This article is an on-site version of our Trade Secrets newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Welcome to Trade Secrets. So what’s new? Ursula von der Leyen last week proposed a set of new portfolios for the incoming European Commission that seem likely to cause a fair number of turf battles in Brussels, but that’s hardly an innovation. The main man in trade is solid performer Maroš Šefčovič. He’s chiefly been notable hitherto for having to deal with post-Brexit Britain, in comparison with which Xi’s China and potentially Trump’s America should be a doddle. Today I look at Šefčovič’s economic security brief, but first point out that the macroeconomic bit of the “polycrisis” isn’t looking very crisis-y right now. Charted Waters is on German carmakers. Question for you: even if Trump isn’t elected, am I being too optimistic on the global economy?

Get in touch. Email me at [email protected]

Dodging the 1920s trap

And so normality becomes the new normal. Jay Powell’s Federal Reserve last week cut rates for the first time in four years. Other central banks are also cutting, inflation is generally falling, global growth is forecast to be north of 3 per cent this year and next, and world trade in goods is recovering.

And then along came Powell’s European Central Bank counterpart Christine Lagarde to argue that, well, monetary policy might not have made the same mistakes as the 1920s and 1930s, but economic integration really might still be in trouble. I guess there’s always something central bankers need performatively to worry about in case people think they’re going soft. But come on, why don’t we cheer up a bit?

Trade Secrets is not a macroeconomics column, and this is not exactly a strikingly novel observation, but it’s really a remarkably short time since the media (including the FT) was full of “ARE WE GOING BACK TO THE 1970s?” The macroeconomic elements of the feared multi-faceted and self-reinforcing “polycrisis” included high inflation, rising interest rates and a possible worldwide recession, along with a looming energy and food emergency, the destabilising shock of Russia invading Ukraine and the fracturing of the trading system.

Well, that’s four interrelated crises that haven’t happened and not much sign of the fifth or sixth either. The macro effect of the Ukraine war has dissipated, and there’s not been enough protectionism to stall the economic recovery. Polycrisis is a thought-provoking concept and we’re certainly still left with the massive medium-term challenges of climate change and geopolitical tensions, which are trouble enough for any planet, but the economic threats have definitely receded.

To be fair, this is of course the kind of hubristic thing that people were writing in 1913 just as the golden age of globalisation was about to end and looked extremely silly afterwards. And as ever, any optimistic predictions about global trade, the economy or indeed democracy have a massive Donald Trump asterisk next to them.

So what do we conclude? Macro is more important than trade policy in the short to medium term, not just for growth but for globalisation itself. Joe Biden kept most of Trump’s protectionism and added some more tariffs and other bad stuff of his own, but his well-timed stimulus plus good monetary policy meant that trade did fine. (Told you so.)

Come to think of it, continually warning we’re going back to the 1920s and 1930s might actually be a happily self-denying prophecy. As Lagarde pointed out, we’ve avoided the mistakes of monetary policy back then because no one currently near the levers of central banking power is bonkers enough (my words not hers) to believe in the gold standard that countries stuck to even after the Great Depression hit. (We also happily ignored the likes of Larry Summers telling us here was a 1970s stagflationary shock again.) And yes there’s been protectionism, particularly in the US, but unless Trump gets elected we’ve had nothing like the rapid increases in US tariffs in 1930 that worsened the Great Depression.

Central bankers and (some, mainly American) fiscal policymakers, take a day off publicly worrying about other stuff. You’ve done pretty well.

Brussels can’t fix economic security on its own

Last week’s Trade Secrets column was about economic security, pointing out that 1. Australia seems to have its act largely in gear about how to deal with it, and 2. the EU doesn’t.

The organigrams of the new European Commission have been fascinating Brussels watchers for a week or so now, fuelling palace intrigue about exactly where power over economic security and indeed other issues actually lies. The answer, unfortunately, is substantially in the member states. The efforts to centralise foreign direct investment screening took literally years (not least because the commission and the MS had to set up a system for sharing secure information that apparently didn’t already exist) and it’s still fundamentally about information-sharing rather than making collective decisions.

Meanwhile, export controls also remain under member state authority, and are vulnerable to pressure from the US. The Netherlands has defended its right to take decisions on export restrictions over the Dutch chip company ASML, even though ASML’s chief executive would prefer it to be done at EU level. Earlier this month the Dutch government said it was taking direct power to do so rather than just accepting US direction, but no one is fooled that this means total independence from Washington.

As for the EU’s new anti-coercion instrument, it was originally designed to combat Trump, was then considered for use against China and now might well return to its original target. But member states insisted on retaining a lot of control over its use, making them vulnerable to lobbying or bullying to weaken their resolve to use it.

Šefčovič might have a wary eye on his commission colleagues, but putting the security into economic security is going to involve cajoling the EU capitals a lot to co-operate.

Charted waters

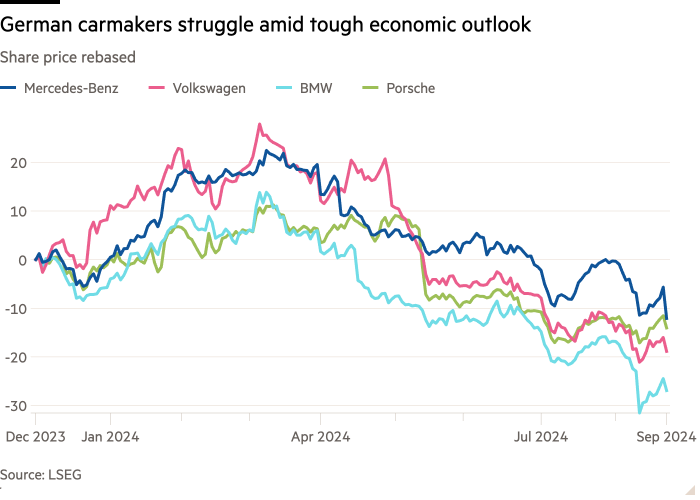

If you’re wondering why German carmakers are lobbying hard against tariffs on Chinese electric vehicles, here’s why. They’re not doing well. They know they can’t really compete against Chinese EVs in the EU right now even with the tariffs, and they’re terrified that retaliation by Beijing will cut them out of the Chinese market.

Trade links

If you want to hear me droning in audio as well as wittering in text, I will appear here some time today talking Trump’s trade policy with my colleague, the great Soumaya Keynes, on her Economics Show podcast.

The academic Henry Farrell in the FT warns against Trump’s idea of replacing financial sanctions with tariffs.

Following former Biden administration official Brian Deese’s response to my response to Deese’s idea for a clean energy Marshall Plan, Charles Kenny of the Center for Global Development think-tank argues for using capital increases at the multilateral development banks to buy green tech for low-income countries. Adam Tooze’s invaluable Chartbook has thoughts on the same subject.

The Economist argues that European regulators are going to have to get more political as they serve more masters.

Enver Solomon, chief executive of the UK Refugee Council, argues for a big change in direction for UK migration and refugee policy, while the ECIPE think-tank’s David Henig is predictably right about the wider EU-UK relationship.

Not much to do with globalisation tbh, but this is amazing research on how those localities that supposedly have lots of centenarians in fact mainly have poor record-keeping and a lot of pension fraud.

Trade Secrets is edited by Jonathan Moules

Recommended newsletters for you

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here

Europe Express — Your essential guide to what matters in Europe today. Sign up here