This article is an on-site version of our Trade Secrets newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Eight days until the US election. I was in Washington talking to people last week and I’ve never had conversations addressing such a weird set of outcomes. On the Harris hand, a narrow range of possibilities: continuity Biden with maybe a tweaking of industrial policy, perhaps a bit more action on renewables and a little less on steel, all very marginal. On the Trump hand, who the hell knows? Massive tariff rises? The end of modern globalisation? A big deal with Xi Jinping? A fundamental rupture in US democracy making trade policy somewhat secondary?

Today’s main piece is on what trading partners can do to prepare for Trump, plus some reader feedback on the IMF and World Bank. Charted Waters is on the European companies exposed to a Trump trade war. Question for you this week: if you had to predict Trump’s actual trade policy in a single sentence, what would it be?

Get in touch. Email me at [email protected]

Tilting at Trump

I see the briefing from Brussels continues apace about the tough actions it will take on trade (and other matters) if Trump gets elected and threatens to put tariffs on EU exports. Hmm. No one knows, obviously, but I must say I’m not entirely convinced that going in with a battle plan to “hit back fast and hard” — still less signalling that plan in advance — is necessarily the right tactic.

Let’s remember two things. One, Trump doesn’t seem to care much about incurring collateral damage. American agriculture got clobbered from Chinese retaliation during his first term. It cost the federal government a lot in bailing out farmers, but did the fiscally incontinent Trump care about the cost? No. Did it materially hurt him politically in farm states? Also no. Iowa voted for Trump in 2020 and will vote for him again next week.

A now well-known study from the economist David Autor and others showed that regions which were more exposed to Trump’s tariffs shifted towards supporting him even if they didn’t benefit economically, and even if they suffered from retaliation by trading partners. Some voters probably don’t think anything will make much difference anyway and just want to see America lashing out.

One of the most successful tactics of almost any trading partner with Trump was harrumphed at by purists (including me, I’ll confess) at the time. In July 2018, then European Commission president Jean-Claude Juncker headed off a threat of car tariffs by promising Trump that the EU would buy soyabeans and liquefied natural gas (LNG), plus some talk of a zero-for-zero deal on industrial tariffs.

This was a genius con on Juncker’s part, including co-opting Larry Kudlow, then the director of the White House National Economic Council and one of the more free-trade characters in the Trump administration. The commission has zero ability to increase soyabean or LNG procurement, and the tariff deal predictably came to nothing. It was extemporised, it was unannounced beforehand and unplanned with EU member states, and it made no real-world sense. But it appealed to Trump’s dealmaking instinct, and it worked. The car tariffs remained unimposed.

I don’t have a superior plan of campaign to the one the EU is briefing. But I do think generally that being flexible and quick-witted — and prepared to dissemble on a giant scale — might be better than preparing a battle plan that commits Brussels to escalating a trade war that it might just have wriggled out of.

The shaky wall of conflicted Brics

President Vladimir Putin hosted the Brics countries summit in Russia last week, supposedly signalling rising opposition to a world order run by rich countries. Really, though? Of the original members, Brazil is currently trying to push through a trade deal between the Mercosur trade bloc and the EU, while India has actively been courting more investment and closer security ties with the US. And if new Brics member Egypt dislikes US hegemony all that much it could always return some of the $1.3bn in military aid it trousers from the American taxpayer each year and stop borrowing from the US-dominated IMF when it gets into trouble. It’s more accurate to describe the Brics summit as Putin creating an alternative reality than a new world order.

Flattering the Fund and bigging up the Bank

There were not many concrete outcomes from the IMF/World Bank meetings last week and I heard nothing to change my conviction that private capital will not, in fact, finance the green transition in developing countries.

I asked you last week to say something nice about the fund and the bank and got some positive replies, some of which I have good reason to believe are from actual people rather than the institutions’ respective managements writing in under assumed names.

Most respondents focused on the institutions’ role in cushioning the blow from the Covid-19 pandemic. The IMF stepped up during Covid and provided a lot of lending. Specifically, it increased global liquidity by a one-off issuance of Special Drawing Rights, imperfect though that mechanism is, and on a bigger scale than an SDR allocation after the global financial crisis in 2009. Similarly the bank and particularly its grant/soft-loan arm (the International Development Association) was praised for increasing its support after the pandemic started in 2020.

The problem is, as more than one reader pointed out, the bank and fund can’t keep this level of lending going in normal circumstances. They’re good in an emergency but not powerful enough the rest of the time. Much like the rest of us, to be honest. As Chekhov reportedly once said, “Any idiot can face a crisis — it’s this day-to-day living that wears you out.”

Charted waters

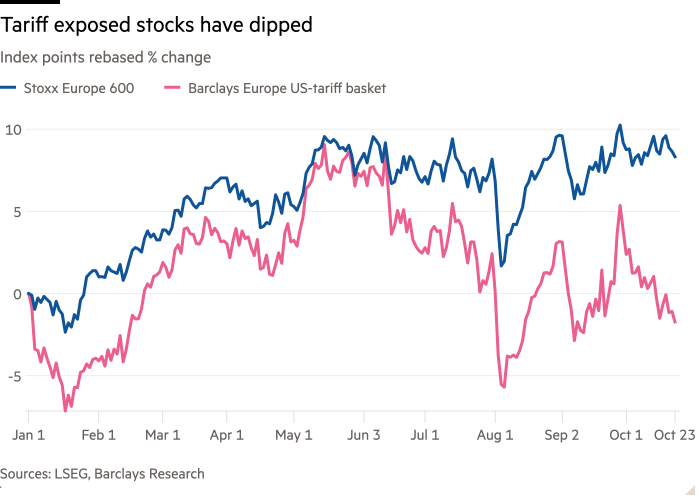

The potential threat from a trade war is reflected in stock prices, with those European companies more exposed to US tariffs underperforming those that are not.

Trade links

-

Todd Tucker of the Roosevelt Institute, a leading Biden-whisperer on trade, makes the case for making the administration’s approach a permanent part of US trade policy.

-

The IMF looks at the macroeconomic implications of the EU’s shift to buying Chinese EVs and concludes it’s small in the short run and nil in the long run.

-

Charles Michel, outgoing president of the European Council of EU member states, joins the chorus of officials warning Brussels not to lecture developing countries over trade, among other issues.

-

There’s now a rival to Senator Rick Scott of Florida, who tried to ban Chinese garlic on national security grounds, for the silliest intervention over food trade with China. Francesco Mutti, chief executive of the eponymous Italian food company, wants to restrict imports of Chinese tomatoes to restore the “dignity” of the Italian variety.

-

On top of mindlessly rejecting an offer from the EU of a youth mobility agreement (plus dishonestly misrepresenting its intentions), and haring off in pursuit of a trade deal with India, the UK’s Labour government is going to continue and deepen the pointless programme of freeports that wastes time and taxpayer money to no discernible end. Still, at least it isn’t going to create more of them, which is what Downing Street incompetently briefed on Friday.

-

Another bunch of non-trade policymakers are warning about protectionism. As I said last week, they do this a lot. I guess they’ll be right one day.

Trade Secrets is edited by Harvey Nriapia

Recommended newsletters for you

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

Europe Express — Your essential guide to what matters in Europe today. Sign up here