Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For a month now, UK small- and mid-cap broker Peel Hunt has been banging the drum about the potentially catastrophic effect that the removal of an inheritance tax loophole might have on London’s ever-eventful small- and mid-cap Alternative Investment Market (Aim).

Still smarting from Labour’s scrapping of the nascent “British Isa”, and with the UK Budget fast approaching, head of research Charles Hall warns that the hypothetical removal of IHT relief for AIM shares would lead to “permanent damage” to what the LSE still describes as “the world’s most successful growth market”.

The removal of the tax incentive, which was introduced in 1996, would threaten the very “future of AIM as a functioning market”, Hall added in a note on Thursday (with our emphasis):

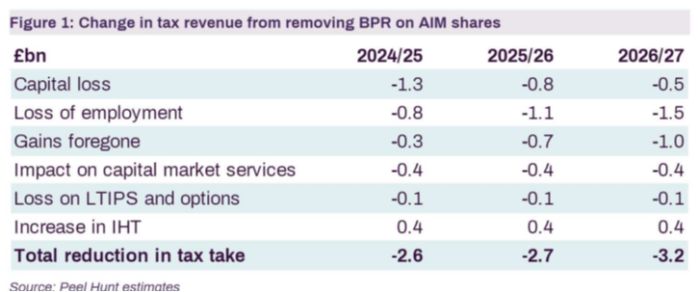

We see material downside risk for AIM form removing IHT relief. Moreover, our forecasts show a net tax reduction to the Exchequer of £2.6bn, rising to £3.2bn . . .

We see an impact on the AIM market of 20-30% if [Business Property Relief, which can be passed on sans IHT upon the death of the investor] is removed, crystallising a loss of value [of] £14-21bn to UK shareholders, resulting in a permanent destruction of spending power.

Here are their numbers:

Other projections are available. Hall admits as much while taking a swipe at the Institute for Fiscal Studies think-tank, two of which’s academics — Arun Advani and David Sturrock — think scrapping the relief would actually raise tax intake by more than £1bn.

Here’s Hall:

There have been several reports suggesting that removing [Business Property Relief, which can be passed on free from IHT upon the death of an investor] from AIM shares would be tax enhancing. Notably, the IFS suggested a £1.1bn increase in tax, rising to £1.6bn per annum. We believe these numbers are flawed for numerous reasons, and estimate a material reduction in tax revenue.

Back in May, Advani and Sturrock wrote that IHT relief “distorts investment choices towards these types of shares, particularly for older people seeking to minimise their inheritance tax liability”. From their article:

Revenue implications: We estimate that the removal of business relief for AIM shares could raise around £1.1 billion in the current tax year, rising to £1.6 billion in 2029—30. This could be an underestimate, since business relief on AIM shares is used very heavily by trusts, for which no direct statistics are available. If those currently using AIM shares to avoid inheritance tax would respond to its removal by using other avoidance strategies, the amounts raised could be lower, though.

Hall was in a fighting mood this morning, writing of the IFS’s £1.1bn: “We do not recognise this number”.

So we asked the IFS’ Advani what he made of Hall’s assessment. Unsurprisingly, he stood by his own figures while taking a swipe of his own at PH’s:

I don’t believe [Peel Hunt’s] assertion that the hit to AIM would be 20 to 30 per cent. It’s not necessarily wrong, but it’s a statement without any underlying evidence. I wouldn’t put much weight on it as I don’t know how they got there . . .

The upfront cost of this relief is £1.1bn. If you spend that money on something else, direct public spending, whatever. That has positive effects for jobs elsewhere etc.

It seems like a very partial way to look at the world to say if you take away this relief, that jobs would go [PH notes that AIM companies are responsible for close to 800,000 employees]. Hall seems to have ignored the other side of the equation. We ignored both. We’re not burning this money, it’d be spent on something tangible.

I’m all for supporting investment. I just think this is the wrong place to do it.

Advani also points out that unlike other targeted tax reliefs (Enterprise Investment Scheme, Seed Enterprise Investment Scheme, Venture Capital Trusts), “the current design of BR does not do anything to explicitly focus investment into companies which are expected to be high-return”.

Aim might not be helped by the removal of the incentive. But its problems — namely a dearth of flotations, high costs and burdensome listing requirements — run far deeper than anything that maintaining IHT relief might fix. Either way, the ball is now back in Peel Hunt’s court. Or, we suppose, in Rachel Reeves’.

Further reading:

— Peel Hunt’s cunning plan

— How to fix London’s markets (if you get a chance, no worries if not)

— Meanwhile, on AIM (FTAV)

— Number of Aim-quoted groups drops to 22-year low in blow to London (FT)