Standing in front of the modernist architecture of Brasília’s presidential palace, a triumphant Luiz Inácio Lula da Silva contemplated the complex balancing act that lay before him.

“The world expects Brazil to once again be a leader in tackling the climate crisis,” he told crowds gathered for his inauguration in January last year. “And an example of a socially and environmentally responsible country, capable of promoting economic growth.”

The election that returned Lula to power was billed as pivotal for the fate of our planet. His defeated rival, former president Jair Bolsonaro, had been accused of turning a blind eye to the surging destruction of the Amazon — the world’s largest rainforest and a bulwark against global warming owing to its capacity to absorb and store huge amounts of carbon dioxide.

Lula, a former trade unionist who was previously in office between 2003 and 2011, cast himself as an environmental champion. This term he has already achieved a significant drop in Amazon deforestation and outlined wide-ranging green economy plans.

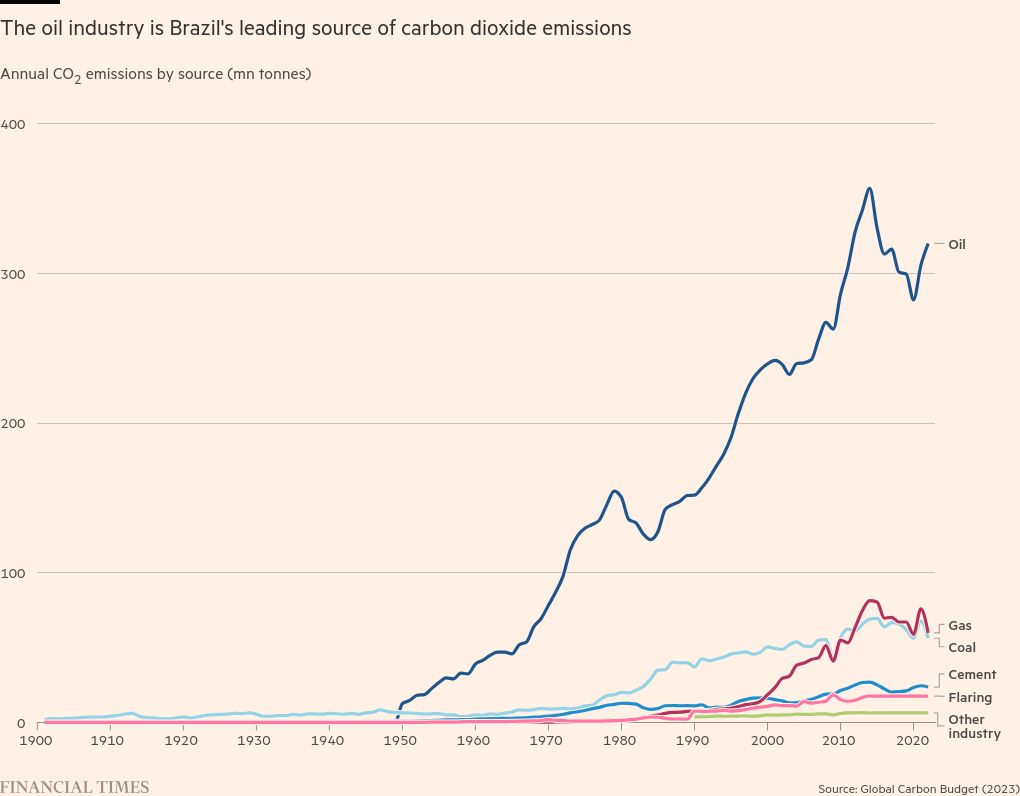

However, an uneasy tension sits at the heart of Lula’s aspirations for global climate leadership. It can be summed up in one word: oil.

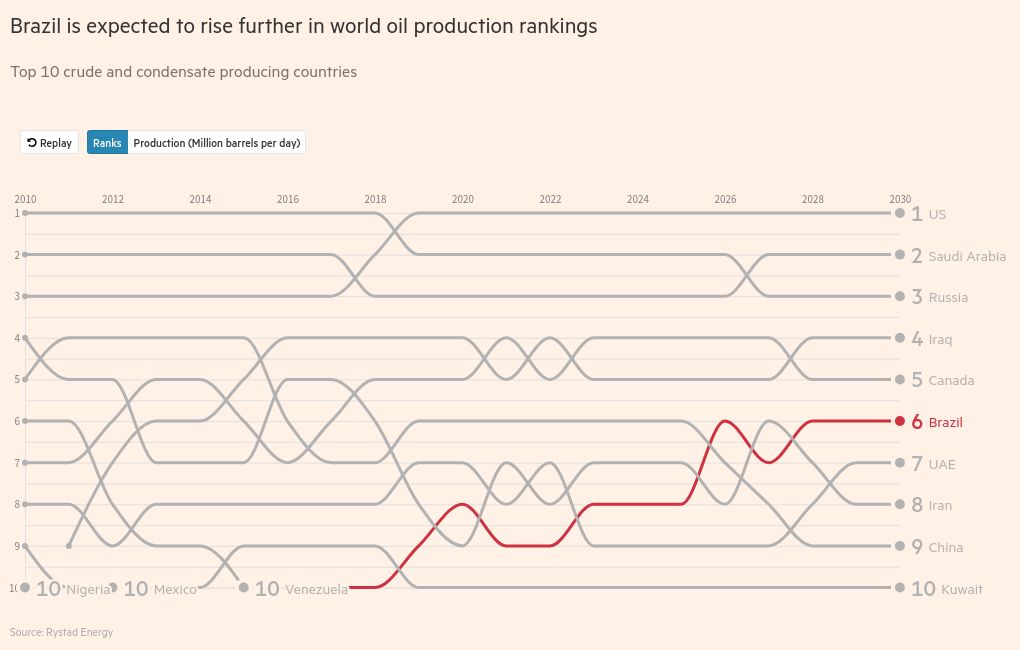

As the South American nation looks to pump increasing volumes of crude from offshore rigs, his government has a goal for Brazil to become the world’s fourth-largest petroleum producer, up from eighth place. Lula sees oil as a central pillar of Brazil’s strategy for economic growth.

There is a push to identify new deposits under the seabed — including one controversial plan to drill for oil in deep waters off the mouth of the Amazon.

The proposals have been criticised by campaigners who say they clash with Lula’s sustainability claims. “There’s no coherence at all,” says Suely Araújo, public policy co-ordinator at the non-profit Climate Observatory. “You can’t be a leader on the environment and climate and at the same time become a mega-producer of oil.”

As Brazil prepares to host next year’s UN climate conference, or COP, the issue threatens to overshadow its leftwing leader’s crowning moment of ecological diplomacy.

Yet while Lula has staked his international reputation on the environment, at home he needs to deliver on pledges to alleviate poverty. Many in his Workers’ party (PT) and beyond view Brazil’s oil riches as a key ingredient for national development.

89%Brazil leads the G20 in renewable electricity, which generated this proportion of its power in 2023

Those in favour of tapping Brazil’s hydrocarbon wealth say that even with the global consumption of crude expected to fall in the shift to cleaner energy, it will still be a part of the worldwide mix for decades. They argue that proceeds from oil and gas sales can assist in funding Brazil’s transition, boosting its low-carbon credentials.

The country leads the G20 in renewable electricity, which provided 89 per cent of its power in 2023, according to energy think-tank Ember. The Lula government has pledged to end all deforestation by 2030 and revised up its emissions reduction targets.

“There is no contradiction in our national energy policy,” says mines and energy minister Alexandre Silveira, who argues Brazil must be “pragmatic”.

“We are putting transition policy into practice, but we cannot pay the price alone,” he adds. “Why can the US and Saudi Arabia continue being oil suppliers and not Brazil? It’s a mismatch and often there’s a hypocritical demand from countries that don’t have oil. For example, France.”

A series of extreme weather events in Brazil over the past year linked by scientists to climate change — including drought, floods and heatwaves — have injected greater urgency to the debate. Massive wildfires have cast smoke across large swaths of the country in recent weeks.

Carlos Nobre, a renowned Earth systems scientist at the University of São Paulo, says with global temperatures rising faster than previously predicted, “it makes no sense” to pursue new hydrocarbon exploration, in Brazil — or anywhere else.

“If we continue with existing fossil fuels, then we get to 2050 with large emissions, and then the temperature will go beyond 2.5 degrees [centigrade above pre-industrial levels], he adds. “This is an ecocide for the planet.”

Lula’s personal connection with oil traces back to his first term in office, when in 2006 state-controlled company Petrobras made a blockbuster discovery off the coastline of Rio de Janeiro.

As deep as 7km below the ocean surface, the enormous reservoirs are called the “pre-salt” layer because they are trapped beneath a thick crust of sodium chloride. Billed as one of the largest finds this century, Lula declared that it proved “God is Brazilian”.

While oil money helped fund social programmes under PT-led governments, the euphoria did not last. First a commodities slump punctured Brazil’s economic boom. Then a corruption scandal centred on Petrobras jailed dozens of businessmen and politicians including Lula, whose convictions were quashed in 2021. Under PT rule, the company also suffered political interference and mismanagement.

Today, crude oil is Brazil’s second-largest export, after soyabeans, with China by far the largest buyer. The sector accounts for about 10 per cent of GDP.

Daily output was 3.2mn barrels in June, about 3 per cent of the world total. Most is from the pre-salt layer, dominated by Petrobras in partnerships with international majors such as Shell, TotalEnergies and China’s Cnooc.

“It wasn’t always a foregone conclusion that Brazil would be an oil superpower,” says Schreiner Parker at consultancy Rystad Energy. “The development costs of pre-salt assets were enormous, requiring a huge capital outlay. We’re starting to see the fruits of that now.”

Energy experts say future oil supply will need to be cheap and have a smaller carbon footprint in order to remain competitive with renewables amid carbon taxes and an eventual decline in demand. Pre-salt proponents say it is ideally suited.

Floating platforms connected to deepwater wells enjoy massive economies of scale that bring down unit costs. The process to extract a barrel of pre-salt oil emits 8-9kg of CO₂, or about half the global average, according to Rystad.

“If oil is demanded by the world, [Brazil] can say, ‘Why should I not be the one producing it when we have really good emissions compared to other producers?’” says Francisco Monaldi, a Latin America energy expert at Rice University in Houston. “Even in the most extreme net zero [emissions] scenario you need significant investment to compensate for declining oil production.”

With Brazil’s crude output forecast to peak by the start of the next decade and then fall, both Petrobras and Brasília are keen to replenish the reserves.

The great hope is the so-called Equatorial Margin: a 2,200km stretch of the Atlantic off the country’s northern coast, facing some of Brazil’s poorest states.

The five basins within this new frontier may contain 10bn recoverable barrels of oil, requiring $56bn of investment, the Ministry of Mines and Energy has estimated. This could increase Brazil’s proven reserves by more than a third and result in $200bn in tax revenues, it estimated. Minister Silveira has called it “a passport to the future”.

Petrobras has dedicated two-fifths of its $7.5bn exploration budget over five years to the zone. It began exploratory drilling in deep waters in one of the basins this year and confirmed oil there.

Yet there are obstacles to the most prized section: the Foz do Amazonas basin — “the mouth of the Amazon river”.

“It is believed to be one of the most promising regions in the Brazilian Equatorial Margin, as it shares geology with neighbouring Guyana, where ExxonMobil is developing huge fields,” says Adriano Pires, founder of consultancy Centro Brasileiro de Infra Estrutura.

However, regulators last year rejected a request by Petrobras for a licence to drill an exploratory well there, in a block the company says lies 500km from the river’s mouth and 160km from the coastline of Amapá state. The case has become a flashpoint for the wider controversy.

Activists say drilling poses risks to a biodiverse and ecologically sensitive areas by the estuary, home to fishing communities as well as mangroves, a coral reef and dolphins. They warn that any spills could be carried far by currents.

The environmental agency, Ibama, cited a lack of in-depth studies into the suitability of the region for oil production, possible impacts on indigenous populations from overhead flights and insufficient plans to safeguard wildlife in the event of spills. An appeal by Petrobras is under consideration.

Ibama’s head, Rodrigo Agostinho, said the biggest concern was the block’s location from the nearest support base: “In a possible emergency, being so far away was unacceptable.”

Industry analysts point out Petrobras’s long experience and expertise on the high seas. The company, which declined interview requests, insists it can conduct the activity safely and has said it does not intend to drill in coastal regions or near sensitive areas.

Its new chief executive, Magda Chambriard, recently said 10 years had already been lost, since the block in question was auctioned off by the oil regulator in 2013.

TotalEnergies and BP held interests in the basin but gave them up after abandoning efforts to obtain drill permits. “It is not credible that three major oil companies are not fulfilling their role in terms of licensing,” Chambriard told an event in June.

With development expected to take several years from first drilling approval, the fear is that the moment could slip away. Brazil’s offshore prospects take longer and more capital to get up and running compared with US or Argentine shale plays, notes Monaldi.

“By the time they develop the Equatorial Margin, it could be the demand for oil has weakened and not many investors are willing to risk stranded assets.”

Officials insist the Foz do Amazonas well request will be decided by regulators on technical rather than political grounds. But to those on both sides of the debate, it will prove an acid test either of Lula’s environmental bona fides or his commitment to drive economic progress.

“What we can’t say is that a priori we are going to give up exploring this wealth, which if the predictions are true, will be very great for Brazil,” the president himself said in June.

“Is it contradictory? It is, because we are investing a lot in the energy transition. But as long as the energy transition doesn’t solve our problem, Brazil has to make money from this oil.”

But within the administration there are differing views. A more cautious approach is expressed by environment minister Marina Silva, who has previously called for a “ceiling” on oil exploration.

“Even if we manage to eliminate CO₂ emissions due to deforestation, if the world does not stop emitting CO₂ due to the use of coal, oil and gas, forests will be destroyed in the same way. So it is a challenge for humanity,” she says.

A life-long green campaigner, Silva served in the same role under Lula during his first stint as president and was credited with overseeing an earlier reduction in Amazon deforestation after years of increases. However, she quit government in 2008 and accused Lula of being in hock with agribusiness.

Silva avoids stating a position on the new oil front in the Atlantic. She says the debate cannot be reduced to one country and calls for wealthy nations to help finance the developing world’s green shift, but is clear about the collective obligations: “A commitment was made during COP28 [in 2023], together with all signatory countries, that we must transition to the end of fossil fuel use.”

At the same UN climate summit, Brazil faced an outcry from activists after announcing it was to align more closely with the oil cartel Opec, though as an observer not subject to its production quotas. Lula justified it as a way to influence petrostates to invest more in renewables.

Brazil already directs some pre-salt revenues towards a fund for social spending and this could be expanded to include ecological projects, says minister Silveira.

“If [Lula] takes a significant amount of those resources to reduce emissions from agriculture and deforestation, he could achieve a better net result,” says Monaldi, referring to the origin of most of Brazil’s greenhouse gases.

But given the country’s strained public finances, to be credible there will need to be clear limits on how the proceeds are used, he adds.

Petrobras says it is investing in greener alternatives, having doubled its pot for low-carbon projects to $11.5bn over five years. But critics argue the sum is dwarfed by the $73bn dedicated to exploration and production over the same period.

Inspecting an overturned tractor caked in mud, Otavino Vedovatto recounted the impact of the worst natural disaster in the history of Brazil’s southernmost state, Rio Grande do Sul, a few months ago.

Extreme flooding washed out rice fields on his farm in Eldorado do Sul, outside state capital Porto Alegre. All the chickens and pigs drowned. Machinery was damaged.

“Nature has given us signs,” says the 57-year-old resident of a settlement established by the leftwing Landless Workers’ Movement. “She is exacting a price for the actions of human beings.”

It was the fourth significant flood to hit the region in less than a year. One estimate put the reconstruction bill at R$110bn ($20bn) and there are warnings that households, businesses and whole towns at risk from future occurrences may need to move.

Climate change made rainfall more likely in Rio Grande do Sul, according to a study by the World Weather Attribution, an academic research collaboration. It made similar findings in relation to an exceptional drought in the Amazon river basin and fires in Brazil’s Pantanal tropical wetlands.

The scientist Nobre says “there is no question” that the increased intensity and frequency of such events is due to man-made global warming. The episodes have renewed calls for Lula to reconsider his bet on black gold.

Raissa Ferreira, campaign director at Greenpeace Brazil, says if the country is serious about its commitment to limit global temperatures to within 1.5C, there needs to be a “radical change” in its policies towards fossil fuels. “They are a loan shark that will backfire really seriously in our economy and our lives,” she adds.

In the meantime, the pending drilling appeal by Petrobras will hang over the countdown to COP30, due to take place in the Amazonian city of Belém in November 2025.

Although an official from the environment ministry has suggested that the licence decision could be delayed until after the conference, Silveira, the mines and energy minister, tells the FT he believes it will be resolved this year.

“For Brazil to lead COP30, [it] could not be a country still defending increasing emissions by fossil fuels,” says Nobre. “We really have to get to zero, because we have tremendous potential with renewable energy and I hope Lula’s government will go in that direction.”

In his inauguration speech, the president said that “no other country has the conditions like Brazil to become a great environmental power”.

In a tightrope act between environmental preservation and economic growth, Lula will soon have to convince the world exactly what this means.

Additional reporting by Beatriz Langella

Data visualisation and cartography by Aditi Bhandari, Ian Bott, Steven Bernard and Justine Williams

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here