Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The UK’s post-pandemic economic recovery has been powered by professional services and IT while retailers and many manufacturers languish, underscoring the uneven nature of the rebound that Labour is expected to inherit.

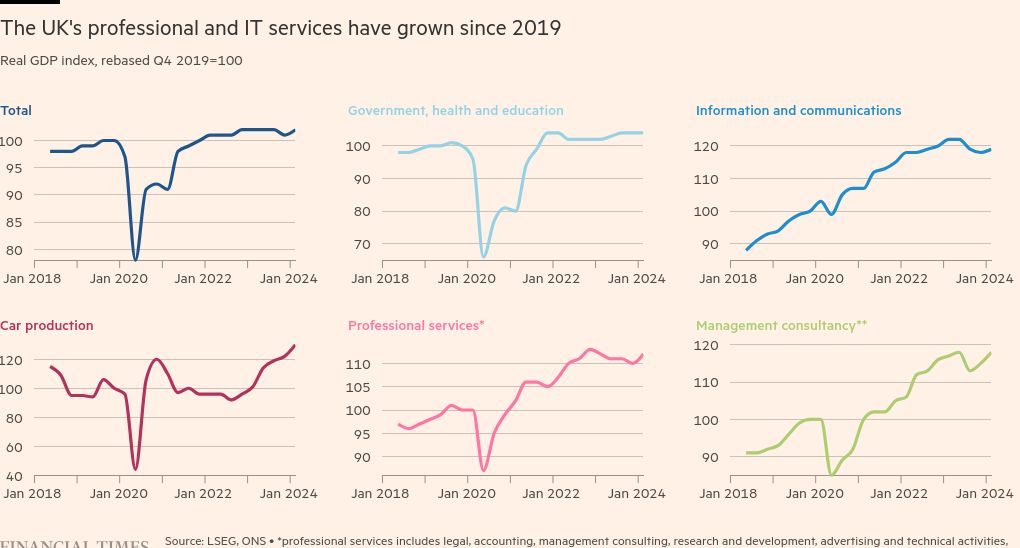

Activity at consultants, accountants and software programmers is up by more than 10 per cent since the final quarter of 2019, according to a Financial Times analysis of data published by the Office for National Statistics. In the same period, retailers have registered a 4.4 per cent fall in output.

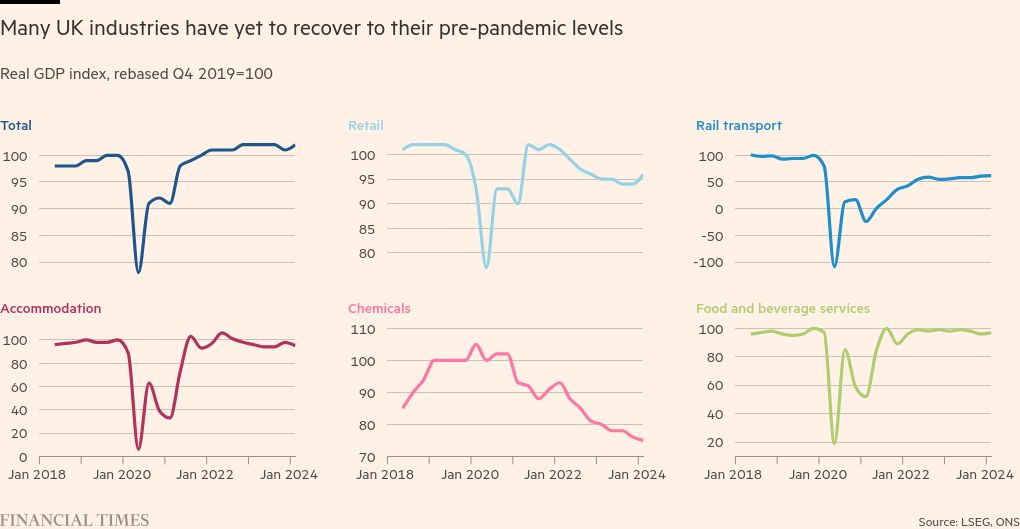

The chemicals industry, hit hard by Brexit and high energy costs, has recorded a crushing 25 per cent decline in output.

Andrew Goodwin, UK economist at consultancy Oxford Economics, said sectors such as consultancy and software had been “star performers” before Covid-19 struck and that they had proven resilient during the pandemic because of remote working, among other practices.

With opinion polls putting Labour on track to secure a large majority on Thursday, he said the question facing the winner of the general election was how to propagate a more widely based recovery.

“You need a more sustainable medium-term boost to growth across a wide range of sectors,” he said. “The challenge is to get supply-side reforms in that have a tangible impact early enough.”

During the election campaign Sir Keir Starmer’s party has vowed to restore UK growth to the highest levels in the G7 group of advanced economies by unleashing private investment and enacting a “new partnership” with business.

An economic rebound will be essential for Labour to meet its goals of boosting government revenue while avoiding further tax rises or cuts to public spending.

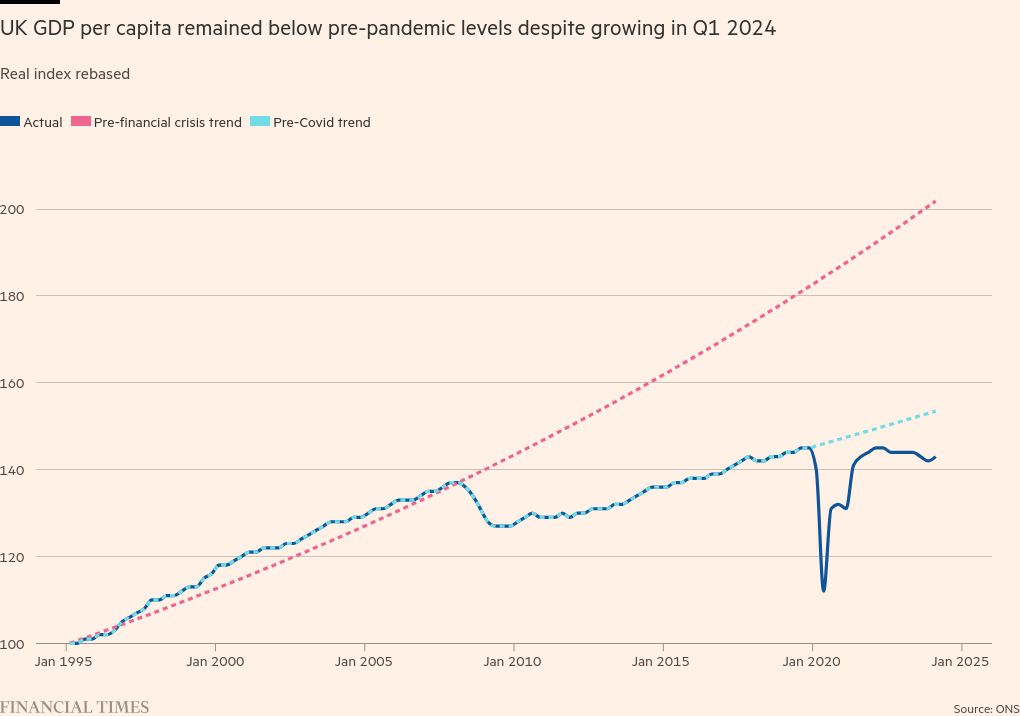

But the decidedly mixed fortunes of the economy suggest this will by no means be an easy task. Overall UK GDP has risen by just 1.8 per cent since the final three months of 2019, according to the ONS.

That is the second slowest figure among G7 economies and compares with growth of 8.6 per cent in the US, despite the UK economy registering its fastest growth in two years in the first quarter of 2024.

While some parts of the economy have flourished, in particular business-facing parts of the services sector and software companies, consumer-facing companies are only just beginning to stage a revival, and some parts of manufacturing are on their knees.

At the start of 2024 professional, scientific and technical activities were up 12.2 per cent compared with the last three months of 2019, the analysis found. Scientific research had jumped by 34 per cent and management consulting had risen by 18 per cent over the same period, while accounting and legal services were up 11 per cent and 7 per cent, respectively.

The IT sector has been an obvious winner of the post-pandemic shift online: output in information and communication, which includes computer programming and web services, is up 18.6 per cent from its pre-pandemic level.

This growth is notable because professional services and information and communications account for about 16 per cent of the economy. The sectors also support services exports, helping consolidate the UK’s position as the second-largest services exporter after the US.

However, manufacturing output is largely unchanged from its pre-pandemic levels with energy-intensive industries, such as chemicals, paints, and rubber production, hit particularly hard.

Steve Elliott, chief executive of the Chemical Industries Association trade body, said the clock was “ticking if the UK is to secure its place as an attractive and competitive location for the chemical investments and jobs of the future”.

He urged the next government to commit “to a long-term industrial strategy, with chemical businesses at its heart, more competitive energy costs and a net zero policy environment”.

Supply chain disruption hit the UK’s car production until the middle of 2022, but the sector has since recovered strongly and was 30 per cent bigger in the first three months of this year than in the final quarter of 2019.

Mike Hawes, chief executive at the Society of Motor Manufacturers and Traders, an industry body, said that while UK car and van production had “rebounded”, the next prime minister should focus on “fostering economic conditions which support manufacturing competitiveness, part of a long-term industrial strategy to help attract investment”.

Output in most consumer sectors has yet to recover from pre-pandemic levels, with household finances hit by high prices, mortgage costs and rents over the past four years.

There are early signs of a rebound in the consumer sector: GDP per capita returned to growth in the first quarter and consumer price inflation fell to the Bank of England’s target of 2 per cent in May, helping consumer confidence and retail sales.

Many economists expect the consumer sector to be a driver of growth for the rest of the year thanks to rising household incomes, and official figures suggest the rebound could be large because the sector is recovering from very low levels.

In the first three months of the year, output in accommodation was still 4.7 per cent below its pre-pandemic level, while food and drink services activities, such as bars and restaurants, remained 3.3 per cent smaller.

Other personal services, which include hairdressers and beauty centres, were down 5.3 per cent. The woes of these and similar businesses have been a big drag on growth, with hospitality and retail together making up 7.4 per cent of the economy.

Helen Dickinson, chief executive of the British Retail Consortium trade body, said shops had gone through “an exceptionally challenging five years” and called on the next government to “fix the broken business rates system”.