This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. In today’s newsletter:

-

Saudi Arabia prepares to abandon its oil price target

-

China’s accelerating green transition

-

How a Chinese billionaire’s Silicon Valley splurge caught the FBI’s eye

But first, China’s leaders have vowed to intensify fiscal support for the world’s second-largest economy, raising market expectations for more intervention just days after the central bank announced the biggest monetary stimulus since the pandemic.

The politburo, led by President Xi Jinping, pledged yesterday to “issue and use” government bonds to better implement “the driving role of government investment”. The comments come as analysts warn that China is in danger of missing its official economic growth target this year.

The politburo usually does not hold economic sessions in September, suggesting “an increased sense of urgency” about growing deflationary pressures, Morgan Stanley analysts said.

But they said China’s government did not yet appear to have reached a “whatever it takes” moment on the economy. Here’s more on the politburo’s statement and how markets reacted.

And here’s what else I’m keeping tabs on today:

-

Economic data: Japan publishes August trade statistics and China reports industrial profit for the same month. On Sunday, Vietnam reports September inflation data and third-quarter GDP.

-

Japan leadership vote: The Liberal Democratic party holds a leadership vote, in effect deciding the new prime minister. Here’s the crowded field to succeed current premier Fumio Kishida, who said last month he would not seek re-election.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Exclusive: Saudi Arabia is ready to abandon its unofficial price target of $100 a barrel for crude as it prepares to increase output. The prospect of Riyadh ditching its target is a sign that the kingdom is resigned to a period of lower oil prices, according to people familiar with the country’s thinking.

2. A company backed by Clayton, Dubilier & Rice and Hellman & Friedman, BlackRock and Singapore’s GIC is preparing one of the largest debt-fuelled dividend payouts in private equity history. Belron, the world’s biggest windscreen repair company, is in talks with lenders to raise €8.1bn through new bonds and loans to finance the €4.4bn dividend.

3. New York City mayor Eric Adams has been charged with fraud and bribery over an alleged long-running scheme to solicit cash and luxury travel from Turkish government officials and other wealthy foreign donors. The explosive charges mark the first criminal case in modern history against a sitting New York mayor.

4. Israeli Prime Minister Benjamin Netanyahu vowed yesterday that Israel would press on with its offensive against Hizbollah in Lebanon, casting doubts on a US-led diplomatic push for a ceasefire to prevent a full-blown war. Netanyahu spoke in New York, where he is due to address the UN General Assembly today.

5. Global companies have stepped off the sidelines in recent months to pursue blockbuster takeovers of rivals, with high-profile transactions such as Mars’s purchase of Kellanova and Verizon’s takeover of Frontier Communications spurring hopes of a dealmaking revival. While the overall number of deals sank to a nine-year low, bankers said boardroom sentiment had become more optimistic.

The Big Read

The scale and pace of China’s transition from fossil fuels has smashed international forecasts, exceeded Beijing’s own targets and put the rest of the world on notice. But to wean the country off coal, Chinese authorities need to push through a politically toxic shake-up of the electricity system, a long and thorny process that has already dragged on for decades.

We’re also reading . . .

Graphic of the day

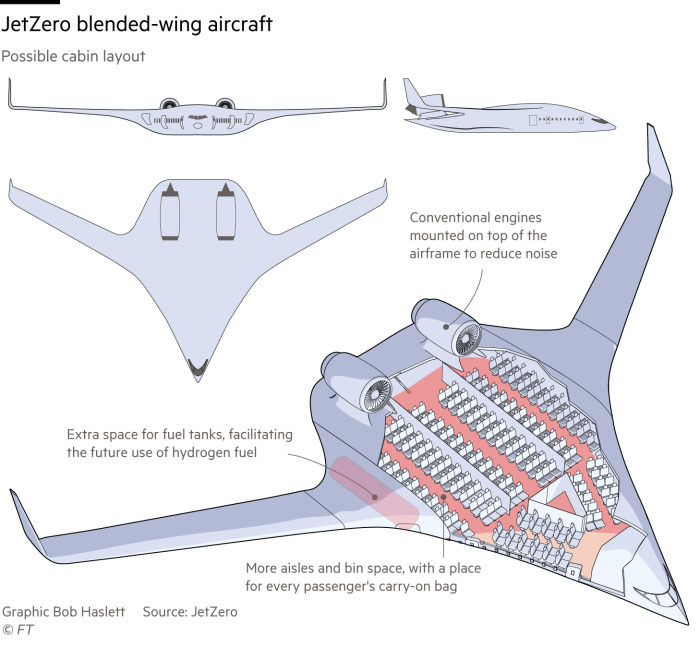

Could this radically shaped plane change the future of commercial flying by 2030? Inspired by the US Air Force’s B-2 stealth bomber, JetZero’s new aircraft promises to be both less noisy and more fuel-efficient.

Take a break from the news

We’re celebrating the 30th anniversary of our iconic Lunch with the FT with a free, pop-up newsletter. Receive our favourite Lunches from the archives in your inbox, featuring fresh insights from the interviewer. Join us for a weekly serving of Lunch starting this Sunday, until November.

Additional contributions from Gordon Smith and Tee Zhuo