In the late 1980s, Sony stunned the world with the $3bn acquisition of Columbia Pictures and a grand ambition to crack Hollywood. Three decades on, the Japanese entertainment giant is pursuing the same strategy in India’s Bollywood.

Sony’s story in India started 40 years ago, when Japanese companies saw south Asia as just another growing market for electronics. But with the world’s biggest population, a rapidly growing middle class and an insatiable appetite for entertainment, India to Sony is now worth much more.

Last month’s approval of a deal between the Japanese giant and Zee, India’s largest listed media group, cleared the way for the creation of a $10bn entertainment conglomerate with more than 70 Indian TV channels, film studios and extensive movie catalogues.

Sony faces a formidable challenge from Disney Star, India’s largest TV network, and other deep-pocketed rivals such as Indian tycoon Mukesh Ambani’s JioCinema streaming service, which are jostling for dominance of the entertainment market in a country of 1.4bn people.

Nevertheless, Sony’s chief executive, Kenichiro Yoshida, is convinced of the opportunities for the combined group.

“If you look at a country’s advancement, the entertainment field expands in the latter half of the development phase and we’re seeing that now in India,” Yoshida said in an interview at Sony’s headquarters in Tokyo.

India, which last year overtook the UK as the world’s fifth-largest economy, could surpass Germany and Japan to become the third largest by 2030, according to some forecasts.

The country’s Hindi and regional language entertainment sector has grown into one of the world’s largest film industries, churning out more movies than any other nation every year since 2005, according to Sony.

The company hopes it can repeat its success in the US, its most lucrative market, in India. The media business Sony built there helped it leverage its intellectual property across games, TV shows, films and animation to evolve from an electronics brand into a $105bn global media giant.

Its most recent hit was turning the 2013 PlayStation game The Last of Us into a hugely successful TV show — a zombie saga streamed by HBO in the US. Analysts expect Sony’s pictures division to be boosted over the next two years by other TV adaptations of its blockbuster games titles. This year, it plans to roll out the car racing GranTurismo movie, while action-adventure hits Horizon Zero Dawn and God of War are being produced by Netflix and Amazon Studios, respectively.

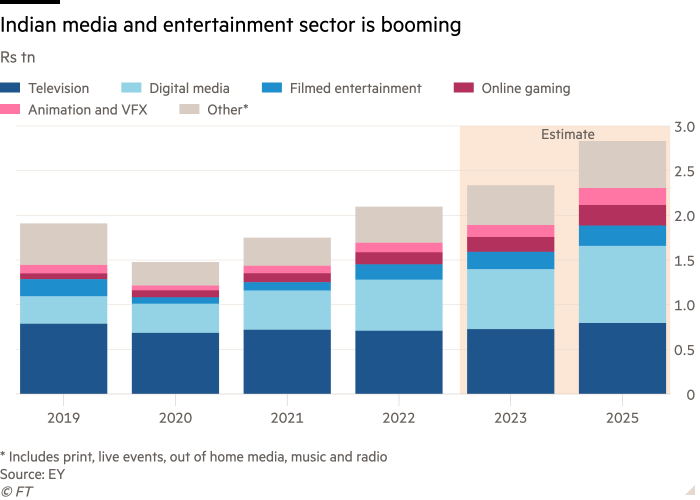

Sony is hoping to capitalise on the rapid expansion expected in the film, games, music and animation industries over the next few years, with Boston Consulting Group projecting that the entire industry in India could grow to as much as $65bn by 2030.

The entertainment company’s deal with Zee creates a 74-channel media powerhouse that gives the Japanese group a 24.8 per cent market share, overtaking Disney Star, which has a 24 per cent share. Once the merger is complete, Sony will take a 53 per cent stake in the combined entity with Zee and invest nearly $1.6bn.

The deal still faces regulatory hurdles. India’s markets regulator Sebi in June banned Zee chief executive Punit Goenka from leading listed companies, over allegations that he was involved in diverting funds from Zee and the group’s other listed entities to founding shareholders.

Goenka had been set to lead the merged group and has been unsuccessful in appealing against the Sebi order. But Sony is willing to replace Goenka if the order is not removed, according to one person with knowledge of the discussions.

Analysts say such a move would be positive since Sony already has a strong local leadership in India and it would address corporate governance concerns at Zee. Sony declined to comment. In a statement, Goenka’s office said he had “always ensured the best interests of the shareholders” and would “continue to take the necessary steps in accordance with the law to seek justice”.

Sony intends to replicate its US playbook by adopting an “arms dealer” strategy where it distributes titles across multiple rival streaming platforms to maximise profits, instead of launching its own streaming service.

“There is various competition out there [in India] but instead of solely pursuing subscriber numbers, we want to do content creation as well. If necessary, we will consider offering our content to other platforms,” Yoshida said.

Sony’s ambitious bet on India comes as the business environment turns more challenging elsewhere. Its Hollywood studios have been stymied by the biggest writers and actors strike in 60 years, while arch-rival Microsoft is on the brink of sealing the largest video game deal in history by buying the publisher Activision.

But in India, Sony’s merger with Zee is well-timed, according to Jefferies analyst Atul Goyal. Industry leader Disney is seeking to cut costs across the board and is examining options for its TV business in India, where it lost the rights to stream Indian Premier League cricket matches last year to Ambani’s JioCinema in a record-breaking $6.2bn auction.

“Sony’s intellectual property is well placed and combined with Zee, it could be a lot more valuable,” Goyal said. “Sony is in a very good position.”

Sony also has a sizeable sports presence in India, broadcasting everything from international cricket matches to Uefa Champions League football.

But Yoshida remains cautious about Sony-Zee’s prospects in sports: “Sports is very attractive for us, but there is no ownership so, personally, I think it is better to be able to hold and spread intellectual property for long-term sustainable growth.”

Using its brand strength from films and TV, Sony ultimately wants to expand PlayStation console sales in India.

Overall console sales in the country remain small — just 300,000 units were shipped in the last financial year, according to Prabhu Ram, head of industry intelligence at research group CyberMedia Research. Sony sold 19.1mn PlayStation 5 units globally in 2022.

Those numbers have not deterred Yoshida. “90 per cent of games are on mobile,” he said. “In other words, we see a console opportunity.”

Additional reporting by Leo Lewis in Tokyo