Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The dominant topic at FT Alphaville Towers these past days has been the same as at every other major credible media organisation: the ferocious small-caps rally, naturally.

Our post about it on Wednesday seemed to jinx things, with the Russell 2000 promptly falling back a little almost as soon as FTAV hit the ^Publish^ button, but the US small-caps index still performed markedly better than larger stocks last week.

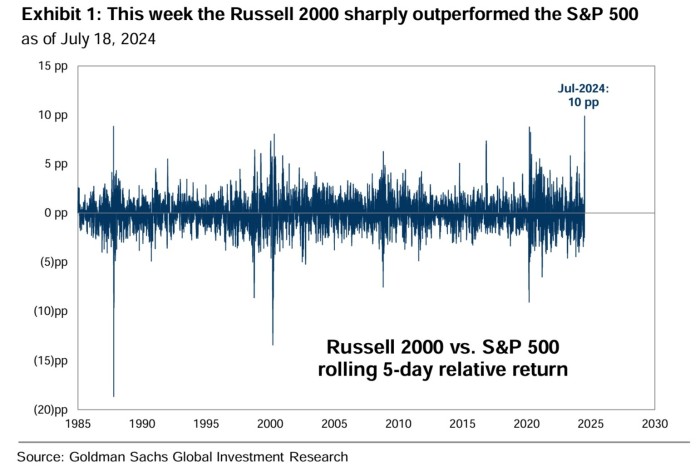

Indeed, Goldman Sachs’ David Kostin estimates that we saw the best rolling-five day relative return for US small-caps for at least 40 years.

On the whole, the last two weeks were the best for the Russell 2000 since 2002, and yesterday it clawed back some early losses to once again outperform the Nasdaq and S&P 500, with a very respectable 1.7 per cent advance.

Kostin argues that decelerating inflation, the imminence of Fed rate cuts, the resilience of economic growth, rising chances of a Trump presidency, and the narrowing of the gap between large and small-cap earnings growth are the primary fuel for the rally.

He therefore predicts that the rotation into small-caps will continue unless the economic environment changes “substantially”, or megacap tech stocks report another smashing series of results that pushes analysts to raise forecasts for the rest of the year.

The likes of William Blair and Robeco are even more optimistic. The latter’s Matthias Hanauer, Jan de Koning and Pim van Vliet estimate that the underperformance of small-caps over the past decade “has been more a function of changes in relative valuation than of deteriorating fundamentals”.

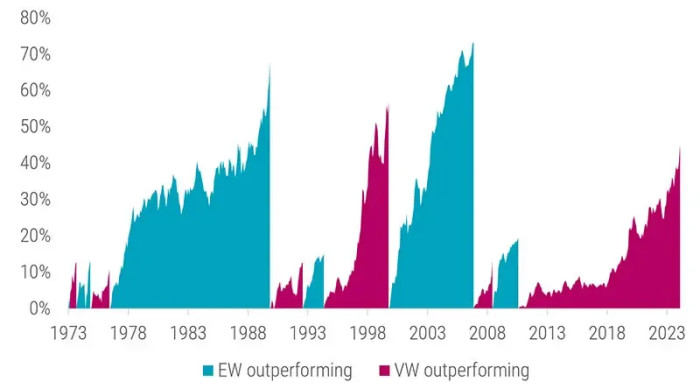

With the difference in valuations between small and large-cap stocks the widest in over 20 years, they are calling this is a “multi-decade opportunity for investors”. After all, the last time value-weighted indices outperformed equal-weighted indices this dramatically was in the dotcom bubble, and that ended in a chunky regime change.

Even now, small-caps trade at a discount of over 20 per cent to large-caps — on almost any valuation metric you care to look at — compared to their long-term historical premium of up to 30 per cent, the Dutch asset manager notes.

However, Robeco’s analysis looks at global small-caps. It’s in the US where the real (under)performance issues have been — for potentially secular reasons. And just because something is cheap obviously doesn’t mean it can’t get even cheaper.

Société Générale’s qüántitátivé strátégy head Andrew Lapthorne reckons that the initial violence of the small-caps rally was probably mostly technical — hedge funds wrongfooted on shorts etc — and argues that this has now “run its course”.

Morgan Stanley Wealth Management’s Lisa Shalett is also sceptical that this is an inflection point for small-caps inflection. She argues that private equity has hollowed out the small-cap universe, leaving it “more of a trading vehicle than an investment destination”:

Yes, small caps appear extremely cheap, but that’s not enough. For starters, most of the rotation appears to have been driven by hedge fund short covering.

Admittedly, small caps have been more rate sensitive, but we doubt that their profitability difficulties will be solved by 75 basis points of cuts. Remember, 60% of the small-cap index struggles with profitability — the result of adverse selection caused by the rapid growth of private equity. If we are in a soft-landing scenario, rate cuts will likely be slow and shallow, with policy impacts drawn out and modest.

Small caps are also hampered by a poor sector mix, with a high degree of leverage to consumers, who are likely to remain restrained given a flatter job market and lack of excess savings, and heavy reliance on regional banks hamstrung by commercial real estate assets.

Perhaps most importantly, small-cap stocks are still experiencing cuts to earnings estimates. While prospects of a Republican win in November may stoke small-cap “animal spirits,” the reality is policy sequencing. Tax policy requires congressional action, and the current version of the 2017 tax act doesn’t expire until the end of 2025.

Tariffs and immigration, both of which can be implemented by executive order on day-one of a new administration, are potentially inflationary headwinds to growth. Here again, we prefer the resilience of large caps to small caps.

Still, judging by the price action on Monday, it looks like people are quite keen on the ‘Russell Rotation’.

Further reading:

— Small stocks, big problems (FTAV)