Receive free Deutsche Bank AG updates

We’ll send you a myFT Daily Digest email rounding up the latest Deutsche Bank AG news every morning.

Johan Löf is a senior economist and head of forecasting at Handelsbanken Capital Markets in Stockholm.

Last week Alphaville wrote an interesting post on pandemic savings based on Deutsche Bank analysis, with the punchy subtitle “Pray for Swedes”. As a Swedish economist I can’t help but point out that, well, it’s entirely wrong, at least when it comes to Sweden.

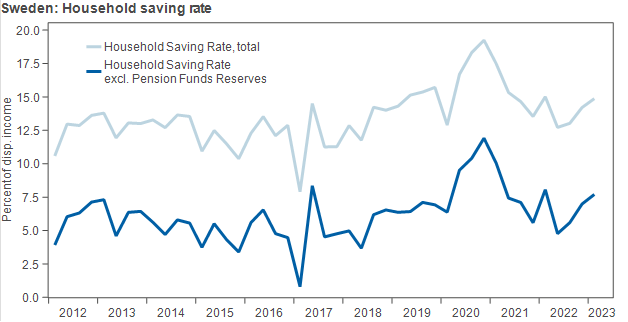

For the Swedish economy, the DB analysis fails even the first inspection, unfortunately. Here is the actual saving rate (see also here).

As you can clearly see in the chart above, Swedes’ saving rate soared when the pandemic hit, and since then it has declined but not been unusually low, suggesting that households still hold at fair amount of “excess savings”.

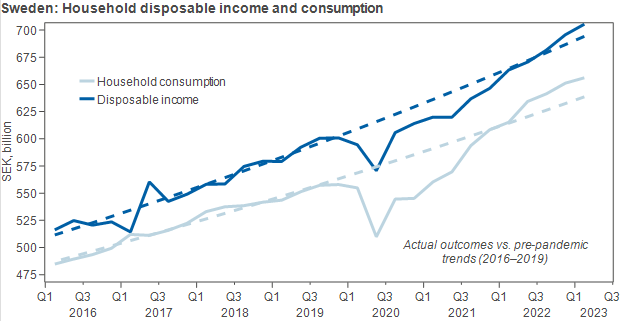

While Sweden had relatively loose legal pandemic restrictions, self-isolation was extensive and de facto restrictions were reasonably tight. Therefore, consumption plummeted, like in other countries. Incomes dropped too, as unemployment picked up, but the decline was limited as furlough programs allowed many to stay employed (while keeping 90 per cent of their regular pay).

The chart below illustrates these developments, which add up to the higher-than-normal saving rate showed in the previous chart.

This also shows the pre-pandemic trends (exponential) for the individual variables that lie behind the household saving rate. This way of analysing “excess savings” has been popular over the past 1-2 years.

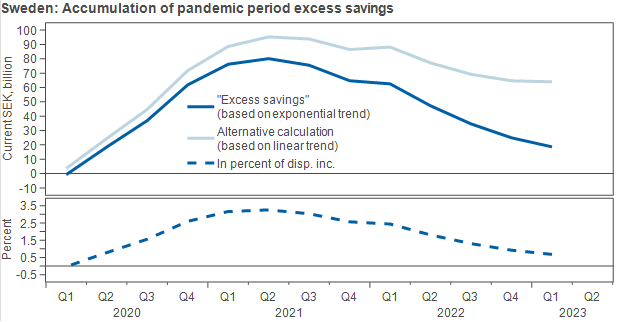

But in the most recent Fed staff paper that Deutsche Bank refers to, a method applied to the aggregate saving rate is used. I don’t want to speculate, but perhaps there are some caveats with the method that caused DB to slip up.

Finally, here is a chart with the resulting estimate of “excess savings” in Sweden. Exact results will always be open to debate since excess savings isn’t an exactly defined concept, but I’m confident this representation gives a rather reasonable picture of what the Swedish statistics tell us, and the DB analysis got wrong.

Basically, yes, excess savings have declined in Sweden, but not nearly as alarmingly as some seem to think.