Stay informed with free updates

Simply sign up to the UK tax myFT Digest — delivered directly to your inbox.

The Treasury could raise up to £1bn next year by taxing profits earned by private equity executives as income, according to an academic study that analysed tax records to estimate the likelihood of individual buyout managers leaving the country.

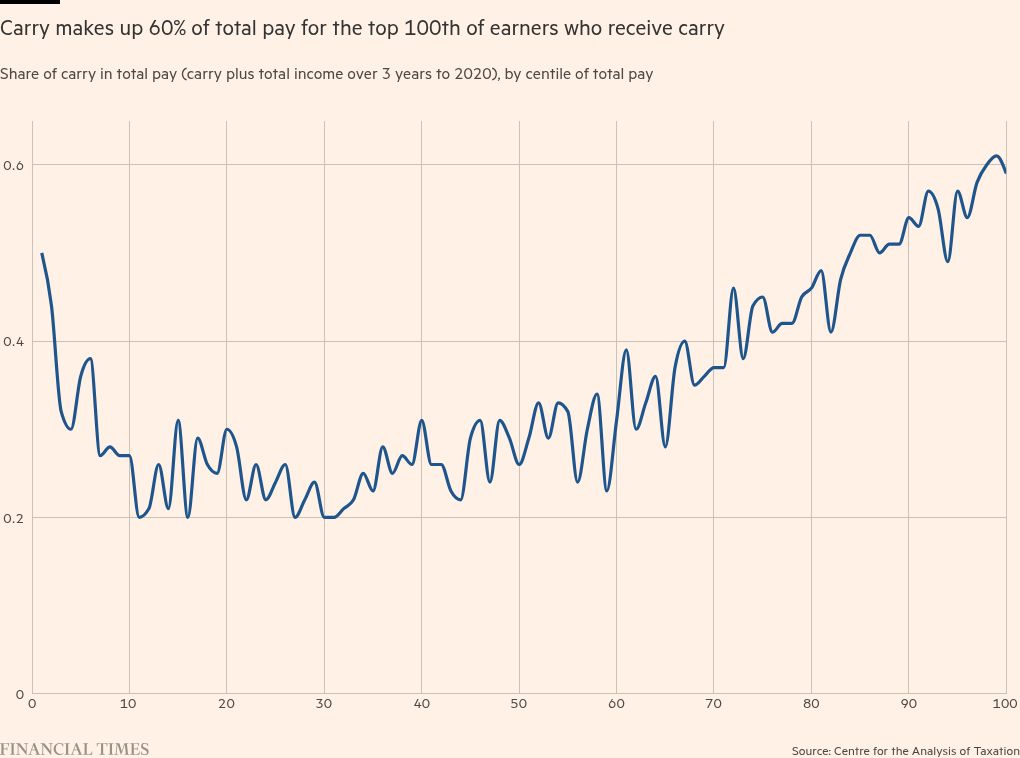

The study by the Centre for the Analysis of Taxation — which is likely to be highly contested by the industry — estimated that taxing gains at 45 per cent would only amount to a 16 per cent reduction in the take-home pay of the industry’s top 100 dealmakers.

The taxation of so-called carried interest — the cut of gains private equity executives make on successful deals — has become a focal point ahead of next week’s Budget, in which chancellor Rachel Reeves is seeking ways to increase taxes to help repair the UK’s public finances.

About 3,000 private equity managers together made £5bn in carried interest in the 2022 tax year, a Treasury analysis of Labour policy found earlier this year.

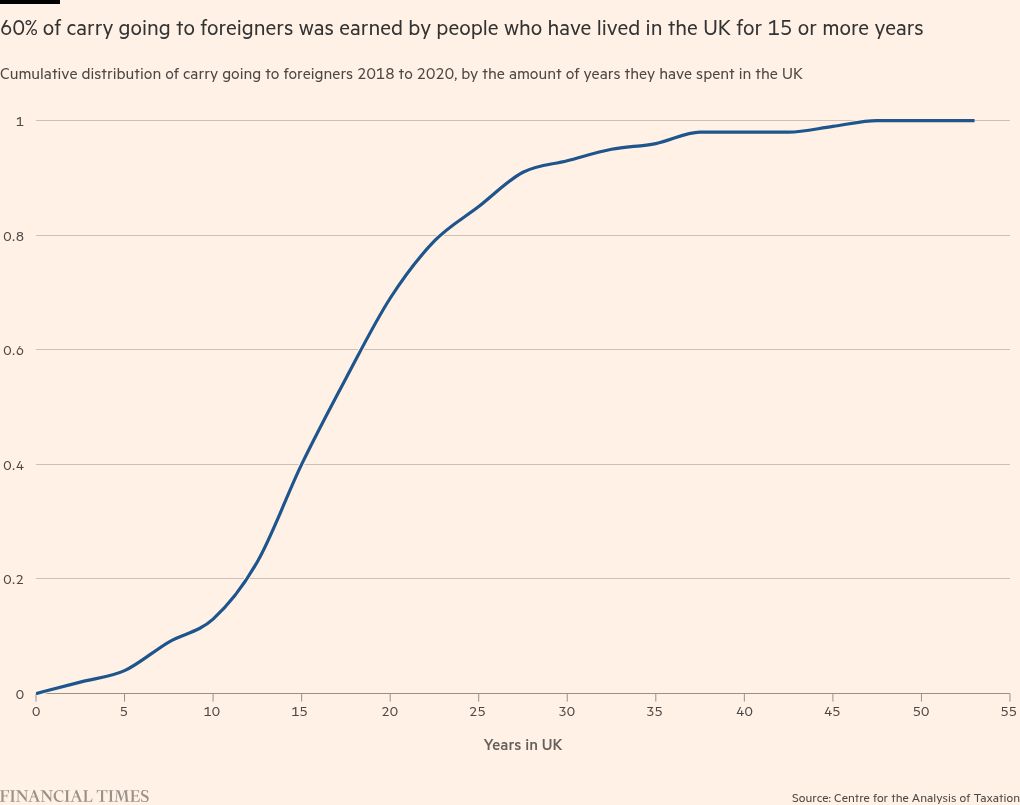

Researchers used their previous studies of how earlier tax reforms correlated with people leaving the UK and applied them to this year’s potential change. These were based on individuals’ characteristics, such as how long they have lived in Britain and how much the tax change had an impact on their overall pay.

The study of previously unpublished HM Revenue & Customs data also found that most of the carry going to foreigners was received by executives who have lived in the UK for 10 or more years.

The private equity industry is waiting on tenterhooks for next week’s Budget to find out what changes the chancellor will make to the taxation of carried interest.

In opposition, the Labour party said it would close what it called a “loophole” through which carried interest is taxed as capital gains at 28 per cent.

The study predicted the move could raise between £300mn and £1bn in the next tax year.

But earlier this month Reeves signalled that she would spare private equity industry this rate, telling the Financial Times she would not be “ideological” and did not want to reduce investment in Britain.

“What sounds like a really big increase in the tax rate on carry translates to a much smaller reduction in take-home pay for most executives,” said Andy Summers, associate professor of law at the London School of Economics, who was part of the research team, referring to the hypothetical increase in the carried interest levy from 28 per cent to 45 per cent underlying their predictions.

He added that the change in take-home pay was what mattered for migration responses to tax changes, rather than the alteration to the headline tax rate.

While foreign private equity executives account for about 50 per cent of all recipients of carried interest, the new study of HM Revenue & Customs data shows that roughly 90 per cent of carry going to foreigners went to people who have been in the UK for 10 or more years.

The same researchers previously found there was a substantial decrease in foreign-born people leaving the UK in response to the 2010 “50p” reform to the top income tax rate if they had lived in the country for five or more years.

They also previously found that a number “not significantly different from zero” of non-domiciled workers in the finance industry left the UK in response to a 2017 reform that removed access to a tax break on foreign income and gains for “deemed domicile” non-doms.

However, the findings of this previous research proved contentious — with non-doms and their advisers attacking the assumptions made. Critics point out that the 2017 reforms left generous protections for non-doms on inheritance tax and say Labour’s intention to remove these has led to a much higher migration response than the researchers anticipated.

Reeves has vowed that the increased tax burden will be borne by those “with the broadest shoulders”. The potential change to carried interest is one of several measures that may hit wealthier taxpayers, alongside an introduction of VAT on private school fees.

The new research contrasts previous findings by the Conservative government that levying carry at 45 per cent could lose up to £900mn in the 2026 tax year if buyout executives left the country in response, or gain at most £200mn.

The British Private Equity and Venture Capital Association, which represents the industry, said: “The importance of the private capital industry to UK growth is clear, and that depends on an internationally competitive investment climate.”