This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. Today we’re covering:

-

Thailand’s cash handout programme

-

How Israeli spies penetrated Hizbollah

-

The chaos and glory of Hong Kong’s Chungking Mansions

But we start in Japan, where Shigeru Ishiba’s election as leader of the ruling Liberal Democratic party is expected to put pressure on the country’s stocks this morning.

Ishiba, a former defence and agriculture minister who is set to take over as prime minister on October 1, is a China hawk who has vowed to prevent the nation from falling back into deflation.

The new LDP leader has said he supports the Bank of Japan’s plan to normalise monetary policy. But investors are concerned about his support for heavier taxes on companies and investment income.

Before the winner of the leadership race was announced on Friday, Japan’s Nikkei 225 index had rallied 2.3 per cent and the yen had fallen, suggesting the market was positioned for a win by economic security minister Sanae Takaichi. Takaichi supported stock market-friendly “Abenomics” policies of ultra-low interest rates and fiscal stimulus.

Nikkei 225 futures traded in Chicago fell sharply after the LDP election result announcement.

“The futures market tells us it’s going to be very ugly on Monday,” said a trader at one of Japan’s largest investment banks. Read the full story.

-

FT View: To succeed as the leader of a divided party, Ishiba will need to show a strong streak of pragmatism, rather than pursue his own, long-held political projects, writes our editorial board.

-

More Japan: Six decades after the first bullet train left Tokyo Station, Leo Lewis celebrates the shinkansen — an icon of speed, style and national identity.

Here’s what else I’m keeping tabs on today:

-

Economic data: S&P Global reports September manufacturing and services PMI data for China. Japan publishes August preliminary industrial production and retail sales figures.

-

United Nations: The UN General Assembly debate concludes in New York.

Five more top stories

1. Thailand has begun rolling out a $14bn stimulus programme this week to distribute cash to millions of citizens, pitching it as the centrepiece of an economic plan to boost growth. But the much-anticipated scheme may not be enough to turn around south-east Asia’s second-largest economy. Here’s why.

2. Israel has launched a wave of air strikes against Houthi rebels in Yemen, dramatically widening its offensive against Iranian-backed militants. The strikes came just two days after Israel assassinated Hizbollah leader Hassan Nasrallah in Lebanon. Here’s the latest.

3. Rescuers are still searching for survivors after heavy rain and wind from tropical storm Helene devastated south-eastern US, leaving more than 60 people dead, destroying homes and causing power outages for millions. The storm could result in up to $34bn in losses from property damage and reduced economic output, according to Moody’s.

4. Austria’s far-right Freedom party was on course to win a historic electoral victory yesterday, in a result that will consolidate pro-Russian, anti-establishment forces in central Europe. The FPÖ, which has never come first in a national election before, was projected to win just under 29 per cent of ballots cast. The result bolsters the claim of its firebrand leader Herbert Kickl to become Austria’s next chancellor but he still needs coalition partners to form a government.

5. A recent string of indicators pointing to the Eurozone’s slowing growth will probably lead to a 0.25 per cent interest rate cut by the European Central Bank next month, economists predict. The long-standing consensus among economists had been that the ECB would wait at least until December before deciding on a further rate cut. Here’s what changed that view.

News in-depth

In the past few weeks, the Israeli military and security establishment has delivered a steady drumbeat of devastating blows to Hizbollah, culminating in the assassination of its leader Hassan Nasrallah on Friday night. But the successful attacks on one of its biggest regional rivals belie an uncomfortable truth: in nearly four decades of battling Hizbollah, only recently has Israel truly turned the tide. What changed, said current and former officials, is the depth and quality of the intelligence that Israel was able to lean on.

We’re also reading . . .

-

Bacha Coffee: The Singapore-based coffee brand is embarking on an aggressive expansion as it launches a store on the Champs-Elysées in Paris and other locations across Europe.

-

The UniCredit-Commerzbank tussle: Banks getting bigger may be attractive, but there are significant drawbacks, writes Simon Samuels, especially for the taxpayer.

-

Green business rethink: An overdue push to reshape markets, not just individual companies, is under way at last, writes Pilita Clark.

Chart of the day

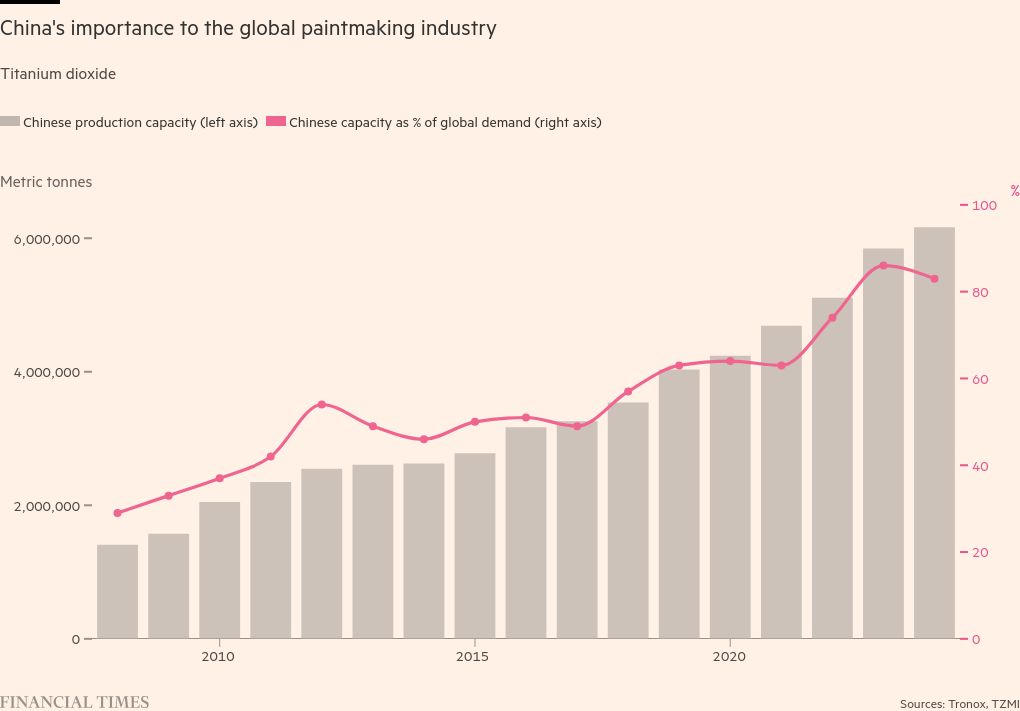

Paint manufacturers are pushing for a rethink of EU anti-dumping measures against Chinese exports of titanium dioxide, a key raw material, saying they will lead to factory closures and further erosion of the region’s industrial base.

Take a break from the news

Since opening in 1961, Hong Kong’s Chungking Mansions have been synonymous with chaos, its name a byword for transience, petty crime and low-end trade. But in the wake of Beijing’s political crackdown on the city, perceptions of the dense and decrepit warren of flophouses and eateries have shifted, the FT’s Orla Ryan writes in a must-read for FT Magazine.