Receive free European Parliament updates

We’ll send you a myFT Daily Digest email rounding up the latest European Parliament news every morning.

This article is an on-site version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning

Good morning. A scoop to start: Margrethe Vestager, the erstwhile EU competition chief now gunning to be the next head of the European Investment Bank, told us in an interview that she wants the bank to be more daring in its lending, particularly for Ukraine’s reconstruction, in her first public pitch for the job.

Today, our man at the European parliament previews a crucial vote on corruption reforms. And our commodities correspondent has got hold of a letter from mining companies demanding more EU funding for critical minerals.

Hope for the best

Nine months after police raids at its offices blew open the Qatargate scandal, the European parliament will today try to further tighten its rules to avoid a repeat, writes Andy Bounds.

Context: Three MEPs, an assistant and a former MEP are among those charged with bribery over allegations that they received cash for favours from countries including Qatar and Morocco. Today, a parliamentary committee will vote on transparency reforms aimed at preventing more scandals, after months of negotiations.

They are based on the 14-point plan outlined by Roberta Metsola, parliament president, soon after the scandal broke. Her bold vision has been predictably blurred as political groups haggle over the details.

“I continue to be hopeful,” Metsola said yesterday. “That’s not to say that it has found unanimous support. Change is always difficult, but the 14 points were done with a realistic plan . . . a very ambitious one, but still achievable.”

“Broadly, the compromises should hold,” she said, while admitting she would have liked a stronger proposal.

Members of the Greens as well as the Socialists — the political group to which all those arrested belong — are pushing to tighten the proposal with amendments.

One battle is over a new advisory body to rule on breaches of the code of conduct. The proposal foresees a board of five MEPs, but some are seeking to add three external experts and allow them to actively monitor compliance, rather than just respond to a referral from the parliament’s president.

There will be new rules on declaring MEPs’ thousands of meetings per year. An amendment seeks to cover all meetings, not just ones where policymakers play an “active” part.

There will also be clearer rules to help avoid conflicts of interest and increase transparency in members’ financial declarations.

If the report passes, the entire parliament will vote on it in Strasbourg next week.

Metsola admitted she wanted to go further but the new rules “will also serve as a deterrent that if you are tempted to do what allegedly has been done, maybe that doesn’t happen next time”.

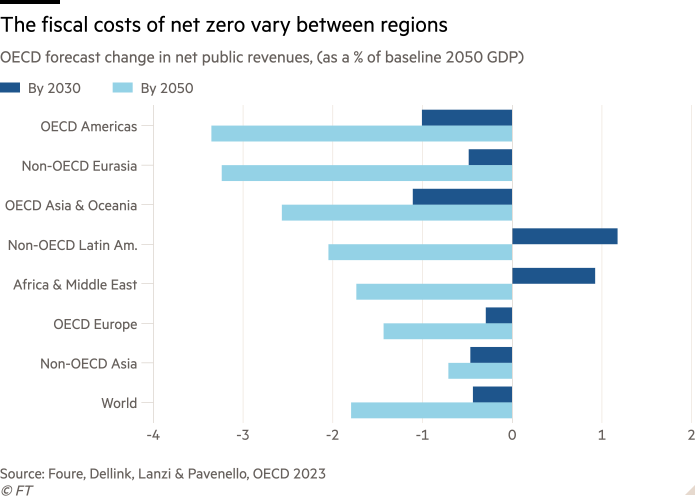

Chart du jour: Green cost

To stem the estimated $100tn needed globally for the green transition without straining government finances, a global accord to price or tax carbon and redistribute the proceeds to the developing world may be needed.

My precious

China and the US are racing ahead to secure key metals for clean energy technologies, leaving Europe in the dust.

Now, Europe’s leading mining and battery companies have written to EU leaders calling for new funding for critical minerals to catch up, writes Harry Dempsey.

Context: The European Commission in March proposed new legislation to boost self-sufficiency in sourcing and processing of minerals such as lithium, nickel and graphite. But the Critical Raw Materials Act lacks new funding to go toe-to-toe with US subsidies under the Inflation Reduction Act and decades of state funding in China.

Eurometaux, the European metals association, wrote in a letter to the EU institutions that the proposal “reshuffles money already available under existing funding plans without attempts to significantly streamline access”.

The 15 signatories — including Rio Tinto, Albemarle and Northvolt — demand an immediate expansion of the EU’s innovation fund and a dedicated critical minerals fund to help the bloc secure minerals foundational to car batteries, power grids and other technologies.

With China pumping out vast volumes of batteries beyond domestic requirements and the US playing catch-up, Europe looks vulnerable to Chinese imports, as well as to any future mineral supply shortages.

That’s why executives argue that Europe needs to rethink strict adherence to free market principles in a sector fundamentally built on subsidies.

“We have one hand tied behind our back while the US and China pump money into their supply chains,” said Eurometaux spokesperson Chris Heron. “The EU urgently needs new critical minerals funding to support our homegrown companies in scaling up their investments.”

France and Germany have offered industry some support but “trying to compete with the US or China on their own is like entering a F1 race with a Fiat 500,” said Julia Poliscanova of the organisation Transport & Environment.

What to watch today

-

European Commission president Ursula von der Leyen visits United Arab Emirates president Mohamed bin Zayed Al Nahyan.

-

Nato secretary-general Jens Stoltenberg hosts new Dutch foreign minister Hanke Bruins Slot.

Now read these

Recommended newsletters for you

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe