This article is an onsite version of our Europe Express newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday and Saturday morning. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. News to start: Brussels is drawing up plans to impose customs duties on cheap goods ordered from Chinese retailers including Temu and Shein, in an effort to stem a surge in substandard items flooding Europe’s mailboxes.

Today, our man at the ECB’s away days in Portugal takes the temperature of the EU’s economy. And I explain why Ursula von der Leyen is skipping next week’s Nato summit to bolster support for her re-election.

Frank Sintra

At this week’s annual conference of the European Central Bank in Sintra, president Christine Lagarde played golf with US Federal Reserve chair Jay Powell and the governors of the German and Canadian central banks. Canada’s Tiff Macklem won thanks to his long drive but Powell gave him a good run; Lagarde was surprisingly sharp around the greens.

And the chatter at the luxury resort in the south of Portugal was not just about the hazards on the golf course — ECB officials were clear about the many risks that lurk on the horizon, writes Martin Arnold.

Context: Eurozone inflation fell from 2.6 per cent in May to 2.5 per cent, data from Eurostat showed yesterday, supporting the ECB decision to cut interest rates last month based on forecasts that price growth will fall to its 2 per cent target next year.

The Eurozone economy expanded 0.3 per cent in the first quarter — ending almost a year of stagnation — and unemployment remained at an all-time low of 6.4 per cent in May.

One of the biggest risks looming is that the world economy is heading for a period of protectionism, especially if Donald Trump wins November’s US presidential election.

Goldman Sachs chief economist Jan Hatzius gave a presentation spelling out how Trump’s promise to increase tariffs on imports from the EU by 10 per cent would hit the Eurozone economy disproportionately hard — predicting it would knock 1 per cent off GDP in the bloc, while shaving only 0.1 per cent off US GDP.

Another worry for Eurozone rate-setters is fiscal policy, particularly the risk that the French election produces a far-right government which embarks on a spending spree that puts it on a collision course with investors, destroys credibility in the EU’s recently revamped fiscal rules and pushes up inflation.

“Fiscal matters enormously,” ECB president Christine Lagarde told delegates yesterday, adding that rate-setters were “very concerned” about the need for governments to bring their deficits in line with the EU’s 3 per cent limit.

The final worry is that inflation is yet to be completely tamed because wages are still rising at about 5 per cent a year, pushing up costs for labour intensive services companies that are passing this on to consumers via higher prices.

“We have to look what is behind it, which is a lot of labour costs,” Lagarde said.

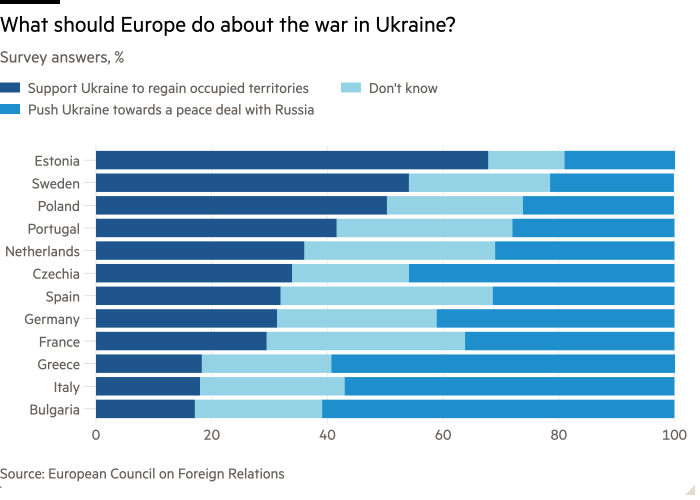

Chart du jour: Endgame

Almost two and a half years since Russia’s full-scale invasion of Ukraine, Europeans have widely diverging views on how the conflict will — or should — end, according to a survey by the European Council on Foreign Relations published today.

Whip it real good

Ursula von der Leyen will skip next week’s Nato summit to instead convince a maximum number of lawmakers to vote for her in the European parliament, amid nerves inside her camp about her coalition’s solidity.

Context: Von der Leyen wants a second term as European Commission president. She won support of EU leaders last week. Now she needs 361 votes in the parliament, with a vote scheduled for July 18.

Von der Leyen’s European People’s party (EPP) and her coalition partners, the Socialists and Democrats (S&D) and liberal Renew, boast 399 MEPs. But defections are historically high in the secret ballot.

Party officials are confident they have struck a deal with French EPP members who had previously threatened to withhold their votes. On Monday, von der Leyen also met with the Green party (54 seats) to discuss potential external support.

But skipping the Nato gathering is seen as necessary to expand the list of trusty backers. European Commission spokesman Eric Mamer said von der Leyen would instead be focusing “on her work to build a majority for a strong Europe in the European parliament”.

“The 13th floor is tied up 24/7 hitting the phones,” said one commission official, referring to the top floor of the Berlaymont building where von der Leyen’s office is based.

“Some people might say to your face that they will vote for you, but you can’t be sure,” said one person briefed on the negotiations. “You want to make sure that there’s a buffer. Nobody wants to lose by three votes.”

Von der Leyen attended the last two Nato summits in Vilnius and Madrid, as a guest of the alliance. EU Council president Charles Michel and chief diplomat Josep Borrell will represent the bloc next week.

What to watch today

-

Finland’s President Alexander Stubb meets Italian Prime Minister Giorgia Meloni in Rome.

-

Closing remarks by ECB president Christine Lagarde at the Sintra forum.

Now read these

Recommended newsletters for you

The State of Britain — Helping you navigate the twists and turns of Britain’s post-Brexit relationship with Europe and beyond. Sign up here

Chris Giles on Central Banks — Your essential guide to money, interest rates, inflation and what central banks are thinking. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe