Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

UK living standards have underperformed those of most wealthy countries since the Conservatives entered government in 2010, according to research published on Friday by the Institute for Fiscal Studies.

The think-tank said median disposable incomes had grown by just 6 per cent between 2009-2010 and 2022-23, despite rapid growth in employment and significant tax cuts for middle earners.

The near stagnation was mainly due to sluggish wage growth. Average earnings were 3.5 per cent higher in 2023-24 than in 2009-10, after taking account of inflation. Before the global financial crisis, it would typically take less than two years for earnings to grow that much.

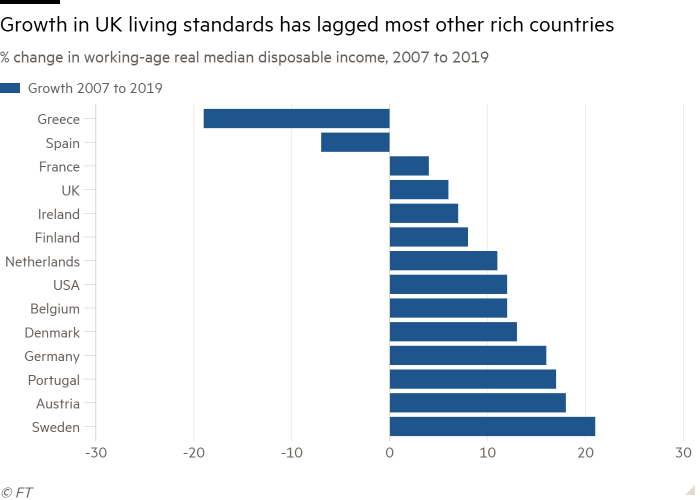

Working-age incomes grew in the UK between 2007 and 2019 at half the 12 per cent pace seen in the US, falling even further behind the 16 per cent gains seen in Germany. The UK outperformed only France, Spain and Greece among 14 countries for which the IFS analysed data.

Tom Waters, IFS associate director, said the UK had sunk to the “bottom of the league” after registering some of the strongest growth in working-age incomes in the 12-year period up to 2007.

The UK’s relative performance did not appear to have improved since 2019. But Waters noted that data collected since the Covid-19 pandemic was not strictly comparable across countries.

The IFS research, funded by the Abrdn Financial Fairness Trust, undermines recent claims by chancellor Jeremy Hunt that countries such as Germany, Austria and Sweden have suffered bigger recent falls in living standards than the UK.

In an interview with Sky News on Thursday, Hunt also pointed to a recent rebound in real wage growth as evidence of the UK’s improving fortunes.

But the IFS said that even though wage growth was outpacing inflation, disposable income for a typical household was largely unchanged since 2019. This was because mortgage payments were higher, taxes had risen recently for some groups and employment had weakened.

Households on both the highest and the lowest incomes have fared worse since 2009-10 than those at the middle, because of weaker earnings growth at the top; more people being dragged into higher rate tax bands; and cuts to benefits.

Income growth “has been slow for essentially everyone; rich and poor, old and young”, Waters said. “Even while income inequality has been stable, progress on reducing absolute poverty has been painfully slow.”