Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Britain: a beacon of stability? The very notion will, understandably, induce snorts of derision. After all, the Labour party will have to take on one of the worst economic inheritances in modern British history. Debt is mounting, taxes are rising, public services are collapsing, and growth is, well, hard to find.

But stability is relative. Britain’s economic peers (US, France, Germany, etc) are awash with political turmoil right now. While there is little to get too excited about in the Labour policy agenda, the party’s strong majority at least signals a high predictability. For hot money flows, and investors seeking opportunity, that is appealing. Quite the turnaround then for the UK.

FT Alphaville pulled out five charts that capture the British proposition to markets and investors right now:

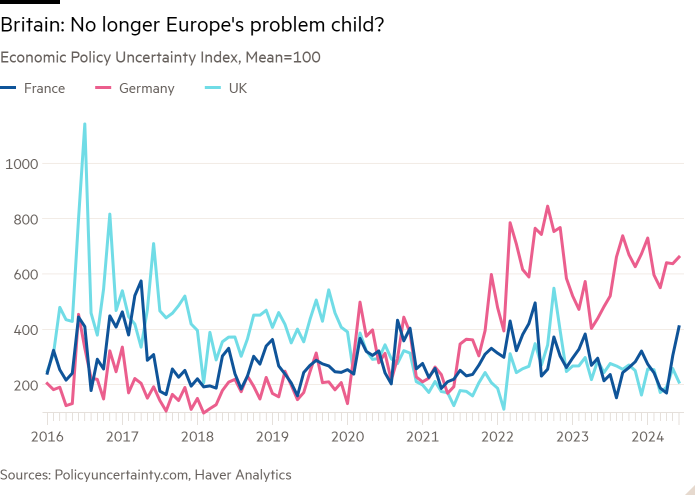

1. More clarity: Measures of economic policy uncertainty — which scrape word usage data from newspapers — suggest that Britain’s national conversation is heading in a calmer direction relative to European peers:

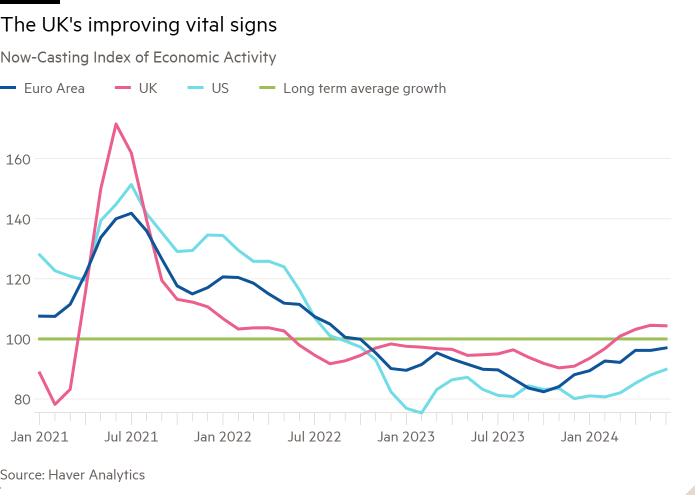

2. Economic momentum: Stability comes just as a range of indicators for UK economic activity are on the up, while the picture is fainter in the US and eurozone:

3. The only way is up: British stocks have been pummeled by uncertainty in recent years. Relative to other developed markets, they now look cheap and with space to bounce back:

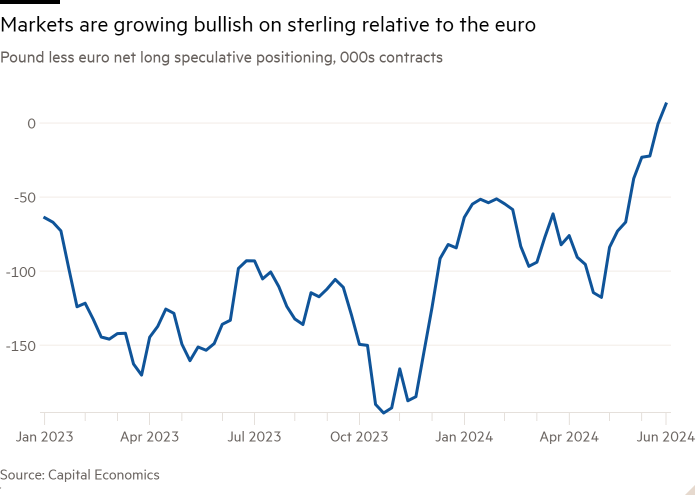

4. Asset optimism: Markets have become increasingly positive about the pound. Speculative bullish bets relative to the euro are near their highest in 18 months.

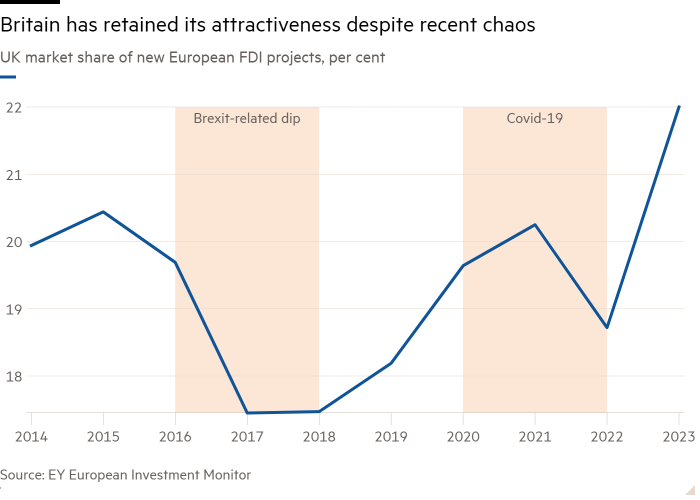

5. A solid foundation: Investors will note that Britain’s draw as a destination for new foreign direct investment relative to Europe has been resilient despite uncertainty, and has recently picked up:

The upshot? The UK ticks the predictability and momentum boxes for markets and investors. At the margin, that will attract hot money and capital. But, as FTAV recently argued, that may not be enough of a recipe for the economic growth the country needs. Indeed, to capitalise on the stability advantage while it lasts, Sir Keir Starmer will need to quickly show investors that Britain actually has the investment opportunities to pair with its relative appeal.