Stay informed with free updates

Simply sign up to the US equities myFT Digest — delivered directly to your inbox.

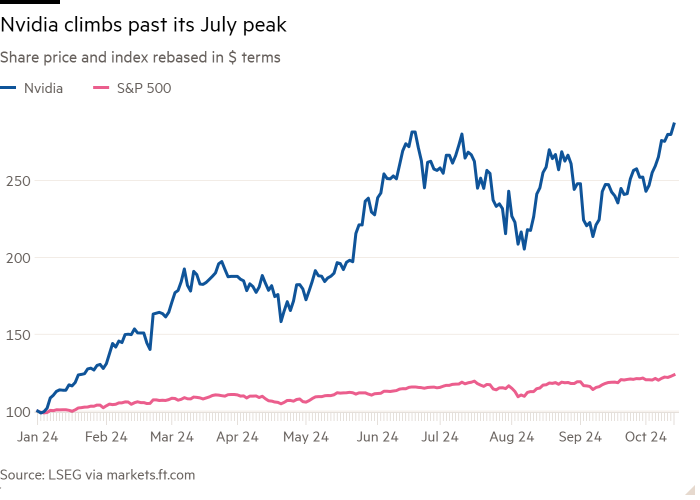

Shares in Nvidia closed at a fresh record on Monday, passing the previous peak they had hit in July as renewed confidence about a soft landing for the US economy drives a rebound in big technology stocks.

Shares in the US chipmaker added 2.4 per cent to close at $138.07, bringing its market capitalisation to $3.39tn, within reach of Apple’s market-leading $3.5tn valuation.

A bout of weakness for Nvidia and other large tech stocks over the summer had led many investors to predict a longer-term rotation away from tech in favour of previously-unloved sectors such as financial services and industrials.

However, the sector has regained momentum since the Federal Reserve began cutting US interest rates last month, with the largest companies once again leading the market higher.

“It does seem like the rotation from megacap to the rest may have run its course,” said Dec Mullarkey, managing director at SLC Management. “Investors had turned defensive heading into the Fed meeting, but the Fed’s tone since then and subsequent data have been very constructive for risk.”

IT and communication services were two of the worst-performing sectors in the S&P 500 during the third quarter, but have been two of its best performing since the Fed’s September meeting, with the IT sub-index up more than 7 per cent.

Despite the recent rally, however, several analysts argued that the current environment had some crucial differences to the first half of 2024, when many investors were concerned about irrational exuberance and unsustainable gains.

While IT has been the best-performing sector since the rate cut, more than 60 per cent of the stocks in the S&P 500 have made gains, including solid advances for cyclical sectors such as industrials and energy.

“I’m not yet convinced it’s a definitive shift back towards outright tech dominance,” said Kevin Gordon, senior investment strategist at Charles Schwab. “It seems more like a catch-up, given other sectors like financial and industrials had been hitting new highs before tech and the megacap stocks . . . There is room for tech to make up for some lost ground, particularly because the sector tends to do well in a slow Fed cutting cycle.”

A strong start to the third-quarter earnings season has added to optimism about the US economic outlook, with better than expected results from JPMorgan Chase and Wells Fargo on Friday pushing bank stocks to their highest levels since before the collapse of Silicon Valley Bank. Stimulus efforts from Beijing have meanwhile raised confidence about the outlook for China, the world’s second-largest economy, which could have a positive knock-on effect on growth elsewhere.

“There’s something material that has changed” since the first half of the year, Mullarkey added. “There has been this shift of everyone re-upping their forecasts for strong growth and earnings . . . [and] China’s monetary and market stimulus and expected fiscal stimulus also brightens the global growth outlook.”