Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The slump in France’s financial markets deepened on Friday ahead of the first round of parliamentary elections that are expected to result in victory for the far-right Rassemblement National.

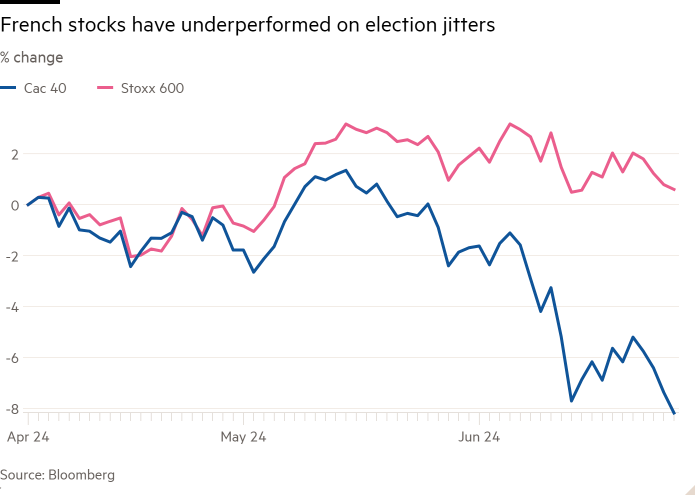

Paris’s Cac 40 stock index fell 0.7 per cent to a five-month low, taking its losses to 6.5 per cent since President Emmanuel Macron called the snap vote earlier this month.

French stocks notched their worst quarter in two years, having tumbled just over 9 per cent from an all-time high hit in mid-May.

The gap between benchmark French and German 10-year borrowing costs — seen as a barometer for the risk of holding France’s debt — rose to 0.85 percentage points, the highest level since the Eurozone debt crisis in 2012, before retreating.

Friday’s moves came after Germany’s finance minister Christian Lindner said on Thursday that an intervention by the European Central Bank if the election triggered a rapid sell off in French debt would raise some “economic and constitutional questions”.

Lindner’s comments underscore mounting worries about a potential spending push by the RN, as well as the radical leftwing policies of the Nouveau Front Populaire, which is running second in the polls.

France was “unfortunately becoming a country with weak governability and a dubious fiscal outlook”, said Christian Kopf, head of fixed income at Union Investment Management.

“The biggest risk for France at the moment is not a ‘Liz Truss moment’ or a repeat of the Greek sovereign debt crisis, but a continued erosion of sovereign creditworthiness, which would ultimately make [government debt] uninvestable for very conservative and rating-constrained investors,” Kopf added.

France overshot its deficit target last year to finish at 5.5 per cent of gross domestic product, above the 3 per cent target laid out by EU rules. Jordan Bardella, the far-right candidate to be France’s prime minister, this week told the Financial Times that 3 per cent “remains an objective”.

Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, said Lindner’s warning amounted to a statement of the obvious. Barring a “full-blown crisis,” the ECB “should not and will not intervene anytime soon”, he said.

Even if it were to intervene, the ECB would probably do so by “buying Spanish or Italian debt, not French, to stop transmission and fragmentation”, Ducrozet added. “That would be the first line of defence.”

The French market’s woes have also dragged down European stocks, with the region-wide Stoxx Europe 600 losing 0.2 per cent on Friday to finish the quarter down 0.3 per cent. London’s FTSE 100 rose 2.8 per cent over the same period.