Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This year’s hurricane season is forecast to be particularly grim. Wildfires in California are intensifying. Floods are wreaking widespread havoc. Who wants to be on the hook for the worst of the damage? By one measure, more investors than ever.

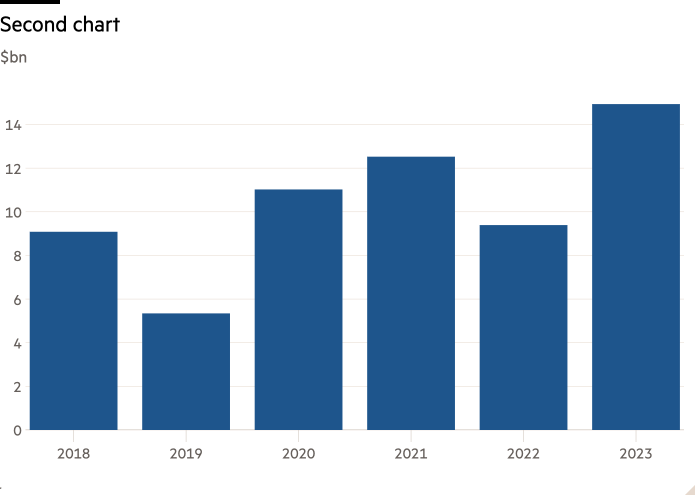

Sales of catastrophe bonds — a securitised form of insurance used to transfer some of the risk of the costliest disasters to capital markets — are soaring. In the first half of 2024, a record $12.6bn of bonds — mostly covering property — were issued by reinsurers and the governments of Mexico, Jamaica and Puerto Rico, according to data provider Artemis. The investor base of the $48bn market is broadening, according to Kepler Partners, a research and advisory firm. More funds-of-funds, family offices and wealth managers are investing through Ucits funds.

Investors’ interest has been piqued by juicy returns. The Swiss Re Global Cat Bond Total Return Index posted a 19.7 per cent return last year, the highest since 2002. This was down to lower-than-initially-feared 2022 costs, higher risk premiums and increased yields on collateral typically invested in money market funds. Cat bonds’ market yield — a combination of the collateral yield and the insurance risk premium — has more than doubled in three years to 13.7 per cent at the end of June, says Artemis.

What are the risks? One issue is that investors’ capital can get trapped after a disaster, owing to settlement delays. That can happen if there is uncertainty about payouts.

Another concern is that investors may be taking on more risk than they expected. So far, bondholders’ cumulative losses have averaged 2.7 per cent of the capital in the 26 years to 2023, according to Swiss Re. Factors limiting payouts include a growing preference for covering specific, rather than aggregate, events insulating them from the escalating costs of high frequency, low severity storms and fires. Moreover, they only pay out when costs pass a certain threshold. Even though 2023 was a record year for disasters, few cat bonds paid out.

But catastrophe modellers cannot assume the past is a guide to the future. “Once-in-a-generation” events are happening increasingly frequently. Global warming risk has been significantly undervalued by catastrophe bonds, according to 2019 research,

Catastrophe bonds offer diversification as well as high yields. Natural disasters are not tied to economic cycles. And this niche is the preserve of sophisticated investors. They should be aware the bonds are hardly a risk-free option. The clue, after all, is in the name.