Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Forget artificial intelligence or robotaxis. Investors hungry for returns may want to turn to their lunches for inspiration.

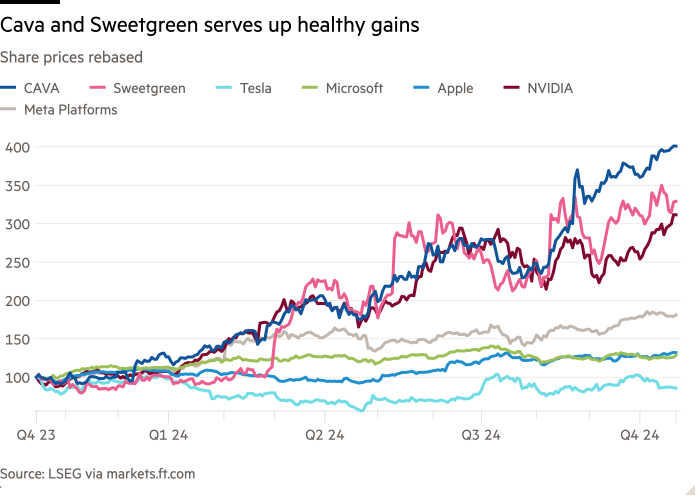

A duo of US fast-casual restaurants — salad hawker Sweetgreen and Mediterranean-inspired outfit Cava — is showing that you can beat the crowd without tech stocks.

Shares in Sweetgreen have more than tripled over the past 12 months. Cava shares have enjoyed an even more blistering run — up over 300 per cent to trade at a record high. That tops even tech darling Nvidia’s 232 per cent rise.

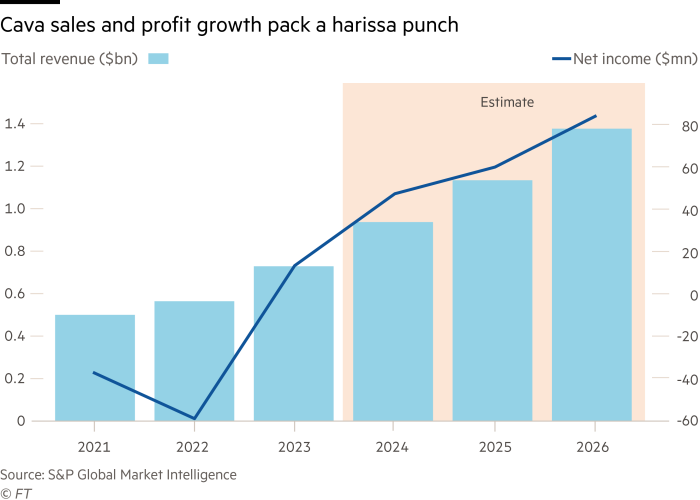

Valuations are punchy. Cava, which only recorded its first annual profit last year, is on a multiple of nearly 300 times. Sweetgreen has a market capitalisation of $4.1bn but is not yet profitable.

This rally may not stay fresh. In the restaurant sector, sales and footfall are sliding as customers cut back spending. Price increases can no longer pick up the slack. McDonald’s, KFC owner Yum Brands and Olive Garden’s Darden Restaurants are among the chains reporting a drop in same-store sales in their most recent quarter. Bankruptcies are also on the rise, with BurgerFi and Red Lobster among the high-profile names that have filed for Chapter 11 protection this year.

But the glum backdrop also explains why the two chains — and their brisk sales — are generating excitement. Same-store-sales rose 9 per cent at Sweetgreen and 14 per cent at Cava in the second quarter. Revenues grew even faster, by 21 per cent and 35 per cent.

Investors on the hunt for the next Chipotle have zeroed in on these numbers. Chipotle shares have generated a near-6,700 per cent return since its initial public offering in 2006.

Comparing Sweetgreen and Cava to Chipotle is not entirely off the mark. The two clearly borrowed their concept from the Mexican-inspired chain. Like Chipotle, both companies have a limited number of fresh ingredients on their menus and customers customise their meals with an assembly line process. The model helps keep labour costs, food waste and wait times down.

But the comparison doesn’t quite stack up. While restaurant-level margins at Cava and Sweetgreen are comparable to Chipotle’s, the gap widens once you factor in administrative overhead, expansion and marketing costs. Cava’s operating margin is less than half Chipotle’s. Sweetgreen’s is negative.

Meanwhile, Chipotle’s market capitalisation equates to $23mn for each of its 3,500 stores. Compare that to Cava: at a near $15.6bn market value, each of its 341 restaurants is worth $46mn. That is even though each store generates only about $3mn in revenue per year on average. That is too rich a valuation to swallow.