Receive free Hedge funds updates

We’ll send you a myFT Daily Digest email rounding up the latest Hedge funds news every morning.

Investors are warning hedge funds that they will face redemptions and further pressure to cut their fees unless they can improve their performance, highlighting the strain placed on the industry by a dramatic rise in global borrowing costs.

An aggressive series of interest rates increases by major central banks over the past 18 months has greatly improved the return that end investors such as pension funds can earn while taking minimal risk. Some investors now say that hedge funds need to lift their returns by a similar amount to the move in global borrowing rates — US rates, for instance, have risen more than 5 percentage points since early last year — or risk heavy outflows.

“Whether you are an institutional investor or a private bank it’s a huge deal that the risk-free rate is now 5 per cent,” said Paul Berriman, global head of Towers Watson Investment Management, which manages $200bn for institutional investors such as pension plans and endowments.

“If I can get 5 per cent in the bank, hedge funds need to explain what they can do for me given that the industry has proliferated and charges high fees . . . the whole hedge fund industry needs to do some serious adapting and has a huge set of challenges to face.”

Hedge funds have delivered gains of 5.2 per cent in the first seven months of this year, according to data group HFR.

“We have been asking all of our managers how they aim to deliver a spread over the risk free rate,” said Patrick Ghali, co-founder of Sussex Partners, which advises large investors on hedge fund allocations.

“And 99 per cent of our managers understand that if they can’t deliver [2 to 5 percentage points above benchmark US risk-free borrowing rates], they are not going to be in business.”

Higher interest rates mean that some safe developed market government bonds are this year offering yields of 5 per cent or more, a yield unheard for years.

“The current yields on government bonds offer the opportunity to lock in real yields we haven’t seen for over a decade with little risk,” said the head of hedge fund allocation at a large pension fund. “This has reignited the debate about whether hedge fund returns are worth the fees.”

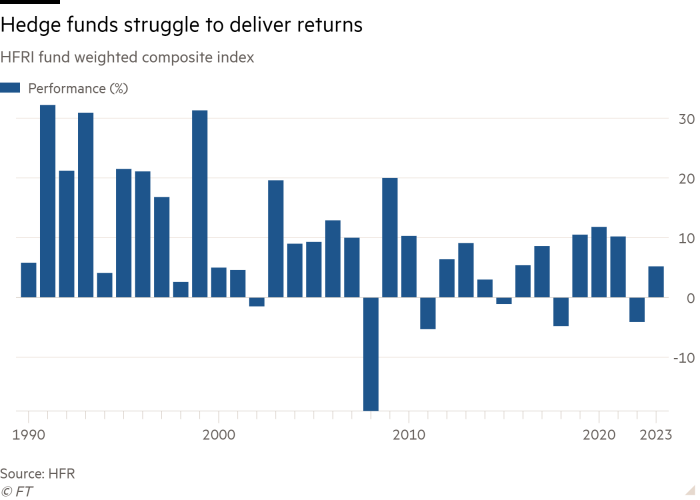

The pressure on performance from higher rates adds to investor disquiet about the $3.9tn industry’s often-lacklustre returns in recent years.

After strong gains in 2020 during the early stages of the coronavirus pandemic, many in the sector had predicted a return to stronger performance, but in many cases this has failed to materialise and has lagged behind stock market gains, leaving investors questioning the value of their hedge fund allocations.

The traditional hedge fund model was known for its “2 and 20” charges, made up of a 2 per cent management fee and a performance fee that took 20 per cent of any gains. In recent years this has come under downward pressure. The average hedge fund fees in 2022 were a 1.39 per cent management fee and a 17.3 per cent performance fee, according to analysis by industry body AIMA.

“The gross returns you have to achieve pre-fees [are] off the [charts],” said one prominent hedge fund manager. “There are alternatives to hedge funds which offer a much better risk/return.”

One area that could come under pressure is the multi-manager sector, which has grown rapidly in size and which instead of a management fee charges a so-called pass-through fee that can amount between 3 and 10 per cent of assets.

The chief executive of a multi-manager hedge fund with more than $10bn in assets under management said that clients were demanding more.

“Now that interest rates are 5 per cent, that is the bogey,” he said. “You need to have 5 per cent plus 3 to 6 per cent. If we don’t have more than the risk-free rate in two years, our fund will get smaller.”

The global hedge fund industry suffered $55bn in net outflows last year and received $12.6bn in net inflows in the first half of this year, according to HFR.

But some allocators are optimistic about the future of hedge funds in a high interest-rate environment. Higher rates will automatically lift the performance at some funds that post cash to fund derivatives trades. This cash is invested in safe assets by the clearing houses facilitating these trades, providing a return close to the risk free rate.

Computer-driven trend followers, which bet on prevailing market trends, and macro hedge funds are two major examples of firms that stand to benefit.

Some allocators also argue that the end of low interest rates will finally puncture the stock market bull run, allowing hedge funds to prove their expertise by picking winners and losers in stock markets.

“Given higher interest rates, returns absolutely do have to go up at hedge funds,” said Darren Wolf, global head of investments, alternatives, at Abrdn. “But we think hedge funds are going back to this really nice environment where volatility is higher and markets are responding to the fundamental underpinnings of the economy as opposed to quantitative easing.”