Stay informed with free updates

Simply sign up to the UK house prices myFT Digest — delivered directly to your inbox.

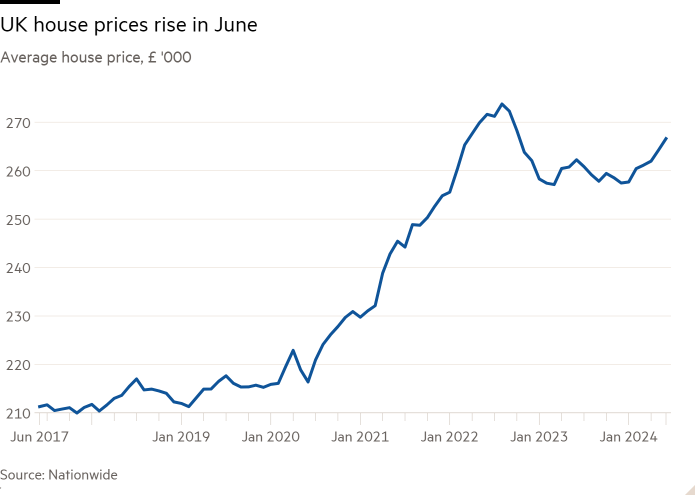

UK house prices unexpectedly rose in June, according to data from lender Nationwide that suggests the property market is stabilising ahead of expected interest rate cuts from the Bank of England.

Property prices were up 0.2 per cent between May and June, following a 0.4 per cent rise the previous month and contractions in March and April, new data showed on Monday.

The rise took the average house price to £266,604, which was 1.5 per cent higher than in the same month last year, up from 1.3 per cent in the previous month.

Both figures exceeded analysts’ expectations. Economists polled by Reuters expected a 0.1 per cent month-on-month contraction and a 1.1 per cent annual increase in prices.

Michelle Stevens, mortgage expert at personal finance comparison site finder.com, said: “The market seems to be stabilising in anticipation of lower rates on the horizon.

“Over the last couple of weeks we’ve seen a few of the major banks reduce their mortgage rates, and this will no doubt help provide a much-needed boost to confidence in the housing market.”

UK inflation dropped to the Bank of England’s target of 2 per cent in May, consolidating market expectations that the bank could start cutting interest rates from their 16-year high of 5.25 per cent as early as next month.

Property prices peaked at £274,000 in the summer of 2022 and fell in the following months as rising borrowing costs hit prospective buyers. They have been recovering in the second half of 2023 after mortgage rates eased from their peak of that summer, but they have fluctuated in 2024 as mortgage rates edged up on the back of elevated services inflation.

Nationwide reported significant regional variations in house prices with strong annual growth in Northern Ireland and the North West of England, both up 4.1 per cent, and sharp contractions in the South West and East Anglia, of 1.5 per cent and 1.8 per cent respectively.

In London, where house prices are the most expensive with an average cost of £525,248, costs rose by an annual rate of 1.6 per cent.

Tom Bill, head of UK residential research at Knight Frank, said the seasonal spring bounce in the UK housing market has been “a little lacklustre” this year, with demand kept in check by high mortgage rates and a degree of uncertainty around the UK general election.

However, “a new government and the first rate cut since March 2020 should inject more energy after the summer”, he added.