Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

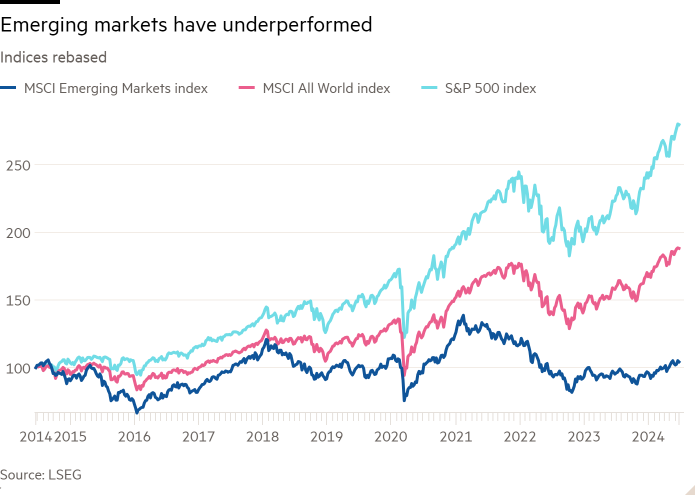

Emerging markets promise much but have a horrid tendency to disappoint. Net returns in the past year clock in at 12.4 per cent, half that of the broader market as measured by the MSCI All Country World Index. Go back a decade and annualised returns of 2.7 per cent are a third of the MSCI ACWI.

Bad years globally tend to be extra bad in the developing world; good years — in the past decade or so — less good. Inherently more volatile, these markets are at the mercy of global policymaking and capital flows.

Thus US dollar strength means US and European investors need not look so far afield for yield. Inflows wane and imported goods and services cost more. The IMF calculates that dollar appreciation of 10 per cent decreases EM economic output by 1.9 per cent after one year, and continues to weigh for a couple of years.

Another rupture comes from the dismantling of globalisation, unpicking supply chains snaking across Asia and Latin America and tamping down trade. The mood music in Washington, including bans on certain tech exports to China and the tariffs recently slapped on its electric vehicles, suggest little change on this front.

Trade last year dropped 3 per cent to $31tn — or 5 per cent in the case of goods, according to the UN. China is being usurped as top exporter of goods in several places: by Mexico in the US and by the US in Germany.

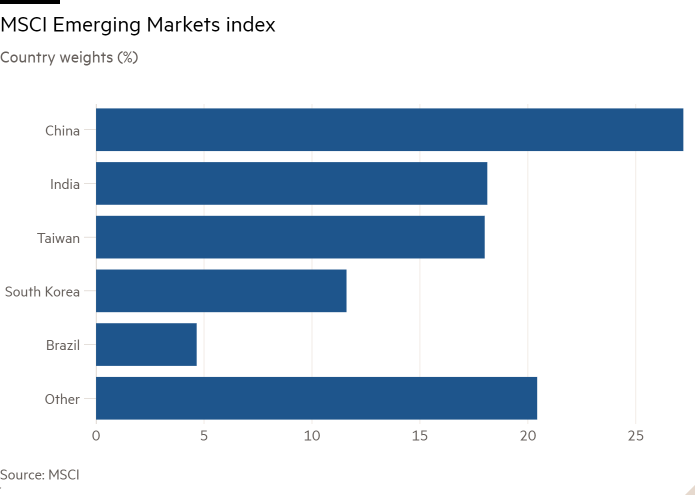

Country specifics can spoil the pack — especially when the country in question is China, roughly a quarter of the MSCI EM index. China’s epic growth story, always heavily predicated on investment and real estate, unwound as the brakes slammed on the property market in 2021.

Investors, already spooked by Beijing’s highly visible hand ripping into the tech sector, fled. MSCI’s China index is roughly half its 2021 peak.

But China last month launched a (paltry) rescue package for the property market. Interest rate cuts are on the horizon in the US and Europe. Emerging market earnings are kicking back upwards, by an expected 18 per cent this year and 15 per cent next.

Panglossian types can even shrug off more fundamental shifts, such as the rewiring of supply chains. Reshoring is not just about factories in the US. There are Asian beneficiaries such as Vietnam, Malaysia and India with its production linked incentive schemes. For China itself the flipside of being cold-shouldered is increased self-sufficiency.

More positive is the AI spillover on to chipmakers. TSMC, the world’s biggest, is in Taiwan. Add in South Korea’s Samsung and SK Hynix and the trio comprise 14 per cent of MSCI EM index. Shares in Tencent, the second biggest constituent after TSMC, are also on a roll. The Chinese social media giant unveiled its large language model last September.

Plenty of elections — including India’s, the biggest — are now done. That removes one set of uncertainties, though Americans’ choice at the polls will have a big bearing on these countries too.

Of course, emerging markets by definition have always been about potential. Indeed, when markets deliver — as India has this past year — investors tend to switch to griping about high valuations. Still, there are just enough glimmers to merit a fresh look for those with a robust stomach for risk.