Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

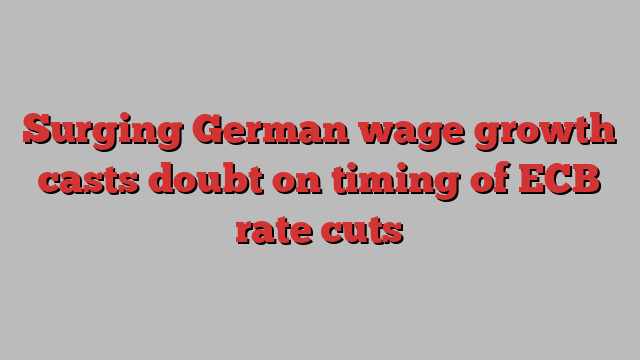

German wages rose at the fastest pace for almost a decade, pointing to a pick-up in the wider Eurozone and casting doubt over how aggressively the European Central Bank will cut interest rates this year.

Collectively agreed wages in Germany rose 6.2 per cent in the first three months of the year, accelerating from 3.6 per cent in the previous quarter, according to Bundesbank figures that include one-off bonuses published on Wednesday.

Economists said the German numbers along with other countries’ data suggested that Eurozone annual collective wage growth rose to 4.7 per cent in the first quarter, up from 4.5 per cent in the previous quarter. The overall figures for the currency bloc will be published on Thursday.

An acceleration of wages would be a setback for investors hoping for consecutive rate cuts from the ECB, which is widely expected to be the first big central bank to slash interest rates on June 6.

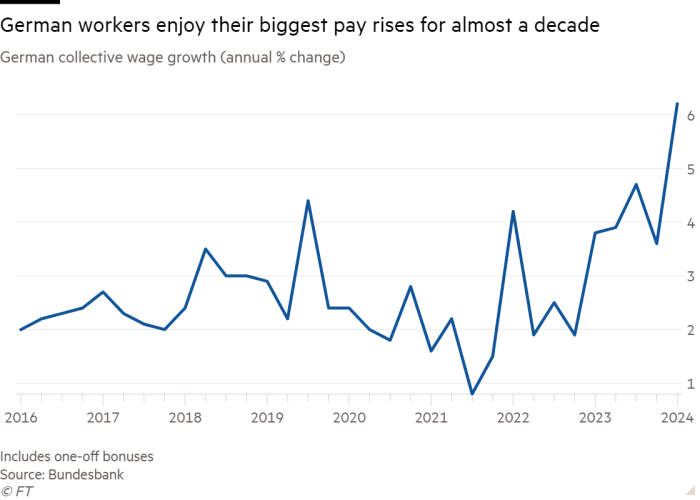

The Eurozone central bank has said the timing of rate cuts depends on whether workers get lower pay rises this year and if those extra costs are absorbed by companies cutting profit margins instead of passing them on with higher prices.

Stronger than expected wage growth in the first quarter will mean policymakers are unlikely to agree on a second consecutive cut in July and more likely to wait until September. Germany’s rate-sensitive two-year bond yield rose above 3 per cent for the first time in three weeks on Wednesday as investors lowered their rate-cut expectations.

“This will be a significant challenge to the idea that the ECB will deliver sequential rate cuts,” said Tomasz Wieladek, an economist at investor T Rowe Price. “The ECB is still likely to cut rates in June, as this was essentially pre-announced and it will be hard to deviate from this forward guidance at this stage.”

ECB policymakers have sent strong signals for several months that they are likely to start cutting their benchmark deposit rate from its record high of 4 per cent in June, as long as inflation does not rise higher than they expected.

Christine Lagarde, ECB president, said this week that there was a “strong likelihood” of it cutting borrowing costs at its meeting in June “if the data that we receive reinforces the confidence level that we have that we will deliver 2 per cent inflation in the medium term”.

Eurozone inflation was steady at 2.4 per cent in April, having fallen from above 10 per cent at its peak in 2022, and Lagarde said it was “under control”.

But other ECB policymakers have warned investors not to expect consecutive rate cuts in June and July. “Even if rates are lowered for the first time in June, that does not mean we will cut rates further,” Bundesbank head Joachim Nagel said this week. “We are not on autopilot.”

The German central bank said: “The widespread labour shortages and the high willingness to strike, which have recently enabled the unions to achieve above-average enforcement rates, also suggest that wage increases will continue to be comparatively high in the future.”

It said recent collective wage agreements, which increased annual pay by an average of 11.7 per cent in March, indicated wage growth in Europe’s largest economy was likely to remain high, particularly in the services sector. It said unions were seeking annual pay rises of between 7 and 15 per cent.

Greg Fuzesi, an economist at US bank JPMorgan, said the latest wage data “could remind some policymakers of the difficulty of the ‘last mile’ [in bringing inflation down to target] with recent productivity disappointments also playing into this”.

But he added that the broader trend of easing wage pressures was largely unchanged because the institutionalised nature of German pay negotiations meant increases were “slow to come through” and wage growth was slowing in other countries.