Receive free Capital markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Capital markets news every morning.

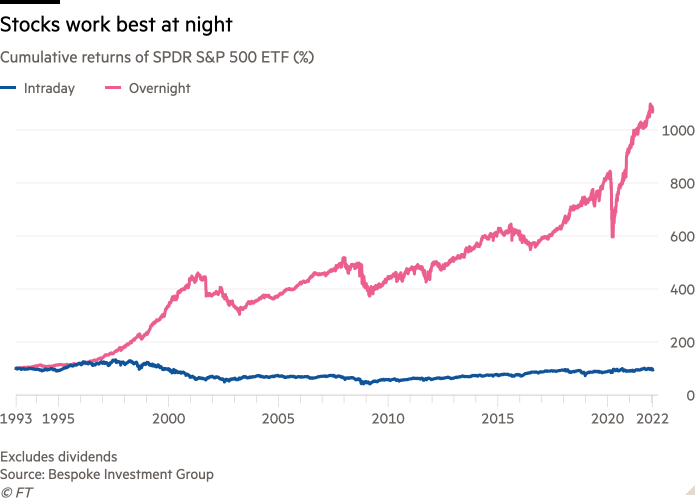

One of the oddest financial phenomena is that US stock market returns tend to be the strongest in the overnight session, and either weak or negative over the actual official trading hours.

Here’s a (2022) chart from Bespoke that shows how stark the phenomenon is in US stocks. This uses the SPY ETF, but the results are the same for the actual S&P 500.

This has attracted attention from a lot of people, ranging from the NY Federal Reserve to a conspiratorial former DE Shaw quant. Someone has even launched an ETF to try to exploit the anomaly.

My conclusion when I dug into it last year was that it’s caused by a mix of factors, such as the shortness of the formal trading hours versus the 24 hour global trading cycle, when earnings are released, and the rising influence of derivatives and index funds.

In practice the anomaly is impossible to easily exploit because of trading costs (liquidity is much lower overnight, and one-day holding periods would make it a high-turnover strategy). The NightShares ETF has actually lost almost 6 per cent over the past year, compared to the US stock market’s 18 per cent gain over the same period.

JPMorgan analysts have also been digging into the phenomenon, and reckon that it DOES offer some valuable, actionable information. Alphaville’s emphasis below:

Interesting as these findings [of overnight drift] are, it turns out that their economic value is rather limited. As is shown in that [Fed] paper, the after transaction costs returns to a trading strategy that holds the future in the overnight period are negligible after transaction costs, as is the strategy that holds a long position during the day. Shortening the overnight holding period to just the hours around the European open doesn’t improve matters much. The exception in the trading strategies that are presented, is the strategy that takes a long position in the hours around European open if there is a negative order flow at market close. Results of this last variant are strong with a Sharpe ratio of 1.1, though we have to realize that in those hours, traded volumes are rather small and therefore it could prove difficult to realize the returns to this particular strategy.

Do these, from a practitioner’s point of view, disappointing results mean that the breakdown of returns into overnight and intraday have no actionable informational content? Not quite.

. . . Returns that are realized in the the overnight period can be used to predict both the subsequent intraday and overnight returns. Specifically, high (low) overnight returns are followed by strong (weak) returns in next day’s trading session which are then followed by a reversal in the next overnight session. Crucially, this overnight signal is sufficiently strong to overcome the high turnover and the associated transaction costs, and is robust with respect to the actual implementation lag we need to consider between determining the signal and the actual implementation.

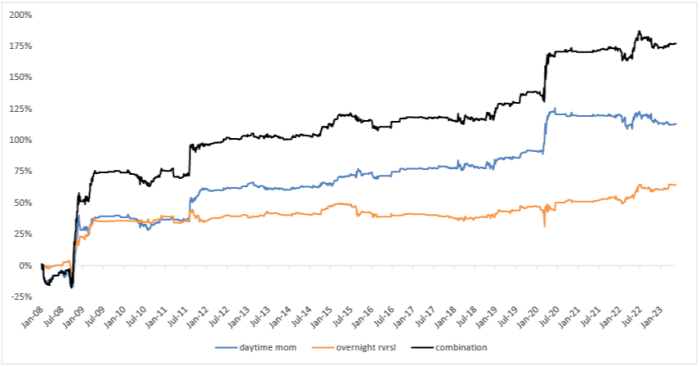

Basically, JPMorgan analysts Erik Rubingh, Dobromir Tzotchev, Thomas Salopek and Marko Kolanovic have constructed a trading strategy that uses overnight returns as a momentum signal for what the next day might hold, and as a reversal signal for the following night. The daytime returns can be used as a reversal signal for the following night and daytime returns.

Here’s what combining both the overnight and daytime signals looks like, after incorporating trading costs. (The strategy seems to do particularly well in turbulent periods, such as 2008 and 2020.)

And here’s how JPMorgan’s analysts explain why the strategy might work, with their emphasis:

The fact that there is a positive relationship between the overnight return and the subsequent daytime return and a negative relationship with the following overnight return indicates that traders that are active during the time when the cash equity market is closed can be viewed as trend setters and demonstrate better skill.

The trendsetters bit makes more intuitive sense than that they demonstrate better skill. Or, at least, both don’t actually need to be true. A lot of investors probably look at what is up overnight and just jump on the bandwagon, irrespective of how sensible any night-time moves are. Things overshoot and then you have a reversal. Skill doesn’t actually have to enter into it.

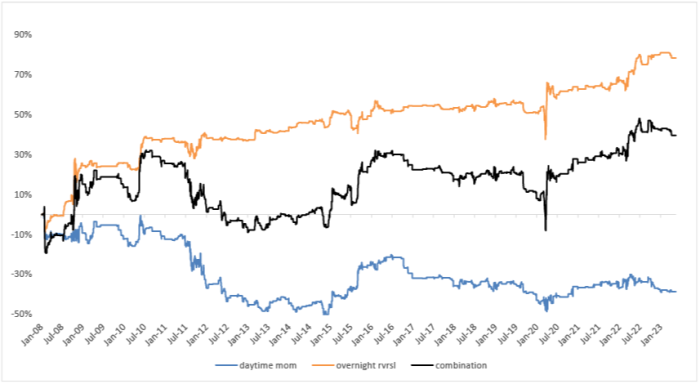

Interestingly, the results are similar in Nasdaq and Nikkei futures (albeit to a lesser extent in Japan) but when JPMorgan tested the strategy against Eurostoxx 50 futures things looked very different.

The overnight reversal signal is actually even stronger in Europe, but the daytime momentum signal is dismal. Why the discrepancy?

We believe that a likely reason can be found in the trading period that overlaps with US cash equity trading. Given the leading role the US plays, some of the returns that are realized in the European daytime session are actually more akin overnight returns, thereby distorting the effect that we observe in Japan and the US. This discrepancy will be subject of future research, for now we will treat the European strategy as having just one leg — the one that uses the overnight signal to profit from the next overnight reversal.

So is all this just elaborate data-mining? Possibly. It’s also likely that by the time any investment bank publishes research on a possible trading strategy it has already been exploited to death by various quant hedge funds years earlier.

But the witching hour drift of stocks remains one of the more fascinating aspects of financial markets, so we’re suckers for any research into it.