Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When a Chinese spy balloon burst off the coast of South Carolina last year, so did investors’ view of Chinese stocks, according to UBS.

Bear with them here and rewind to February 2023. Chinese equities had already been selling off hard for two whole years, when the Pentagon shot down a balloon that had been drifting across American airspace, antagonising already tense relations between Washington DC and Beijing.

At around the same time, several “long-standing valuation relationships broke down” and the market basically “stopped responding to solid [return on equity] improvements of [China-listed] stocks,” says UBS.

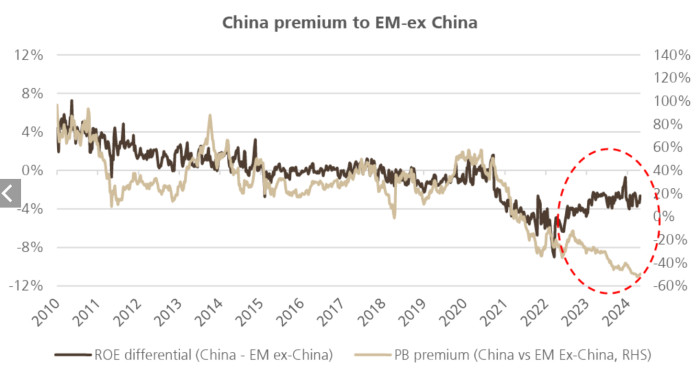

Correlation does not imply causation . . . but the chart does look nice:

UBS’s strategy team led by Sunil Tirumalai upgraded China to “overweight” in April of this year, which turned out to be a good call. They argue in a note published on Friday, assuming the price-to-balloon-book discount should no longer apply, that recently resurgent Chinese stocks still have some catching up to do:

A market that at current levels of ROE should have traded at a 15% premium to [the] rest of EM, has fallen to a 50% discount. Even if the China equities close only a third of this gap — that is still a 40% upside from [current market prices] on what is still the largest EM market.

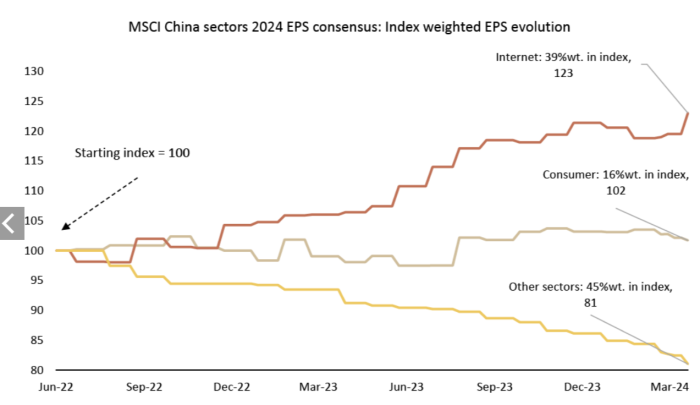

UBS funded its China upgrade five months ago by downgrading semiconductor-heavy Taiwan and Korea to “neutral”, on the observation that many of the “largest stocks in the China index have been generally fine on earnings/fundamentals”.

The country’s underperformance was “purely due to valuation collapse,” UBS said at the time: most MSCI China earnings were never really affected by the implosion of the property sector or geopolitics, and there was a “growing trend of China companies giving positive surprise[s] on dividends/buybacks”.

By April, the internet groups that account for almost two-fifths of the weight of the MSCI China had been reporting healthy earnings growth for several months, it told clients:

More cautious is JPMorgan, whose strategists moved Chinese stocks to “neutral” from “overweight” in the first week of September.

China’s Covid reopening in late 2022 preceded a three-month 50 per cent gain for the Hang Seng China Enterprises Index (HSCEI), JPM notes, while ETF purchases by the country’s “national team” of sovereign wealth funds at the start of this year had helped to boost the same index by around 40 per cent by the end of May:

Referencing these past events, one can make the case for the HSCEI to rally another 20% from current levels over the next 2-3 months as part of a “tactical” bounce (i.e., without having to turn structurally bullish on China).

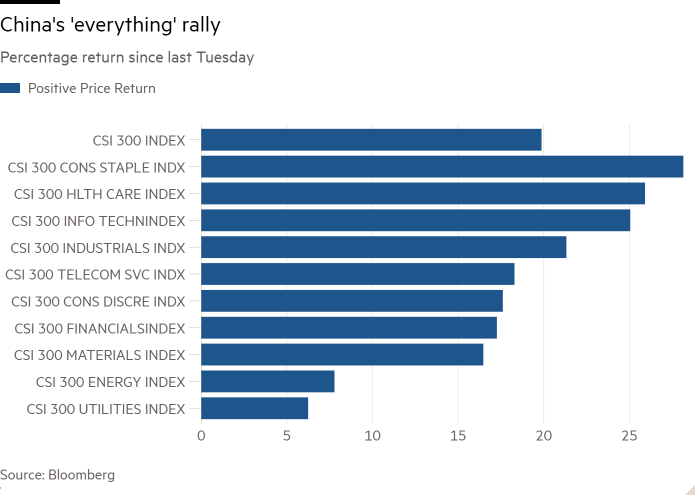

“Structurally bullish” perhaps underplays the mood swing. Last week’s massive demand-side stimulus measures have for some investors detoxed the country’s once “uninvestable” equities markets.

On Friday, for example, hedge fund billionaire David Tepper told CNBC he was inclined to buy more of “everything”, enticed by US-listed Chinese stocks with “single-multiple PE’s” and “double-digit growth rates” as well as what he described as PBoC governor Pan Gongsheng’s borderline “jovial” press conference.

Others seem to agree:

Some of the past week’s jump would have been driven by short covering — Bank of America’s latest survey of global fund managers, published two weeks ago, showed that one in five investors thought “short China equities” was the most crowded trade.

But JPM reckons “most of the buying has come via longs added,” with hedge funds having last week notched the “strongest 1wk buying of local China stocks that we’ve seen over the past ~7 years”.

Other analysts point out that the rally will live or die on the appetite of domestic, rather than foreign, investors. And they haven’t been hungry for a while.

Funds announced last week, including a CNY500bn swap facility and CNY300bn relending facility, represent less than 2 per cent of China’s total listed onshore market cap, according to Barclays — the implication being that more will be needed to sustain stock market inflows from previously consumption-averse consumers and households.

UBS, on the other hand, thinks last week’s policies already “directly address” this problem:

We’ve been of the view that the primary drag on China equities have not been foreign selling (China UW level in EM funds has been largely flat for two years), nor weak company fundamentals — but a lack of domestic flows support. China’s post Covid experience has been unique in that the big savings from lockdowns have not hit the stock markets. A high real interest rate scenario encouraged savings over consumption and bank deposits over risky market investments. The outsized policy actions earlier this week and the specific liquidity support to markets directly address this, in our view.

Whatever one makes of the rally, and however long it lasts, the optimum strategy seems clear: sell everything if you spot another balloon.