Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

Last week the New York Federal Reserve unveiled a new measure of how flush with money the US financial system is. Lo and behold, it showed that bank reserves “remain abundant”. We’re shocked. SHOCKED.

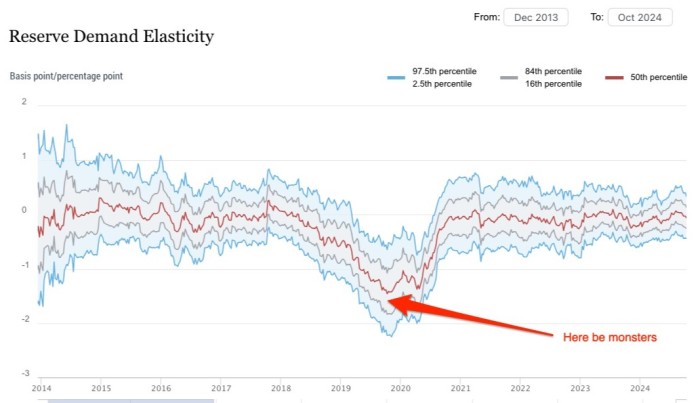

Interest in the NY Fed’s new fancy “reserve demand elasticity” gauge has been heightened by concerns that we don’t really know when we’ve wandered from an “abundant” regime era to an “ample” one — or a merely mildly comfortable one.

We only tend to learn when we are in an uncomfortable regime when things break. The big end-of-quarter spike in the secured overnight financing rate (SOFR among friends) sparked concerns in some quarters that we might be approaching that level.

The NY Fed’s new tool focuses on the Fed funds market and how it reacts to changes in reserves, using daily non-public data on bank balances. The gauge is designed to be at about zero if reserves are abundant.

So you can see how things got a bit tight around the September 2019 repo market mayhem.

It’s a cool new measure, but the conclusion is extremely unsurprising.

Can you imagine the Fed unveiling it if it showed that reserves were alarmingly tight? That the name of the NY Fed’s president John Williams is on its write-up of the gauge is a pretty clear indication of high-level involvement.

Moreover, like all attempts to corral a multitude of different dynamic factors into single straight lines, there can still be gremlins lurking out of sight. As Teresa Ho, JPMorgan’s head of US short-duration strategy, noted in an (excellent) podcast on the subject:

The problem with answering that is that no one really knows what that magical level is. The notion of reserve scarcity is dynamic, it changes over time, depending on the environment that you’re in . . . It’s one of those things that you know it when you see it.

Secondly, the measure’s reliance on the Fed funds market is a bit curious, given how comically emasculated it is these days. JPMorgan says that daily trading volumes average $50-100bn, compared to the vastly larger and more diverse SOFR market.

As JPMorgan rate strategist Phoebe White wrote in a report, with FT Alphaville’s emphasis below:

Disproportionately focusing on fed funds also implies that more weight is placed on bank liquidity as opposed to non-bank liquidity. SOFR is the rate at which both banks and non-banks borrow on an overnight collateralized basis, and provides a more comprehensive gauge of liquidity in the marketplace in that it reflects the liquidity needs of a range of market participants.

To be sure, the recent spike in SOFR was not a reflection of aggregate reserve scarcity, and more likely reflected growing frictions in the repo markets. Even so, we believe that’s enough for the Fed to consider ending QT earlier rather than later as those frictions (e.g., balance sheet constraints, counterparty limits) are unlikely going to be resolved anytime soon, and in fact, could get worse. Meanwhile, the demand for repo financing will only grow relative to supply.

To that end, even if aggregate reserves remain abundant, it’s likely that more and more market participants will be approaching reserve scarcity on an individual basis, particularly in the absence of dealer intermediation and for those that lack direct access to SRF or MMFs for liquidity.

However, despite the choice of post image (it was just too tempting), it’s hard to get really worked up about this.

Repo shenanigans can ripple in unpredictable ways, but the fact that the Fed is publishing tools like this indicates that they are keeping a close eye on things. That minimises the chances of accidents.

Secondly, there genuinely does still seem to be plenty of money sloshing around, and the Fed’s balance sheet shrinkage has been slowed since June, precisely to avoid accidents.

Lastly, even if they go things wrong the US central bank has plenty of tools to quell any turbulence. As unnerving as the 2019 shenanigans were, there was no real collateral damage, aside from the egg on the Fed’s face.

In other words, this is not a systemic thing. But it could be a highly amusing thing if the NY Fed really has gotten this horribly wrong, so we’re rooting for that scenario.