Stay informed with free updates

Simply sign up to the Chinese business & finance myFT Digest — delivered directly to your inbox.

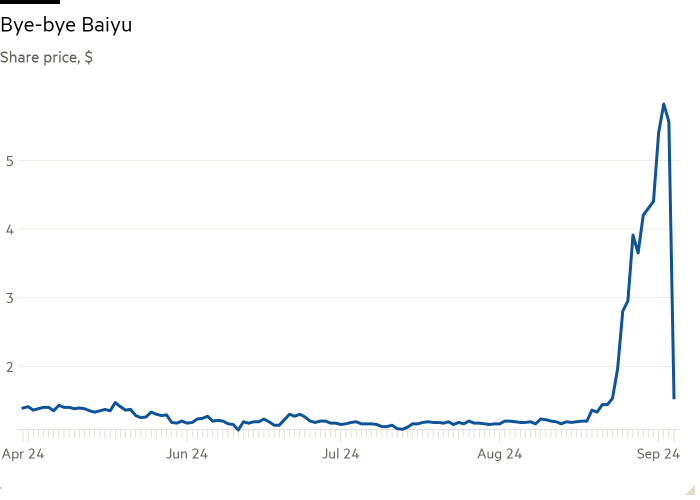

We wrote earlier this week about some weird price moves among US-listed, China-based micro-caps, rounded off with a warning from a retail trader that Baiyu Holdings (BYU) — which for weeks has been flogged in seedy Whatsapp groups by persons unknown — might be the next Nasdaq stock to plunge from a recent peak.

Aaaaannd it’s gone:

Wednesday’s 73 per cent decline coincided with news that Baiyu has signed a letter of intent with Adler International “to cooperate in the construction and operation of charging and swapping stations in Cairo”.

Pursuant to the LOI, [Baiyu] agrees to provide energy storage systems, charging piles and swapping equipment, and to oversee the planning and construction of the charging and switching stations. Both parties have agreed to jointly operate and manage the stations through a newly established Egyptian joint venture. The project, fully funded by the Egyptian government, involves the planning, renovation, and reconstruction of 365 charging and swapping stations in Cairo, with an initial investment of approximately $1.5 million per station, totaling $547.5 million, subject to the scale of subsequent construction.

[Zoomable version here]

Baiyu hasn’t always been in battery swapping. Like UTime, the Shenzhen-domiciled phone company turned wannabe mpox vaccine manufacturer whose shares last week fell 90-odd per cent, it has lived many lives.

The company currently says it has two main business lines: commodities trading, and supply chain management. Until 2018, however, Baiyu (which at the time went by China Commercial Credit) operated a micro-lending business out of Suzhou in Jiangsi Province.

Slowing growth in the local textile industry to which CCC presumably extended credit ended up hitting the company hard, according to its contemporaneous accounts. By the following year the firm had changed its name to Bat Group and pivoted to leasing pre-owned luxury cars.

It didn’t own many such cars. Eleven, to be precise, with the fleet distributed across Beijing, Shanghai, Zhejiang and Chengdu. Bat nevertheless said it earned roughly $1.8mn from operating leases during 2019. But that business was wound down 12 months later.

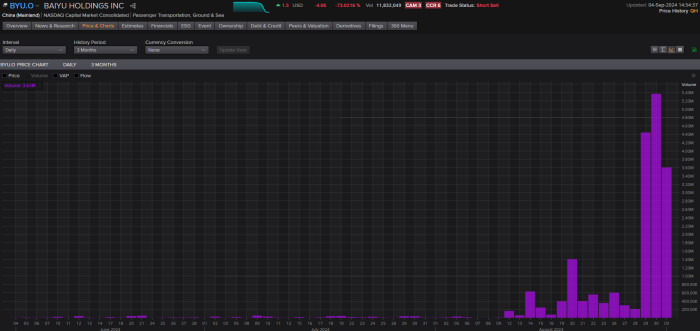

Bat became Baiyu soon after and has been trading non-ferrous metals ever since, albeit with “zero margin,” according to a deep-dive on the company by J Capital Research, published with impeccable timing on Wednesday.

[Zoomable version here]

Anne Stevenson-Yang, who co-authored the report (entitled “Three Businesses, Four Names, and We Still Don’t Know What They Do”), told us Baiyu was “significantly overvalued but too small and volatile for us to cover on an activist basis. So we wrote up this piece.”

There’s plenty in there to enjoy. Baiyu “admits to zero inventory of commodities as of Q2 2024,” J Capital alleges. “This suggests what the company discloses elsewhere: ‘trading commodities’ actually means lending cash.”

“BYU’s other business line of supply-chain management services has completely collapsed,” J Capital adds, with revenue having fallen from $1.4mn in FY22 to $68,000 in FY23. “Strangely, costs of revenues ballooned from $7,500 to $59,000 in the same period.”

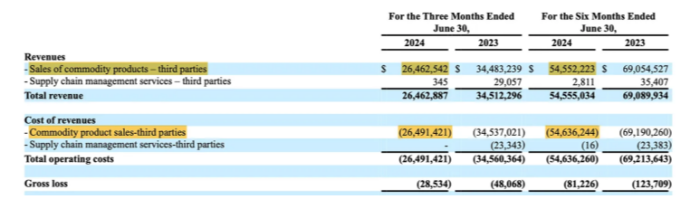

Cash and cash equivalents may be low ($255,750 as of last quarter) but Baiyu is sitting on current assets of $307.4mn. Just over $290mn of this is made up of loans receivable from third parties:

[Zoomable version here]

As J Cap points out, Baiyu says it charges 10.95 per cent per annum on said loans, “which is more than three times the one year Loan Prime Rate of 3.45 per cent set by the People’s Bank of China”. Baiyu has written at least 11 loan agreements over the past six quarters.

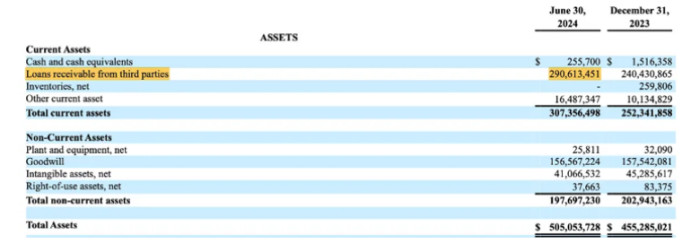

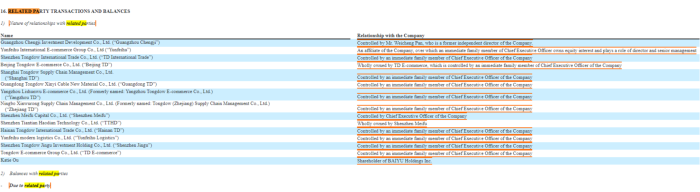

It also boasts a rather long list of related-party companies:

[Zoomable version here]

J Capital also notes that Baiyu has cycled through no less than six different auditors over the past seven years. It might not come as a surprise that BF Borgers, of Trump SPAC fame, was one of them.

At press time Baiyu had not responded to a request for comment.