Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Some argue the Vikings discovered America about 500 years before Christopher Columbus. In the same pioneering spirit, Sweden’s Riksbank is leading the US Federal Reserve on interest rate cuts, having made two already this year. The Riksbank’s looser approach to monetary policy reflects the increasingly precarious position of Sweden’s economy. But its woes could be a warning sign for elsewhere in Europe too.

The trouble is that this is hard to discern from Sweden’s stock market. Swedish equities have outperformed European peers this year in both krona and dollar terms. That is down to the Riksbank: rate cuts mean less pressure on over-indebted households and property companies. But the rally may soon run out of steam. Investors should look to Sweden’s vast industrial sector for signs of what is to come.

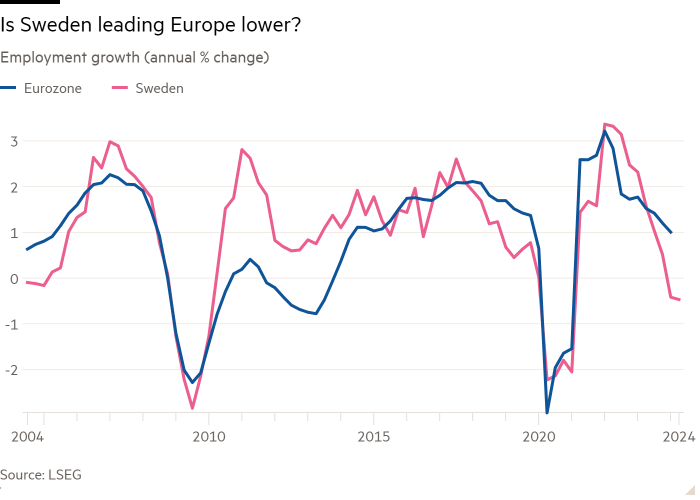

True, the more pressing issues this year have been a Swedish housing bubble that has left consumers overleveraged and disposable incomes stretched. Other local problems include corporate bankruptcies at a 30-year high and signs of weakening employment.

But it is Sweden’s position as a small open economy with big links to the rest of the world that makes the country a good leading indicator for the global economy, thinks Mathieu Savary at BCA Research. Exporters such as Atlas Copco, which manufactures all manner of industrial parts such as gas compressors, and mining equipment maker Sandvik had a good start to the year as the economies they sell to performed well.

That has turned around since the end of May, with Swedish industrial stocks underperforming the rest of the domestic market. Orders at Atlas Copco were 2 per cent below market expectations in the second quarter. Weak demand from the auto sector was particularly noticeable. Limp purchasing managers’ indices in July reinforced this shift in sentiment. And a disappointing reading for new orders was of particular consequence for the rest of Europe, argues Savary.

Germany is an obvious place where weakening industrial demand would bite. The German industrial sector is already struggling with higher energy costs and soft demand from China. The big difference compared with Sweden is that household balance sheets are much less leveraged.

The Euro Stoxx index, like Swedish stocks, has been buoyant, rallying sharply after the August sell-off and closing in on an all-time high. But the woes of Sweden’s industrial names could mean trouble, suggesting that Europe is heading to a broader slowdown that stocks are barely registering.