Stay informed with free updates

Simply sign up to the EU business regulation myFT Digest — delivered directly to your inbox.

“The main reason EU productivity diverged from the US in the mid-1990s was Europe’s failure to capitalise on the first digital revolution led by the internet — both in terms of generating new tech companies and diffusing digital tech into the economy. In fact, if we exclude the tech sector, EU productivity growth over the past 20 years would be broadly at par with the US.” This passage from Mario Draghi’s report on European competitiveness points to a core part of the agenda for the EU’s future.

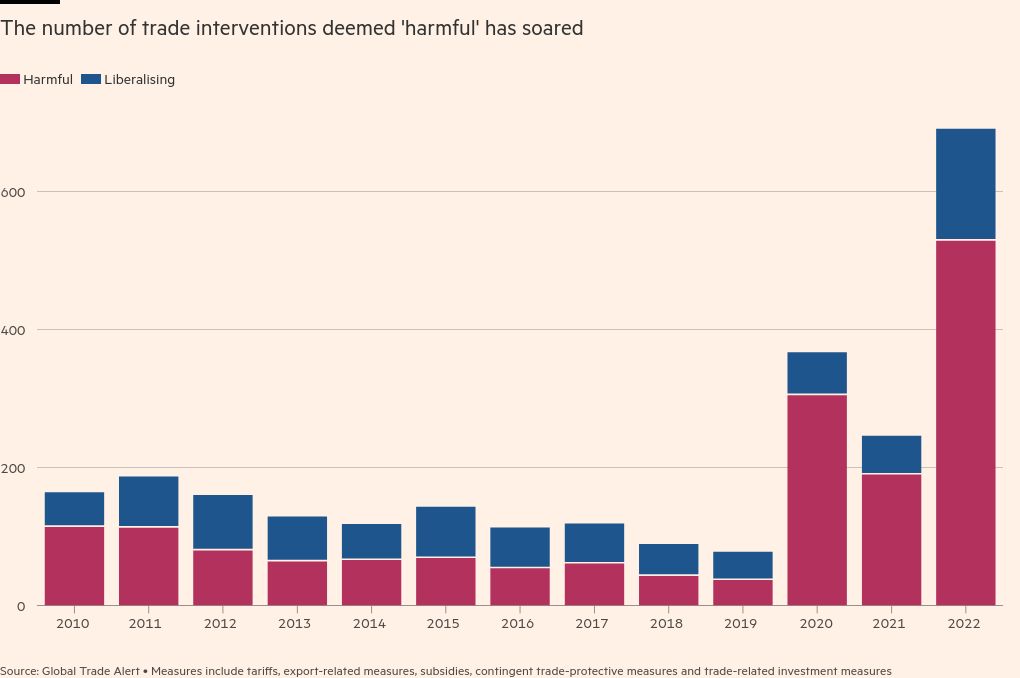

However vital, this is just one of the strategic economic challenges the EU confronts. Others include energy vulnerability, the green transition and the rise of protectionism. Draghi provides both a framework and suggestions for how to respond. This will include more interventionist trade and industrial policies. The challenge is to make these policies targeted and sensible.

In the defence industries, for instance, the case for building on the example of Airbus seems strong. Compared with the US, the European defence sector is too fragmented. Cross-border mergers would appear to be essential.

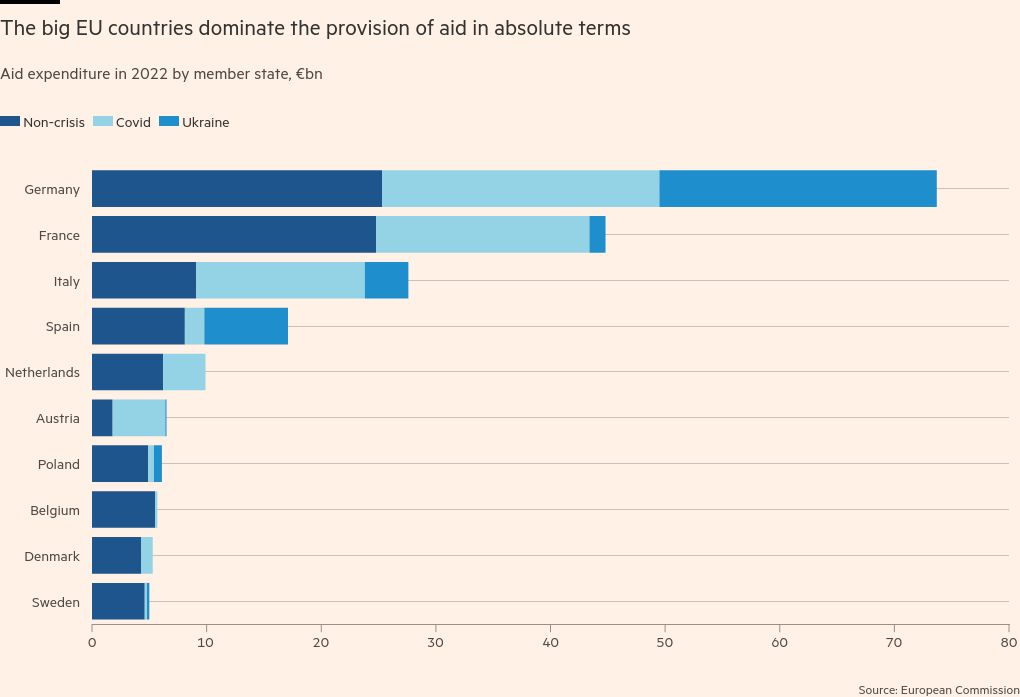

Not dissimilar problems exist in banking, capital markets and energy supply. For varying reasons, governments are refusing to allow much needed cross-border integration. This largely reflects nationalist politics and special interests. As a result, regulatory barriers persist. Happily, the history of the EU shows that such obstacles can be overcome with political will. But will that will ever be forthcoming?

The shift to “clean tech” in the automobile and energy sectors is a more complex challenge. As the Draghi report notes: “Owing to a fast pace of innovation, low manufacturing costs and state subsidies four times higher than in other major economies, [China] is now dominating global exports of clean technologies.” This creates both opportunities for accelerated adoption of new technologies, but also disruption for important EU industries and the possibility that they will be locked out of parts of the supply chain, such as batteries, because they lack access to critical raw materials. In all, intervention is inevitable. Trade law also permits it. Intervening effectively is another matter. But, done with care, it should be possible.

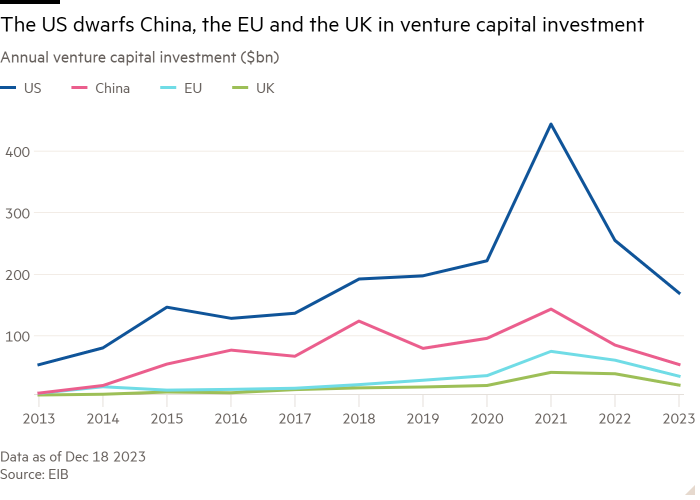

The digital revolution is another matter again. It would be ludicrous to imagine that investing in “EU champion” versions of Google, Microsoft, Apple or Nvidia would work. Nor would standard trade measures help: how could one hinder Google searches without introducing Chinese-style restrictions? Nor does it seem plausible that funds are unavailable for attractive tech opportunities, though reform of capital markets should help to build a bigger EU venture capital industry. But the fact that venture capital investment in the EU was a mere fifth of that in the US in 2023 is not due to a shortage of savings in the EU. It is due to a failure to create the required technology ecosystem. (See charts.)

So, why has that happened? It is not that the EU lacks the people. Informed commentators argue that it is largely due to overregulation. Two sorts of regulation are crucial: regulation of the tech sector specifically and wider regulation of the economy, especially the labour market, that particularly affects unpredictable new ventures. If you cannot fire, you will not hire and so you will go elsewhere.

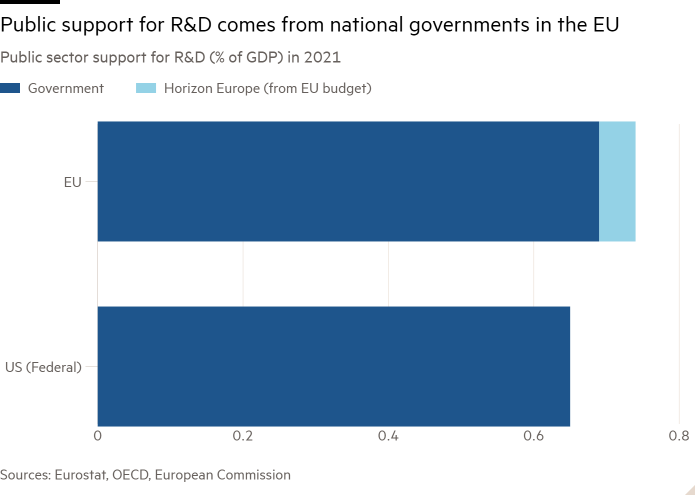

The well-known tech expert Andrew McAfee of MIT has made a powerful critique of EU policy. He agrees that the state of the EU tech industry is dire. But the problem is not lack of money: EU governments spend much the same amount (and share of GDP) on supporting research and development as the US federal government. Yes, the former is fragmented among member states. But that is not the main problem, he argues: “It’s governmental intervention in that ecosystem not with funding, but with laws and regulations, and other constraints, restrictions, and burdens on companies.”

The tech policy analyst Adam Thierer elaborates the point: “Several recent studies”, he notes, “have documented the costs associated with the GDPR [General Data Protection Regulation] and the EU’s heavy-handed approach to data flows more generally.” This imposes heavy costs on innovative firms and, inevitably, the smaller the firm, the bigger the implicit tax. Given this, as well as the fragmented EU markets, it is little wonder that the US is so far ahead.

A paper by Oliver Coste and Yann Coatanlem, published by Bocconi University in Milan, makes another important and still broader point about regulation: new and dynamic companies have to be able to adjust their costs quickly in the light of market developments. Thus, note the authors, the costs of restructuring, largely the result of employment protection regulation, are fundamental. The more expensive it is to restructure, the more cautious the company. Cumulatively, such protections are crippling. The UK’s Labour government should note this potential danger in their plans.

Draghi agrees that regulation is a big issue. Thus, he notes, “the EU’s extensive and stringent regulatory environment (exemplified by policies based on the precautionary principle) may, as a side effect, restrain innovation. EU companies face higher restructuring costs compared to their US peers, which places them in a position of huge disadvantage in highly innovative sectors characterised by the winner-takes-most dynamics.” He even recommends a new “commission vice-president for simplification”. Good luck with that approach.

The issue is rather philosophical and political. The EU needs to find a way to regulate the tech sector that does not simultaneously throttle its growth. Doing that will be a huge challenge.

Follow Martin Wolf with myFT and on X