While most people in China spent the weeklong national holiday this month enjoying the cooler autumn weather, brokers in Shanghai were stuck in their offices conducting a sector-wide stress test of their trading systems.

The Shanghai Stock Exchange is keen to avoid a repeat of events from late September, when Beijing’s abrupt announcement of its biggest monetary stimulus since the pandemic sparked a stampede by China’s 220mn retail investors back into equities that crashed the market’s trading systems.

“This is the first time in over a decade of my career that I’ve seen a sector-wide test,” says one person at a mid-sized brokerage in Shanghai, who requested anonymity as he is not authorised to speak to the media. He says the system crash was caused by “an overload of orders” that resembled an assault by computer hackers.

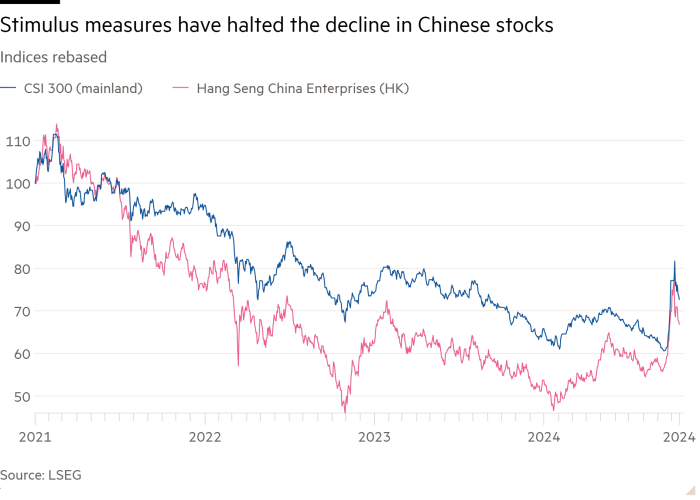

The precipitous shift in fortunes for China’s market, which hit a third year of consecutive decline in 2023, follows an abrupt U-turn from China’s president, Xi Jinping, and his policymakers on providing stimulus for the world’s second-largest economy.

For years, Xi has largely resisted the calls for a big fiscal scheme to boost parts of the ailing economy, especially households and indebted local governments, whose wealth has been decimated by a three-year slump in real estate. According to some estimates, the sector had accounted for about 30 per cent of the economy.

With property prices failing to stabilise and many local governments unable to pay their bills, Beijing was in danger of missing its official GDP growth target this year of 5 per cent. On Friday, it reported GDP growth of 4.6 per cent for the third quarter — the lowest growth in 18 months.

China’s central bank and financial regulators kicked off the stimulus push with interest rate cuts and unprecedented support for the stock market, as well as help for homeowners. Two weeks later, the finance ministry announced plans to bail out China’s local governments, recapitalise large banks and help buy millions of unsold apartments.

Beijing is yet to announce the size of the fiscal package, but has promised that parts of it will be the biggest in “recent years”. The question now for investors is whether these measures, which Beijing calls a “combination punch”, will be big enough.

Given the scale of China’s underlying structural challenges — which range from high government debt, demographic decline and youth unemployment to growing tension with trade partners — economists say Beijing has its work cut out.

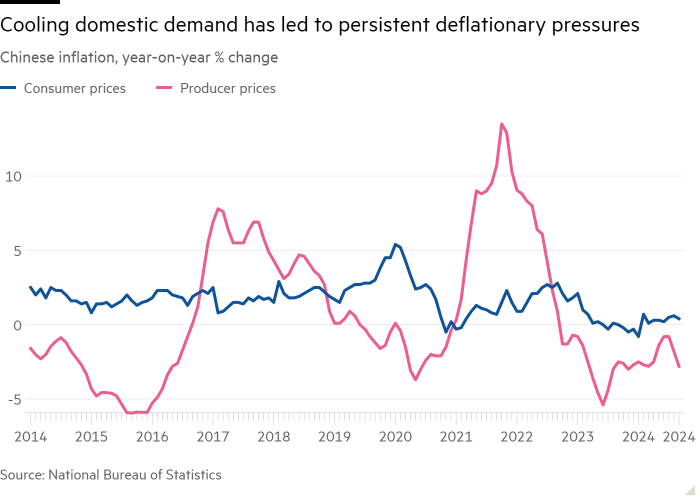

The stakes for Xi and China could hardly be higher. Failure could throw China into a deflationary spiral similar to that of Japan after the bursting of its real estate bubble in the 1990s, from which it has taken decades to recover.

This would not only risk Xi’s strategic goal of doubling per capita GDP by 2035 and, by implication, overtaking China’s geopolitical rival, the US, as the world’s biggest economy. It could also spark discontent among a population that in recent decades has become accustomed to constant improvements in living standards.

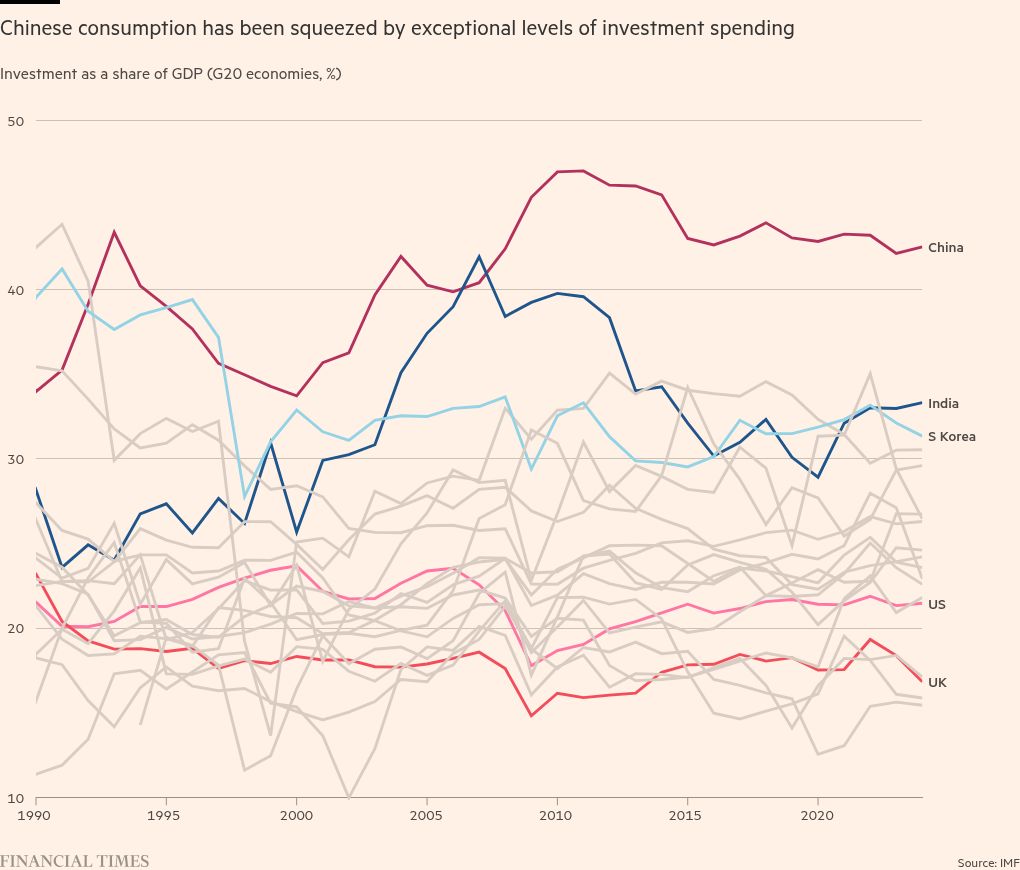

Many believe Xi will try to adopt a middle path. He is reluctant to fall back on China’s old playbook of debt-intensive investment in low-tech sectors to boost headline growth. Instead, analysts say, he wants China to focus on what he calls “new productive forces” areas such as green energy and advanced semiconductors.

“We are seeing fundamental shifts in both the way Xi Jinping views the state of the economy and his approach to addressing the problems,” says Andy Rothman, an investment strategist at the Matthews Asia fund, on the sudden acknowledgment of the need for stimulus.

“Xi now recognises that China’s economy is on the wrong track, and that a pragmatic course correction is urgently needed.”

Why Xi seemingly changed his mind so suddenly about undertaking a large stimulus remains a mystery to investors.

While China had taken incremental steps to boost the economy since last year, Xi was publicly showing no serious concerns about growth even in the weeks before his economic team’s big announcement.

In September, a cheerful-looking Xi was pictured by state media during a trip to the historic western province of Gansu, where he paid homage to China’s mythical first emperor at Fuxi Temple and met apple growers and military personnel.

Xi even appeared relaxed about the government’s growth targets, despite a slew of weak data in August pointing to a deepening slowdown in the third quarter. He told a symposium in Gansu that cadres, or officials, should simply “do a good job in economic work at the end of the third quarter and the fourth quarter” — seen as a softer tone than previous statements.

Analysts believe that behind closed doors officials had been growing increasingly concerned about the economy since at least July, when the party held its third plenum, a five-yearly session that typically lays out Beijing’s economic road map.

Publicly, the meeting was widely seen as a doubling down on Xi’s strategy of greater self-reliance and investment in science and other areas as it battles the US for technological supremacy.

FT Edit

This article was featured in FT Edit, a daily selection of eight stories to inform, inspire and delight, free to read for 30 days. Explore FT Edit here ➼

The third plenum listed important social reforms, such as raising the retirement age and loosening the hukou system, China’s household registration rules, which restricts access to services for migrant workers. But it largely brushed over what economists see as the need to stimulate domestic demand directly, particularly household consumption, and lift the economy.

China has continued to increase investment in manufacturing, according to official data, even though its share of world gross output is more than 30 per cent — higher than the next top nine countries combined. Meanwhile, its consumer spending to GDP remains well below the global average. This has left China overly dependent on overseas markets to absorb its growing goods production, sparking trade tensions, economists say.

The third plenum gave priority to “investment and production as the drivers of growth and far less attention to consumption and households”, says Scott Kennedy, trustee chair in Chinese business and economics at the Center for Strategic and International Studies, in a note published after the meeting.

Investors were underwhelmed, analysts say, and after rising slightly ahead of the meeting, China’s CSI 300 index continued its downward trajectory, losing more than 10 per cent of its value before the current rally.

“The plenum’s focus on long-term structural shifts . . . was widely interpreted as a signal that Beijing was indifferent to immediate economic growth,” says a paper by independent analysts Hutong Research.

But Xi and party leaders were indeed worried about missing their growth targets, analysts say. This came to a head in September while Xi was in Gansu, where he witnessed high unemployment and other social strains stemming from the fall in growth and rising local government debt, says one person familiar with the senior leadership.

Economic data also became more alarming. The youth unemployment rate, which was 13.2 per cent in June, quickly shot up to 18.8 per cent in August. The property crash has left consumers reluctant to spend on big-ticket items, with many paying back mortgages and piling up savings.

More bad news came in September, when China’s producers marked their second consecutive year of deflation, a trend that puts intense pressure on corporate earnings. Even exports — the engine of China’s economy — unexpectedly slowed in dollar terms during the same month.

Putting further pressure on Xi were signs of brewing social tension. A cadre in Hunan province’s finance department was murdered in her home, according to reports in state media. There have been other reports of violence against cadres, including one who was allegedly stabbed by the driver he had just fired.

Local governments in particular are increasingly struggling to pay their bills amid the property crisis, which deprived them of much-needed land sales. To recover the loss of their largest source of revenue, they have begun fining and taxing entrepreneurs.

Beijing is now making “extraordinary shifts”, says Ryan Manuel, managing director of Bilby, an advisory company that uses AI to analyse Chinese government documents.

He points to thorny reforms of the hukou system and sharpening oversight of central state-owned enterprises. “This is going to be a two- to three-year shift where every department needs to have a response to the plan . . . This isn’t ‘bazooka’, this is more ‘steady flame-thrower’.”

The focus for investors now is how much Beijing plans to spend on the stimulus.

In a press conference after the national holiday, finance minister Lan Fo’an refused to reveal the number. Markets hope that detailed figures will be unveiled at a leadership meeting of China’s rubber-stamp parliament, the National People’s Congress, expected in the coming few weeks.

But Lan did outline planned fiscal stimulus measures, promising that local governments would receive more support. In addition, state banks would be recapitalised, he said. Lan also promised that local governments would receive “the strongest debt alleviation measure introduced in recent years”. And he left the door open to more general stimulus, pledging that “we have significant room” to increase the central government budget deficit and debt.

Economists say much of the fiscal plan hinges on helping local governments refinance “troubled” loans among about Rmb60tn ($8.4tn) of debt carried by their financing vehicles — off-budget companies that invest on their behalf. Goldman Sachs estimates that about Rmb12tn of this credit is a concern.

The government has already approved a quota of nearly Rmb4tn for local government debt swaps this year and last year. Goldman also expects the NPC to approve more than Rmb5tn for this purpose over “multiple years”. On top of this, the government could announce Rmb1tn-Rmb2tn of ultra-long central government bonds, which are used for wider stimulus measures, and to set a higher official budget deficit target.

Tao Wang, chief China economist with UBS investment bank, says the finance ministry’s guidance on local government debt refinancing and the use of government funding to help buy unsold property “are a very important confidence boost for the market and could help stabilise the economy”.

“Unfortunately, if you want to alleviate a debt problem, you have to throw more debt at it. We learnt the hard way from the two opposite experiences in the US and Europe,” Wang says, pointing to America’s mobilisation of huge resources after the global financial crisis in 2008 to deal with the subprime crisis, which helped it to resolve its debt problems more quickly than in Europe.

“So I think China . . . also needs a really big push on the fiscal and credit sides to jump-start the economy,” Wang adds. “Otherwise, we’re in danger of getting into a deflationary spiral.”

The other leg of the stimulus is support for the stock market, with the central bank providing facilities for insurers, funds and securities companies to borrow money to invest in the market and to support listed businesses undertaking share buybacks.

The idea, analysts say, is to try to drive up institutional shareholdings in China’s stocks, which are often volatile, and turn the market into a reliable investment alternative to property for households.

“At the moment, few expect property prices will go up quickly in the next decade. So that means the Chinese people need a new wealth reservoir to help their household assets to grow,” says Lei Meng, China equity strategist at UBS Securities.

The policy shift already appears to be working. During the holiday break, the talk among diners in China’s big cities was how much money people had previously made on the stock market. But valuations have now risen to their five-year historical average. In the longer run, macroeconomic fundamentals would also need to be supportive of the market.

“There’s a lot of debate. Someone who is bullish will argue that the policy has turned things around and from here the economy will stabilise and go up and that will support the market,” Meng says. “But the bearish guy will argue that the problems can only be solved by a super strong policy and we don’t have the details yet.”

Many agree that, while Xi’s thinking on the stimulus has changed, there is no sign yet of determined reforms or spending to rebalance the economy towards more household consumption.

While the government has extended the retirement age and increased aid for needy groups, such as students, the focus is still mainly on repairing the balance sheets of local governments and state banks. This is what Beijing hopes will lay the groundwork for lower authorities to begin spending again.

“Nobody has done it so far,” says Richard Yetsenga, group chief economist of ANZ Research, referring to attempts to resolve the debt fallout from property crises purely by repairing government balance sheets. “International experience has been that you need to have fiscal and structural policy at the same time, and both need to be very substantial.”

Most analysts agree, however, that Xi’s aim is to keep growth on track rather than change his long-term vision for the economy.

“I won’t call it a U-turn — it’s better described as a recalibration for the sake of preventing the economy from falling further,” says Olivia Cheung, co-author of The Political Thought of Xi Jinping and an academic at Soas University of London. A stable economy is necessary “to provide a material foundation base for Xi to do what he wants to do”, she adds.

Yuen Yuen Ang, a China expert at Johns Hopkins University, says Xi is staking his legacy on what he calls “high-quality” development, essentially in moving China’s industry up the value chain especially in sophisticated technology. “He has little interest, perhaps even disdain, for the old economy.”

But now that officials are panicking that they might miss the official growth target, the lesson is that “the old and the new economy are intertwined”, adds Ang. “The Chinese government is learning that they can’t only chase the new economy relentlessly while neglecting the old economy, which still provides the majority of growth and jobs in China.”