Receive free African politics updates

We’ll send you a myFT Daily Digest email rounding up the latest African politics news every morning.

This article is an on-site version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning

Good morning. Today, I explain why Europe’s foreign ministers will spend much of today talking about west Africa, and our environment correspondent ponders whether EU debt rules are restricting climate-friendly investments.

Domino effect

EU foreign affairs ministers have become accustomed to discussing updates from the war in Ukraine during their regular meetings. But they’re also increasingly familiar with maps of west Africa.

Context: Military leaders in Gabon yesterday seized control of the oil-rich nation and deposed its long-time president. The coup comes a month after one in Niger, and is the eighth in the region since the start of 2020. The string of insurrections has underscored the lack of influence held by outside powers such as the EU in west Africa.

European diplomats in Libreville, Gabon’s capital, held crisis talks yesterday as the country’s arrested president, Ali Bongo, issued a video calling for western assistance. Brussels has not made any decisions regarding potential evacuations of EU citizens, officials said.

The coups in Gabon and Niger were discussed by EU defence ministers yesterday as they huddled in Spain. Talks will continue today among their foreign minister colleagues, including making progress on “an autonomous sanctions regime to take measures against the [Niger] putschists”, the bloc’s chief diplomat Josep Borrell said.

After the safety of its citizens, the EU’s primary concern is containing instability and attempting to maintain some influence on countries where adversarial states — such as Russia — or Islamist terrorist groups either have, or seek, footholds.

All of the region’s military takeovers since the start of 2020 have been in former French colonies: Gabon, Niger, Chad and Guinea, and two each in Burkina Faso and Mali.

France has troops in Niger and Gabon, Spain has armed forces on the ground in Mali. The EU had agreed to fund a military training mission in Niger before abandoning it in response to the putsch; a previous mission in Mali was suspended in similar fashion.

As more of the region’s governments fall to insurrections and the risk of instability rises, the EU’s room for manouevre to stem it narrows. Brussels has committed to maintaining its peacekeeping efforts in the Sahel, but it is rapidly running out of stable states in which to base missions.

Niger’s foreign minister in exile, Hassoumi Massaoudou, and Omar Touray, the president of the commission of the Economic Community of West African States (Ecowas), will join the EU ministers today as they debate ways to respond. Ecowas has readied a military intervention into Niger; Borrell has said the EU is open to all suggestions.

“It is clear that the coup in Niger is opening a new era of instability in a region which was already very fragile, and this will undermine the stability of the region,” Borrell told reporters yesterday evening. “The ministers reiterated our will to support African solutions to African problems.”

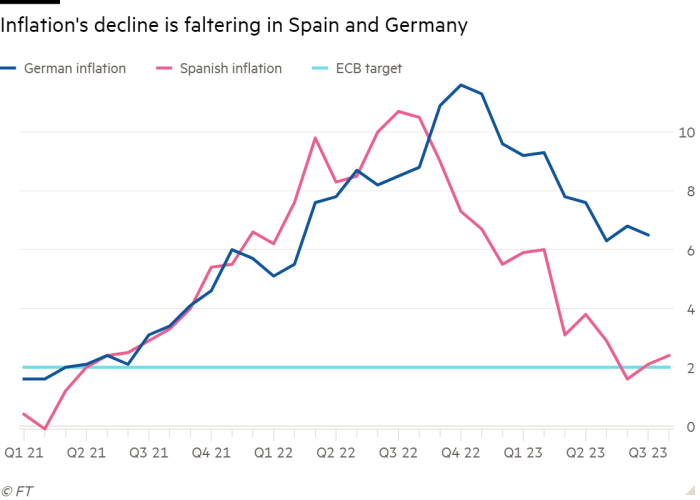

Chart du jour: Sticky prices

Investors are increasingly convinced that the European Central Bank will raise interest rates again next month, after German inflation remained higher than expected in August and Spanish price growth hit a three-month high.

Spend to grow

The EU’s debt rules are holding back investments for the green transition that would at the same time stimulate growth, argues a paper published today.

According to the New Economics Foundation, the EU’s most indebted countries could spend an additional €135bn a year to meet their climate targets while diminishing their debt burden by the end of the decade, writes Alice Hancock.

Context: The European Commission in April proposed changes to the bloc’s budget rules, requiring countries to reduce their public debt over a four-year timespan. The rules were suspended during Covid-19, but debt reduction is expected to be enforced again from next year.

The UK-based think-tank argues that green investments are likely to stimulate growth and outpace debt levels. If countries cut spending to meet the EU’s budget demands, they will probably have to spend more in the future to mitigate the effects of climate change.

Countries would therefore be able to reduce their debt-to-GDP ratio even without applying the strict reduction targets and while running a deficit, the researchers argue. The NEF said that the targets should not be applied in a blanket manner, but take into account different countries’ circumstances (like Greece’s, which has taken a heavy hit from devastating wildfires this summer).

Countries such as Spain and Greece, which cut their budgets the most between 2009 and 2019, saw the largest increases in their debt-to-GDP ratios, the researchers added.

“The EU is failing to see the bigger picture by focusing on arbitrary debt reduction goals that restrict green spending, rather than encouraging the green investment Europe desperately needs to transition our economies,” said the NEF’s Sebastian Mang.

What to watch today

-

EU foreign ministers meet in Toledo, from 8.30am.

-

European Commission president Ursula von der Leyen meets French president Emmanuel Macron in Paris.

Now read these

Recommended newsletters for you

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe