Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Fund managers are getting just a little fidgety over Japan. The country’s two major stocks indices go from strength to strength, setting their new highest points in three decades on a still pretty regular basis.

But some investors who have been in this bet for a while are not exactly quitting while they’re ahead, but taking time for a pause. “I’m falling a little bit out of love with Japan,” said Caroline Shaw, portfolio manager for some multi-asset funds at Fidelity International in London at an event this week.

“That initial flurry of excitement has driven the market up, but it’s a slow burn. I’m not negative about Japan. I have a positive view on it for the first time in my career. But corporates are changing very, very slowly. The pace of change is glacially slow.”

Shaw said she had trimmed a little exposure to Japan recently, switching instead to Europe, mostly the UK, which is basking in a warm post-election glow.

Believers in the market can still point to a long list of reasons why they think the Japan trade can run and run as the stock exchange itself and the companies inside it court foreign investors in a way they have not done in decades.

“I consider myself a cynic and a natural pessimist, but I’m convinced that this time is different,” said Alicia Ogawa, a board member at the Nippon Active Value Fund, adding that she has not felt this way in 35 years.

Japan is woefully under-owned by global investors as a rule — most are still running underweight positions relative to benchmarks — and under-covered by analysts, all of which leaves plenty of gems to be discovered. Few doubt that the shift among companies towards boosting share prices and even working with activist investors is real.

Enthusiasts include BlackRock, the world’s largest asset manager, whose investment institute said this week that its overweight position in Japan — larger than benchmarks would suggest — is one of its highest-conviction stances.

Japan specialists nonetheless agree some investors are backing away, and many of those getting somewhat cold feet point to the same thing: the yen, which is comfortably the worst-performing major currency in the world this year. It still stands out as a doozy if you add some of the more obscure currencies in, too — it’s right up there with the Malawian kwacha as one of the standout poorest performers, due to the Bank of Japan’s strikingly easy monetary policy.

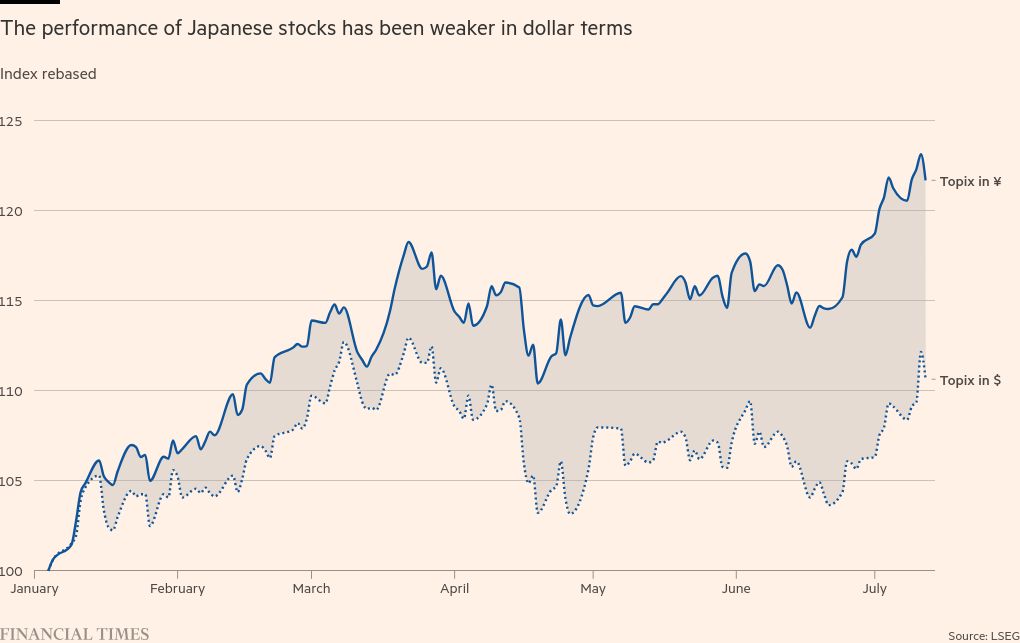

That bites hard into the returns foreign investors can earn on Japanese stocks. In yen, the Topix and the Nikkei 225 are up 22 per cent and 24 per cent respectively this year. But things look very different if your portfolio is measured in dollar terms. In US currency terms, those Japanese indices are up by a still decent but more modest 9 per cent or so, with something of a dip since March.

The latest lurch lower in the yen has left a mark. At a recent online event, Kentaro Watanabe, head of Asian equity sales at Nomura Securities, told me international investors largely welcomed the drop in the yen from ¥140 to ¥150 as “great” — a boost to exporters. Beyond ¥150, though, the currency became a major point of pushback, especially given that only about half of big asset managers hedge their currency exposure.

Perhaps unsurprisingly, Watanabe is still firmly in the “buy Japan” camp. But Wataru Ogihara, chief investment officer at Sumitomo Mitsui DS Asset Management, also told me over a tasty sushi lunch in London recently that when the currency is so feeble, “it is very difficult to convince international investors to come back to the Japanese market” after what, for many, is at least 20 years of absence.

A boost for them both came this week in the form of surprisingly low readings of US inflation, which have again stoked up expectations of an interest rate cut by the Federal Reserve. The yen is among the many beneficiaries of that, helping to pull the US currency down from its recent peak of ¥160 to more like ¥158 — a modest move for now but potentially the start of something bigger.

Ripple effects from the yen are one thing, but the urge among investors to lock in their winnings on Japan is strong, and reflects a long history of disappointment among big money managers dipping a toe in this market ever since the spectacular crash of 1990. Time and again, market revivals have fizzled, and no one wants to be the last person looking for an exit in the horrible event that history repeats itself. It’s certainly a difficult one to explain to your boss.

Josh Kutin, head of asset allocation for North America at Columbia Threadneedle, said at an event this week that colleagues often suggested it might be time to take some profits in Japan and pull back.

“It’s unfair,” he said. “Because why would you not sell the US for the same reason?” But, he said, investors who have been kicking around for a while bear the scars of previous failed efforts to make allocations to Japan work. “The US has not affected us the way Japan has over the past many years,” he said. That trauma still runs deep.