This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. Today we’re covering:

-

The latest on the 7-Eleven takeover bid

-

How China ‘throttled’ its private sector

-

Nippon Steel and the limits of American friendship

But we start with an exclusive story: the US Navy Seal unit that killed Osama bin Laden in 2011 has been training for missions to help Taiwan if it is invaded by China, according to people familiar with the preparations.

Seal Team 6, which is tasked with some of the military’s most sensitive and difficult missions, has been planning and training for a Taiwan conflict for more than a year at its headquarters in Virginia Beach, about 250km south-east of Washington.

While US officials stress that conflict with China is “neither imminent nor inevitable”, the secret training underlines Washington’s increased focus on deterring Beijing from attacking Taiwan.

The US military has in recent years stepped up preparations for such an event, sending more regular special forces to Taiwan for missions that include providing training for the Taiwanese military.

But the Seal Team 6 activities are far more sensitive because its covert missions are highly classified. Here’s what else we know.

And here’s what else I’m keeping tabs on today and over the weekend:

-

Economic data: Japan publishes revised industrial production for July. China on Saturday reports August retail sales, industrial output and the house price index.

-

Central Asia: German Chancellor Olaf Scholz on Sunday begins a three-day visit to Uzbekistan and Kazakhstan.

How well did you keep up with the news this week? Take our quiz.

Five more top stories

1. Exclusive: Seven & i Holdings has tapped Nomura to advise its board in preparation for a potential takeover battle with Canada’s Alimentation Couche-Tard, whose opening $39bn bid for the 7-Eleven owner was rejected. The appointment of Japan’s largest investment bank comes after Couche-Tard said this week it remained “highly focused” on the merger.

2. The European Commission has rejected offers by Chinese electric-vehicle makers to adjust their prices in a bid to avoid sharply higher tariffs. The decision to refuse the Chinese carmakers’ offers comes ahead of potentially pivotal trade talks between Beijing and Brussels next week.

3. OpenAI will launch an AI product it claims is capable of reasoning. The company said the models will be able to solve hard problems in maths, coding and science in a critical step towards achieving humanlike cognition in machines.

4. Russia launched a major counteroffensive to push back Ukrainian forces from its southern Kursk region, as Vladimir Putin warned that Moscow would consider Nato nations “at war” if they allowed Kyiv to use western-made weapons for strikes deep inside his country.

5. Donald Trump has ruled out another presidential debate against Kamala Harris. The announcement comes two days after a showdown when the Republican former US president was rattled by his Democratic opponent. Here’s what Trump said.

The Big Read

Amid political and economic pressures, venture capital finance has dried up in China, prompting a dramatic fall in new company formation. Founders and investors harbour few hopes of a return to the glory years before the Covid-19 pandemic, when the likes of Alibaba and Tencent took advantage of rapid economic growth and the rise of mobile internet to become globally significant tech companies. One Chinese executive said: “The whole industry has just died before our eyes.”

We’re also reading . . .

-

Nippon Steel: The Japanese company’s doomed bid for US Steel during the election season offers lessons on the limits of American friendship, writes Leo Lewis.

-

Rahul Gandhi’s US trip: With Narendra Modi on the defensive at home, the leader of India’s resurgent opposition is being seen with fresh eyes in Washington, writes John Reed.

-

Indian delivery apps: Reliance and Google-backed Dunzo is reported to have cut staff amid intensifying competition. Chris Kay explains the pressures on India’s delivery market.

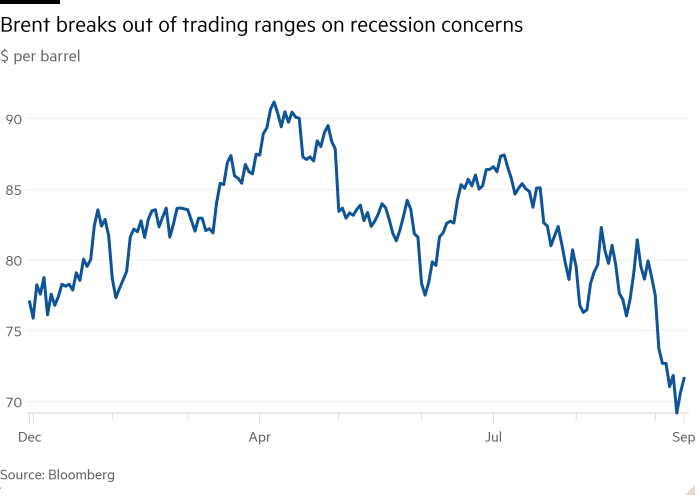

Chart of the day

The price of oil has tumbled out of its year-long trading range as investors grow increasingly nervous about the impact of a slowdown in the world’s largest economies on the demand for crude.

Take a break from the news

This year’s annual FT Business Legal Leaders series examines how senior in-house lawyers are responding to changing demands — from keeping up with developments in artificial intelligence to managing cyber threats and geopolitical risk.

Additional contributions from Gordon Smith and Tee Zhuo