their recent run end in a Trump administration. But utilities also get a bit hazy — if AI continues to drive higher energy demand, the bear case for utilities will be offset.

In short, there are few obvious Trump or Harris equity trades. Scott Chronert, equity strategist at Citi, thinks most investors are sticking with rates plays:

I think most [investors] have been looking for Trump and Harris plays for some time. The election discussion comes up in most every client conversation. While there has been a lot of discussion, it is hard to say if there is direct positioning . . . It is hard to do much besides a small hedge . . . showing up in the interest rate plays.

(Reiter)

One good read

Mishit.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here