Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The received wisdom for a while has been that the end of this year will be tough for investors. Monster-sized tech stocks are already expensive by any sensible measure and the intense sensitivity across markets to every even minor hit and miss in the economic data point to an extended period of uncomfortable volatility. Plus, the US is doing that election thing again in November with, let’s say, potentially extreme outcomes.

But the US Federal Reserve scored a master stroke this month in hacking back interest rates hard without triggering alarm that it is fending off a recession. Since then, the mood has shifted: what if risky assets do not melt down, nor even stumble, but melt up?

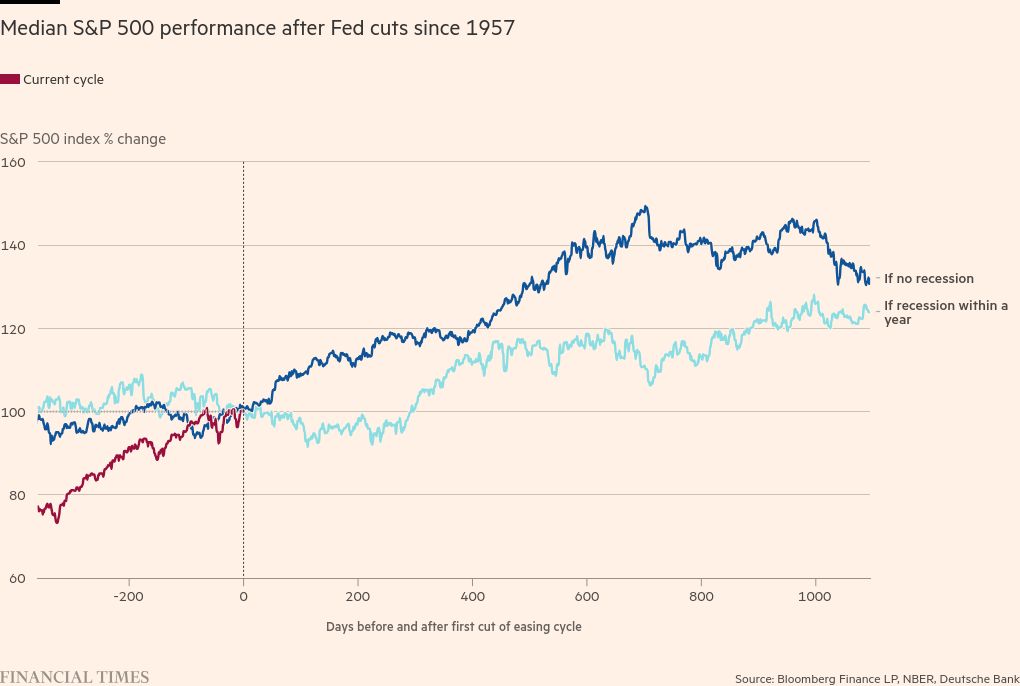

The historical record paints a strong case for this. US interest rate cuts of any size generally coincide with declines in stocks and other risky markets if they come in or around a recession, but not if the economy is humming along reasonably nicely, as it appears to be now.

Deutsche Bank notes that looking back at all the US rate-cutting cycles from the past 70 years, easing linked to a recession generally fails to stop the S&P 500 benchmark of US stocks from falling in the following few months. “However, if we have an easing cycle and no recession then markets tend to fly,” wrote strategist Jim Reid at the bank. “In fact, at just under two years after such cycles the median move has been almost 50 per cent higher. S&P 500 at 8450 in late 2026, anyone?”

That is likely to be a little ambitious, as Reid says, because US stocks had already marched higher in advance of the US rate cut, carving out the biggest such pre-easing ascent ever over that 70-year period. So, this outcome might already be in the price, and it could even mean that if a recession does emerge — still a long shot but you never know — then market declines could be particularly painful.

But investors appear to be setting aside that risk for now. Stocks have hit several more all-time highs since the Fed’s decision a week and a bit ago.

One big reason for this is that the Fed has convinced the market it is taking a proactive stance, trying to steer the economy away from a crash in the jobs market before it happens. The long-run rate projections released at the time of the monetary policy decision suggest policymakers still expect to cut rates a fair amount further, in turn suggesting they know they still have half a foot on the brakes.

Research house TS Lombard is among those saying this presents the possibility of a “melt-up” for risky assets. “The fact that the Fed looks prepared to continue delivering aggressive rate cuts into this economy is a bullish set-up for equities and low-grade credit,” analysts there wrote this week.

Absolute Strategy Research also says the worst of the economic downturn may already be behind us without our even having noticed. As Ian Harnett and David Bowers there note, US corporate debt defaults appear to have already peaked — an outcome, if proved, that would be “a tremendously positive result for the Fed, the US economy, and US equity and credit investors”.

Worry worts (myself included, to a degree) were convinced at the end of last year and start of this that the aggressive run-up in interest rates would lay waste to corporate balance sheets and tip a wave of companies in to debt distress, but that horror show has not materialised. Instead, the trailing 12-month US corporate debt default rate has already started to edge down from June’s 4.8 per cent pace, data from S&P Global show. The rating agency expects that rate to sink to 3.75 per cent by June, or even to 2.75 per cent in an optimistic scenario.

So far so rosy. But now additional support has come from, of all places, China, home of a truly grim market performance this year. First off, the central bank and financial regulators this week unleashed a series of stimulus measures including interest rate cuts, further support for the property market and even efforts aimed specifically at lifting stocks. “We were surprised by the extent of the measures, and by the extent of the measures all at the same time,” said Laura Cooper, a London-based strategist at investment firm Nuveen.

The following day, Chinese authorities went even further, promising to step up fiscal support. Together, this has forged comfortably the strongest week for the CSI 300 index of Chinese stocks of the past decade, with a gain of nearly 16 per cent — its best week since 2008. China has deployed a safety net for the economy that could also support investors at home and abroad. European markets also caught some of the good vibes. Barclays is calling this an “early Santa rally” for stock markets.

The biggest risk now might be that the US and global outlook is sufficiently robust that the expected rate cuts that are underpinning at least some market gains are not needed after all. But increasingly it feels like you have to reach for reasons to be miserable in a world where the US economy is holding up pretty well and big central banks have got your back. The path of least resistance here appears to be further, potentially even rapid, gains.