Receive free US employment updates

We’ll send you a myFT Daily Digest email rounding up the latest US employment news every morning.

It’s jobs day, and you know what that means: Charts!

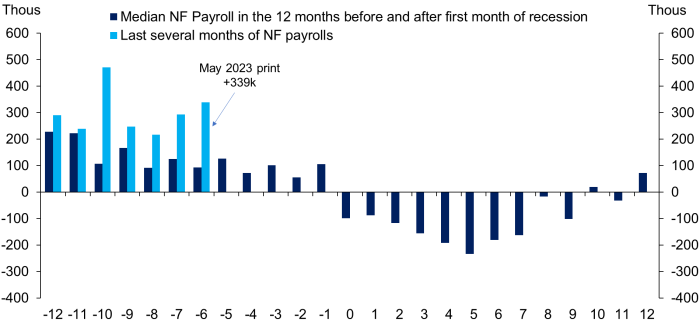

The US economy created 209,000 jobs in the June, below the 225,000 print expected. This is the first time the numbers have fallen short of economists’ forecasts in 14 months, according to Bespoke Research.

You might’ve seen the chart if you didn’t get rate limited by Twitter before 8:40am EST. Luckily, we logged on to that imploding submersible so you don’t have to:

The second set of charts, which hit our inboxes before NFP, might’ve made a bit more sense after the blowout ADP data.

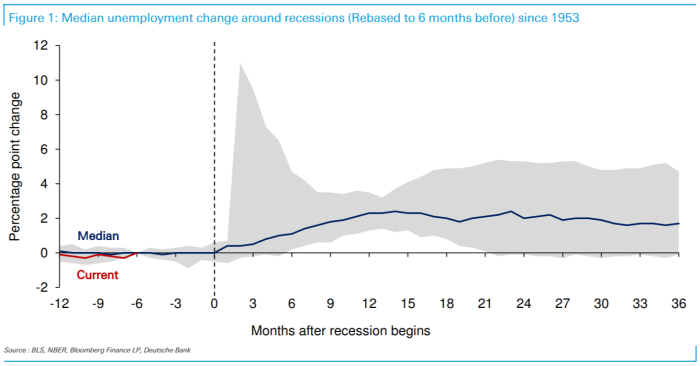

Jim Reid of Deutsche Bank reminds us that changes in labour markets lag behind changes in the broader economy. In other words, people normally don’t start losing their jobs until the recession has already started. Is this widely known? Yes. Are these charts nice anyway? Also yes.

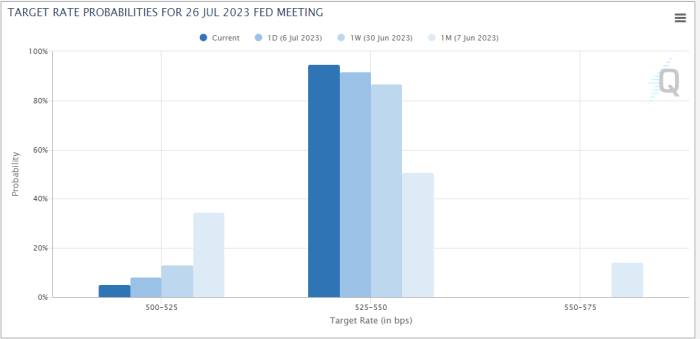

Labour-market strength isn’t irrelevant for the future economic outlook, obviously. The forward-looking relevance is primarily its effect on Fed policy. The only thing this week’s jobs data has done is reinforce investors’ belief that the central bank is going to raise rates at its July 25-26 meeting.

So here’s your bonus chart for the day:

The fed funds futures market still has that 5.25 to 5.5-per-cent level as the terminal rate, more or less. Over the past month the market has started to coalesce around a cut back to 5-per-cent rates in May of 2024.

But futures liquidity gets worse the further you go into the future, so make of that what you will.