Receive free Technology updates

We’ll send you a myFT Daily Digest email rounding up the latest Technology news every morning.

Hello, everyone, this is Akito in Singapore.

Tesla has long said that its mission is to “accelerate the world’s transition to sustainable energy”. Undoubtedly, the US electric vehicle maker, which celebrated its 20th anniversary this year, has made major strides towards this goal.

But even a company as successful as Tesla can’t achieve a global shift of this magnitude all by itself. One company can’t meet the rapidly increasing demand for EVs worldwide.

Tesla’s ambitious chief executive, Elon Musk, has long been aware of this. In an interview with Nikkei back in 2014, Musk said there was only so much Tesla could do to spread EVs globally and that the company’s role was to show auto giants the potential of going electric. While many of them may have been sceptical at the time, most of the world’s major automakers have shifted significantly towards EVs.

As the market grew, so did Tesla’s sales and global prominence. But one thing Musk might not have counted on was the emergence of a huge rival in China, which is also the primary market of Tesla.

In the big leagues

Chinese automaker BYD joins the ranks of the world’s 10 biggest car companies by sales for the first time, Nikkei staff writer Sei Matsumoto reports, while Tesla remains in 15th place.

BYD’s global new vehicle sales grew 96 per cent on the year to 1.25mn units in the first half of 2023, putting it in 10th place, surpassing German brands such as Mercedes-Benz and BMW.

While Tesla focuses on premium EVs, BYD has expanded its line-up at both the low and high ends of the market in a range of vehicle types, including pure electric and plug-in hybrid. The Chinese company also enjoys the benefit of a vast domestic market to sell into, though fierce competition has sparked a bruising price war there.

But the company is also looking beyond China, to south-east Asia and Russia, where Japanese, US and European automakers have withdrawn following Moscow’s war with Ukraine.

BYD exported more than 80,000 Chinese-made autos in the first half of 2023, compared to Tesla’s 180,000 units.

Whichever company comes out on top in the long run, there is little doubt that their competition is helping to drive the global transition that Musk envisioned.

A serving of angst

An influx of cheap Chinese robot waiters has provoked anxiety in South Korea as the country wrestles with a declining population and intensifying competition from Chinese tech companies, write the Financial Times’ Christian Davies and Song Jung-a.

Server robots, which ferry dishes to and from diners’ tables, are popular with South Korean restaurateurs struggling to hire staff amid labour shortages and surging wages.

But executives worry government programs designed to encourage the adoption of robots regardless of their country of origin are undermining South Korea’s domestic robotics industry, seen as key in a country with the world’s lowest birth rate.

Korean companies are fighting back with sophisticated server robots for hotels and delivery robots serving buildings and apartments. But industry officials say Seoul’s reluctance to offer meaningful subsidies is threatening their development.

According to the Federation of Korean Industries, Korean robot companies lag behind peers in Japan, the US, Germany and China in competitiveness because of their overreliance on foreign parts and Korea’s weakness in software development.

Down on spending

For south-east Asia’s tech stars, the age of growth above all else seems well and truly over. Investors are becoming increasingly focused on a path to profit and rewarding companies accordingly, write Nikkei Asia’s Tsubasa Suruga, Nana Shibata and Dylan Loh.

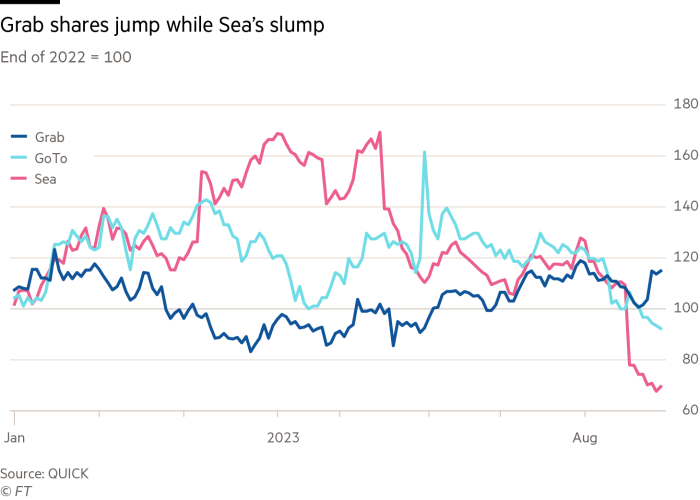

This year, shares in Grab are up around 15 per cent as the market applauded its efforts to rein in costs and inch closer to breaking even. Shares in Singapore’s Sea, by contrast, dropped sharply after the company announced plans to ramp up investments in ecommerce — a move that CEO Forrest Li warned could send Sea back into the red. The share price drop wiped close to $10bn off the company’s market value.

But online companies like Grab, Sea and Indonesia’s GoTo are caught in a tricky situation. Investors want to see costs cut, but rising competition and difficulty holding on to customers make it difficult to ditch pricey incentives like free deliveries and discounts.

Where’s the rush?

China’s tech manufacturing industry usually ramps up hiring every summer, recruiting hundreds of thousands of temporary workers to help handle the rush of orders from US tech companies and others ahead of the year-end holiday shopping season.

But not this year, write Nikkei Asia’s Lauly Li and Cheng Ting-Fang.

“It’s so easy to hire workers,” an executive at an Apple supplier said. “And they are not expensive at all.”

The unusually weak hiring is, at best, a mixed-blessing for suppliers. On the one hand, they are spared the cost and headache of mass recruitment. But it also highlights the ongoing slump in electronics demand and the painful effects of supply chains shifting out of the country.

For Beijing it is unwelcome news, as the government grapples with a weak post-Covid recovery of the economy. Youth unemployment hit a record high of 21.3 per cent in June before authorities decided to suspend publication of those figures, while debt woes in the property sector threaten to spill over into the broader economy.

Tech suppliers, meanwhile, can expect little reprieve even if wage growth cools. As one analyst said, the driving force behind the global supply chain shift is not cost, but “concerns of the US-China tech war and geopolitical uncertainties”.

Suggested reads

-

Japan’s cyber security agency suffers months-long breach (FT)

-

Is the new Mate 60 Pro a 5G comeback for Huawei? (Nikkei Asia)

-

Singapore data centres look to Malaysia, Indonesia to satisfy demand (Nikkei Asia)

-

SoftBank seeks to build investment war chest on back of Arm IPO (FT)

-

Huawei agrees long-term patent deal with Ericsson despite western curbs (FT)

-

China behind biggest online influence network: Meta (Nikkei Asia)

-

India’s first ‘unicorn’ of 2023 boosts tech sector’s hopes of funding revival (FT)

-

Singapore’s Vertex Growth eyes Japan’s cloud software sector (Nikkei Asia)

-

Cultural entrepreneur Suhair Khan on why tech and the arts need to work together (FT)

-

India’s PC import curbs draw US concerns (Nikkei Asia)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at [email protected].