This article is an onsite version of our Disrupted Times newsletter. Subscribers can sign up here to get the newsletter delivered three times a week. Explore all of our newsletters here

Today’s top stories

For up-to-the-minute news updates, visit our live blog

Good evening.

The race is on across the world’s major economies to cut interest rates, but the jury’s still out on who will move fastest.

Eurozone inflation accelerated for the first time this year in May, according to figures released today, clouding monetary outlook across the bloc and bringing its hard-won progress on inflation to a standstill. Consumer prices accelerated to 2.6 per cent, up from 2.4 per cent in April and overshooting forecasts. Price pressures also accelerated in France, the euro area’s second-largest economy.

The numbers cast a shadow over the trajectory of rate cuts in the region. Although they are unlikely to deter the widely anticipated cuts at next week’s European Central Bank rate-setting meeting, questions abound surrounding the number and scale of cuts over the rest of 2024.

Markets are pricing in two to three 25-basis point cuts this year, but today’s figures make a back-to-back cut in July much less likely, according to analysts.

After the wave of Covid-era inflation washed over Europe, peaking with energy price shocks after diversification away from Russia, central bankers have been under close scrutiny. Critics lambasted their failure to anticipate the surge in the cost of living, and the lack of consensus on whether inflation was “transitory” or not.

Now things are looking up, but central banks still walk a tightrope. Being too dovish could imperil the steady progress made on disinflation; too hawkish and they risk suppressing demand to lockdown levels.

This could lead to a decoupling in monetary policy as each institution responds to different challenges, some economists have noted.

“It is not ordained that interest rates need to move in sync across the world’s leading advanced economies, though global forces have kept them in tandem this century,” the FT’s economics commentator Chris Giles writes.

Some analysts worry that divergence could cause depreciation of the euro and push up inflation by raising the prices of imports to the bloc.

But Philip Lane, the ECB’s chief economist, is not too worried about that. Speaking to the FT, he said: “Barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.”

However, he noted that “things will be bumpy and things will be gradual” — with today’s data being a case in point.

Need to know: UK and Europe economy

A controversial levy on gas piped through Germany will be abolished, as its neighbours warned it could threaten progress on diversification away from Russian imports.

The UK housing market is “showing signs of resilience”, as house prices returned to growth in May.

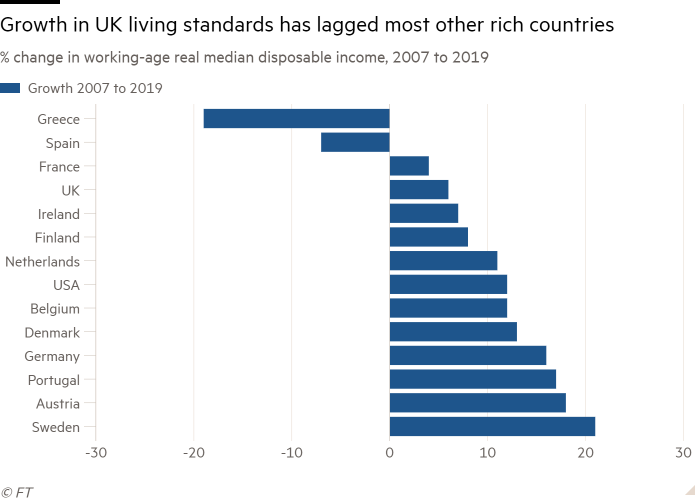

UK living standards have trailed behind most wealthy peer countries since 2010 due largely to sluggish wage growth, says the Institute for Fiscal Studies.

Need to know: Global economy

Saudi Arabia is selling roughly $12bn worth of shares in Saudi Aramco, its national oil company, bolstering its sovereign wealth fund amid doubts about the ambition of its economic diversification plans.

Manufacturing activity in China dropped in May, undershooting expectations at a time when the politburo seeks to spur momentum in the economy.

Egypt has quadrupled the price of subsidised bread, risking social unrest in a country where 30 per cent of people live under the poverty line.

Japan spent a record ¥9.8tn ($62bn) from late April to May to boost the tumbling yen, but the currency has resumed its slide back to 34-year lows.

Need to know: business

The Italian government will give an EU grant worth €2bn to STMicroelectronics, a semiconductor company, as Europe aims to elevate its standing in the global chip supply arms race.

The UK government has sold £1.24bn of its shares in NatWest via a buyback, slashing its stake in the bank to 22.5 per cent from 38 per cent at the end of 2023.

Budget retailer Costco has more than trebled its share price over the past five years, as $5 chickens and gold bars entice consumers to their doors in droves.

OpenAI’s models have been used in covert foreign influence operations to disseminate disinformation related to war, politics and elections across the globe.

Science round up

Federal funding for a late-stage trial of Moderna’s pandemic bird flu vaccine could come to pass as early as June, as an H5N1 outbreak ravages dairy and egg farms the world over.

The Crown Estate is converting a department store in London’s Oxford Street into a science and technology lab, as Britain grapples with a shortage of good lab space and homegrown tech firms.

A record-breaking heatwave in New Delhi has seen temperatures soar to 50C, prompting authorities to ration water as India struggles with the effects of climate change.

Some good news

When Maddux Springer, a US high schooler, noticed an outbreak of disease killing sea turtles in his native Hawaii, authorities would not give him the permits necessary to biopsy the reptiles. Two and a half years and 400 hours of diving later, he won a $10,000 science prize for his investigation into the creatures — and their unlikely killer.

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

One Must-Read — Remarkable journalism you won’t want to miss. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you