A wave of consolidation has swept across China’s battery industry, leading to cancelled investments and the exits of smaller players even as leaders CATL and BYD push ahead with their expansion plans.

In the first seven months of the year, 19 battery gigafactory projects were cancelled or postponed in China, according to London-based research firm Benchmark Mineral Intelligence. That has only accelerated an existing pullback of investment into battery plants as electric-vehicle manufacturers — mainly in Europe — grapple with slowing sales.

“A lot of consolidation has occurred at Chinese facilities where low prices, combined with struggles with yield, means companies have abandoned plans,” said Benchmark analyst Evan Hartley. He has estimated that these cancellations would reduce China’s battery gigafactory capacity for 2030 by 3 per cent.

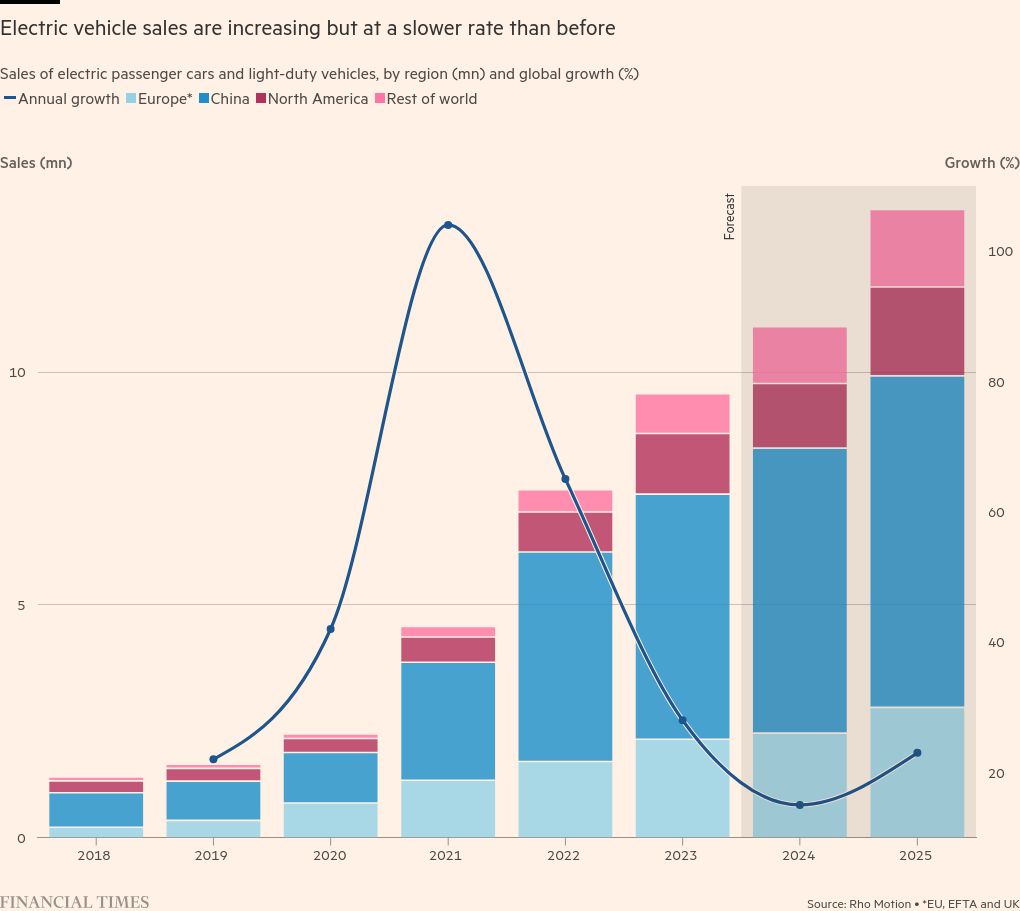

The upheaval in the crowded Chinese batteries industry comes as EV sales growth have declined in parts of the world. After double-digit increases, the growth rates in Europe and North America are expected to fall to 6 and 7 per cent respectively, according to Rho Motion, an EV supply chain consultancy.

The Chinese car industry is also bracing for a similar rationalisation, after proliferating during an investment boom over the past decade.

Industry bodies estimate that there are roughly 50 Chinese EV battery groups producing in the world’s largest car market, leading to a survival game that is set to intensify as they face fierce competition for technology and stricter government regulations.

The Chinese market is sharply divided between the bigger players such as CATL and BYD, which dominate the global market for electric vehicle batteries, and a score of smaller players that are left to compete with less financial power and cost competitiveness.

“The Chinese industry has entered a new round of competition driven by technology innovation and capacity upgrades,” said Kevin Shang, a principal analyst at data and analytics firm Wood Mackenzie. “Basically those who cannot keep up with the trend will gradually be kicked out of the market.”

Beijing has also issued new regulations to tackle overcapacity, forcing a number of local battery manufacturers to suspend projects recently in China and overseas markets.

China’s Ministry of Industry and Information Technology in June finalised revised guidelines for the country’s lithium-ion battery industry, which set higher standards for energy intensity, power density, cycle life and other battery specifications. The rules will help companies cut down on production projects that are “purely for capacity expansion”, the ministry said.

“This indicates that the government is aware of the low utilisation across the supply chain,” Citi analysts wrote in a research note. “We believe that the regulation will benefit the leading names in each battery-related subsectors, as it tries to phase out idle capacity and strengthen the entry barrier with technical standards.”

As a result, new players have struggled. In April, Nanfang Black Sesame Group, China’s largest puréed foodmaker, told investors that it had suspended its planned $3.5bn battery project in the eastern province of Jiangxi, citing “profound changes” in the new energy market landscape. The group had only last year announced a pivot to energy storage.

“The company will not act too hastily . . . and wait for our best chance to execute [the project] to avoid higher investment costs and related losses,” it said in a stock exchange filing.

In April, more than 20 Chinese companies disclosed construction plans for new battery production facilities that were expected to total an annual capacity of 152 gigawatt-hours, down 55 per cent from a year earlier, according to data compiled by the China Energy Storage Alliance, an industry group.

Smaller Chinese battery makers have also been forced to rethink their once aggressive overseas expansion plans.

SVolt Energy Technology, which was spun off from carmaker Great Wall Motor and the seventh-largest battery maker in China, abandoned plans in May to build a battery plant in eastern Germany, citing uncertainty over planning, tariffs and subsidies, as well as the loss of a leading customer.

SVolt chair Yang Hongxin has warned that fewer than 40 battery manufacturers could survive the wave of consolidation by the end of this year. “Previously, tier-2 and tier-3 battery makers participated in pricing competitions to grab more market share. Currently, even the biggest players are lowering prices,” said Yang at an event last month.

Companies from battery makers and lithium miners to cathode and anode producers have suffered a profit decline because of falling battery prices, caused by an overexpansion in response to a demand surge between 2021 and 2022.

Combined revenues and net profits at 107 mainland-listed companies in the lithium battery supply chain came in at Rmb293bn ($40bn) and Rmb17bn for the first quarter, down 18 per cent and 50 per cent from a year earlier, respectively.

However, top-tier battery makers are expected to emerge even stronger and increase their investments as smaller players merge or go under.

Last month, Amplify Cell Technologies, a joint venture between China’s fourth-largest battery maker Eve Energy, Indiana-based engine maker Cummins and two truck manufacturers, Daimler and Paccar, began construction of a new battery plant in Mississippi

Eve Energy also announced a Rmb3.3bn investment in a new factory in Malaysia to produce energy storage and consumer batteries, while China’s fifth-largest battery producer Gotion High Tech plans to invest $1.3bn to build its first gigafactory for EV batteries in Morocco. Sunwoda, China’s sixth-largest battery manufacturer, aims to invest up to Rmb2bn to construct a new battery plant in Vietnam.

But Shang at Wood Mackenzie cautioned that Chinese battery manufacturers, even the bigger ones, are likely to face challenges in their overseas ambitions as they face a different regulatory environment as well as the geopolitical uncertainty.

“Chinese companies want to go overseas but they are becoming more realistic,” Shang said. “It’s not as simple as copy and paste [their success in China] so it’s much more complicated than that.”