Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Good morning. Today we’re covering:

-

India and Russia’s secret trade channel

-

How China-related security concerns have transformed US economic policy

-

An interview with Sony’s CEO

But first, President Joe Biden will block Nippon Steel’s acquisition of US Steel after concluding that the $14.9bn transaction posed a national security risk that could not be mitigated by the US and Japanese groups.

Several people familiar with the matter said the White House would prevent the acquisition of the Pittsburgh-based group on national security grounds.

Biden’s decision, which is expected in the coming days, comes as Kamala Harris, the Democratic presidential nominee, steps up her campaigning for blue-collar votes in Pennsylvania, a swing state that could decide November’s US election.

Speaking in Pennsylvania on Monday, Harris said the iconic US steelmaker should remain “American owned and American operated”, mirroring the stance that Biden took after Nippon unveiled the deal last year.

But many foreign policy experts — and some administration officials in private — have ridiculed the notion that Nippon’s proposed acquisition is a security risk. Japan is the most important American ally in the Indo-Pacific and has been working very closely with Washington on a range of efforts to counter China.

Here’s what else I’m keeping tabs on today:

-

Economic data: South Korea publishes revised second-quarter growth figures and Singapore reports July retail sales. Thailand, Taiwan and the Philippines report August inflation data.

-

Monetary policy: Malaysia’s central bank announces its interest rate decision.

-

China-Africa summit: Leaders and officials from 50 African countries are gathered in Beijing, where Xi Jinping is expected to urge them to absorb more Chinese goods in return for pledges of loans and investment. (Reuters)

Five more top stories

1. Exclusive: Russia has been secretly acquiring sensitive goods in India and explored building facilities in the country to secure components for its war effort, according to Russian state correspondence seen by the FT. The leaked files outline Moscow’s plan to use “significant reserves” of rupees amassed from oil sales to India on securing critical electronics through channels hidden from western governments.

2. Investment banks are cutting their growth forecasts for China, believing Beijing risks falling short of its official target of about 5 per cent. China’s GDP target has attracted close scrutiny in the wake of the pandemic amid weak investor confidence and a struggling property sector.

3. Washington’s new envoy to Taiwan has praised Taipei’s defence reforms, in a statement of reassurance as the prospect of another Donald Trump presidency raises concerns over the US’s commitment to its allies and partners. Raymond Greene also said Washington would “not rule out” joint weapons development with Taiwan.

4. Volvo Cars has abandoned its ambitious target to sell only electric cars by 2030 amid a global slowdown in growth for battery-powered vehicles. The Geely-owned Swedish group blamed changing market conditions and consumer worries over the lack of charging infrastructure for its revised target.

5. Prime Minister Justin Trudeau’s critical parliamentary alliance partner has torn up a deal to support his Liberal government, throwing Canada into new political uncertainty and raising the chance of a snap election.

Our new-look newsletter Newswrap rounds up the biggest economics and business stories three times a week, also including a regular good news story. Sign up here.

The Big Read

The growing intersection of economic policy and national security in the US has many roots, but the biggest factor has been China. Fears about espionage and dual-use technologies have fused with economic nationalism to create an American mindset unrecognisable from the country’s post-cold war free market attitude — with dramatic implications for the future of the global economy.

We’re also reading . . .

Chart of the day

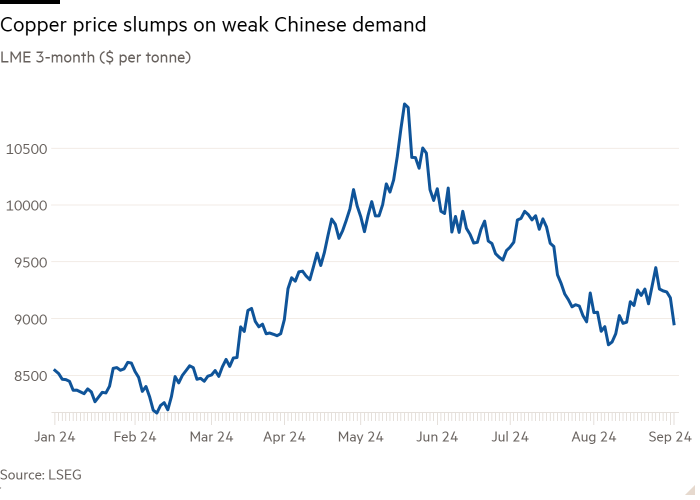

Goldman Sachs has slashed its 2025 copper price forecast by a third, clouding the profit outlook for leading miners of the metal. The Wall Street bank warned this week that an expected rally would not materialise as the Chinese property rout depresses demand for commodities.

Take a break from the news

Scientists are studying — and recreating — molecules that no longer exist, in a field known as “molecular de-extinction”, writes Anjana Ahuja. No, this isn’t about bringing back the dodo or the woolly mammoth, but rather trying to see whether their genomes hide long-lost molecules that offer solutions to our modern problems.

Additional contributions from Tee Zhuo and Harvey Nriapia