Ajay Rajadhyaksha is global chair of research at Barclays.

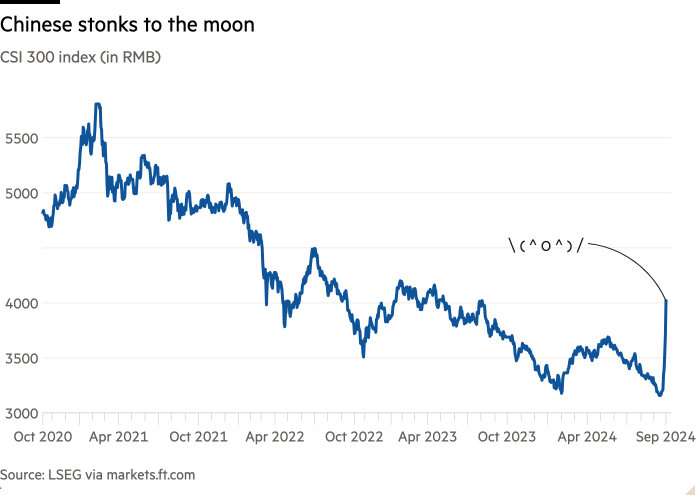

Chinese equity markets are on fire. The major indices have now rallied an astonishing 30-35 per cent in just three weeks. The shift from the doom and gloom this summer couldn’t be starker.

Local brokerages are working overtime as Chinese households rush to open stock trading accounts. Trading systems are jammed. Appaloosa’s David Tepper, one of the most successful investors of all time, went on TV to declare that when it came to Chinese equities, he was willing to break his own risk limits.

Nor is he being particularly discriminating. When Tepper was asked what he was buying, he replied:

‘Everything . . . everything — ETFs, we do futures . . . everything. Everything. This is incredible stuff for that place, OK, so it’s everything.

After years of doom and gloom, animal spirits are finally back in China’s equity markets. Surely, surely, it’s only a matter of time before animal spirits also lift up China’s economy? Well — colour us sceptical, at least for now.

The stock market rally is understandable. In mid-September, China’s central bank slashed interest rates and reserve requirement ratios for the banking system. More importantly for equities, the People’s Bank of China set up a lending facility to allow firms to buy stocks with borrowed money, and hinted at a standalone “stock stabilisation fund”.

A central bank willing to buy equities is a powerful thing. It’s the one entity in a modern economy that doesn’t issue debt. All a central bank has to say is “let there be money” and lo, there will be money. It doesn’t need to mark holdings to market. And it cannot be margin called. Little wonder that Chinese stocks, as beaten down as they were, took off after such a strong statement of political will from the government.

But the stock rally will eventually lose steam unless the underlying economy picks up. And here China still has a problem. The economy has disappointed enormously for several quarters, and nowhere is this more apparent than in the all-important real estate sector.

For decades, getting on the property ladder was the key to wealth creation. You bought one apartment and after a few years, you bought another if you could. Rental yields were low, but that didn’t matter because everyone knew that home prices would keep rising.

Real estate construction fed a bunch of other industries — buy an apartment, buy an automobile. A new suburb would be built, which would lead to investment in transportation arteries, the electricity grid, and a host of other infrastructure spending.

And the numbers were astronomical. That well-known statistic about how China poured more concrete in two years than the US did across the 20th century? Well, it’s true. More to the point, over the past decade, China built multiples more housing flooring space on average per year than the United States did. Per capita.

All of that came to a crashing halt a couple of years ago. Since then, home prices have fallen, eroding trillions of dollars in household wealth. Tens of millions of housing units lie empty across the country, even though the authorities have repeatedly cut mortgage rates and down payment ratios, including a couple of weeks ago.

Youth unemployment has risen to record highs, to the point where China briefly stopped publishing that statistic. While the West has battled inflation, China has struggled with deflation. Consumers have pulled back on spending and have saved even more feverishly than usual. Credit growth has slowed to a crawl, as has domestic demand. There are worrying signs of wage deflation.

Exports and the manufacturing sector — the one success story of recent years — face a huge headwind if the US imposes harsh tariffs after the November 5 election. Even the non-US world is pushing back on China’s exports, especially in the auto sector. There is an eventual demographic time-bomb ticking as well but China’s immediate problem is that animal spirits have disappeared from its economy.

The policy prescription seems well-understood. A number of prominent Chinese economists have called for China to do Rmb10tn of new fiscal stimulus to get the economy moving — but of a different sort than the past.

Previous rounds of stimulus involved heavy investment in manufacturing, and left China with massive overcapacity in many industries and a mountain of debt.

The goal this time is to give money to Chinese consumers, encourage them to spend, and jolt the domestic economy into action. It is an approach that Chinese policymakers have historically resisted. That’s why it is encouraging that for the first time, the government is planning cash handouts, rich cities like Shanghai and Ningbo are handing out consumption vouchers, etc etc.

But for all the excitement of recent days, China has so far announced just Rmb2tn of extra gross issuance of debt. At current exchange rates, that’s less than $300bn. That’s really not much for a $18tn economy.

And it’s minuscule compared to previous rounds of Chinese stimulus, which China has usually done through both fiscal (central and state government spending) and quasi-fiscal channels (banks pressed into “national service” to lend massive amounts to companies, local government vehicles, investment funds, households, etc).

In the 2009-10 and 2015-16 rounds, China’s overall deficit (once quasi-fiscal efforts were factored in) was 15-20 per cent of GDP. That was absolutely massive. The 1-1.5 per cent of GDP so far announced is a drop in the bucket, especially compared to the scale of the problems. That has left China as a system — households, corporates, local and state governments, and the central government — heavily indebted, and understandably reluctant to reopen the credit spigots.

On the other hand, the country has done policy U-turns before. China had perhaps the harshest Covid lockdown policies in place by 2022, while the rest of the world had largely reopened. And then in November 2022, the government did a complete about-turn and opened China up. Perhaps its fiscal approach will change similarly.

There are already media reports of another $142bn in new capital for the banking system, which would be a positive step if it actually occurs. Investors expect several trillion renminbi more in new stimulus to be announced soon.

And this isn’t about a return to the glory days of commodity supercycles and 8-10 per cent growth rates. The goal of stimulus now should just be to put a floor under growth and prevent it from falling below the 5 per cent target.

But the clock’s a-ticking. Like the football player in Jerry Maguire, markets need China to “show me the money!” Ideally in the next few weeks, with all eyes on the October Politburo meeting.

It’s hard not to be cynical. China’s National Development Commission has announced a press conference on Oct 8 to discuss “a package of incremental policies”, and the word “incremental” doesn’t exactly instil confidence. Even if China does announce Rmn10tn in new spending (a massive lift from what it has done so far), this stimulus would still be far smaller (as a share of GDP) than in past rounds.

Chinese equities are famously momentum-driven, and even after the latest rally the Shanghai Comp is still a well below the highs of 2015 despite China being a much larger economy than a decade ago. So the latest rally might well continue for a while, even if policy underwhelms.

But expectations have built up a lot in recent days. If the government fails to get the economy moving yet again, that will disappoint a lot of people, and the rally will be remembered as just another brief spell of market euphoria rather than the start of a sustained China rebound.