Receive free Renminbi updates

We’ll send you a myFT Daily Digest email rounding up the latest Renminbi news every morning.

Earlier this year China made a big deal about how the renminbi had for the first time leapfrogged the US dollar in its own cross-border payments, following a big push to ‘internationalise’ its currency.

Many think it will inevitably become the next big global currency, given that China is already comfortably the world’s second-biggest economy, its biggest trading power, and an emerging financial hub with capital markets only the US can rival in size.

But how successful has Beijing actually been so far? A little in some areas, but not much on the whole, according to a Goldman Sachs report titled “Progress check on RMB internationalization” published yesterday.

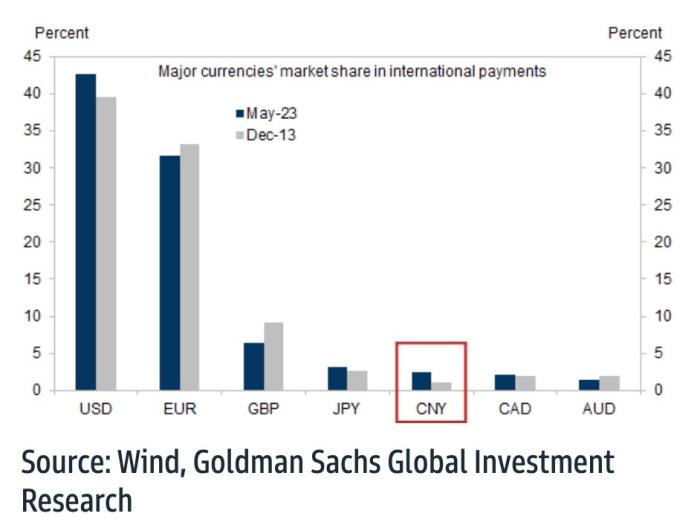

Take the renmimbi’s share of international payments. According to SWIFT, the Chinese currency’s market share has more than doubled over the past decade, from 1.1 per cent in 2013 to 2.5 per cent at the end of May 2023.

But this remains paltry compared to the US dollar’s 43 per cent share (which actually increased over the period). Even sterling remains almost three times more important as an international payments currency.

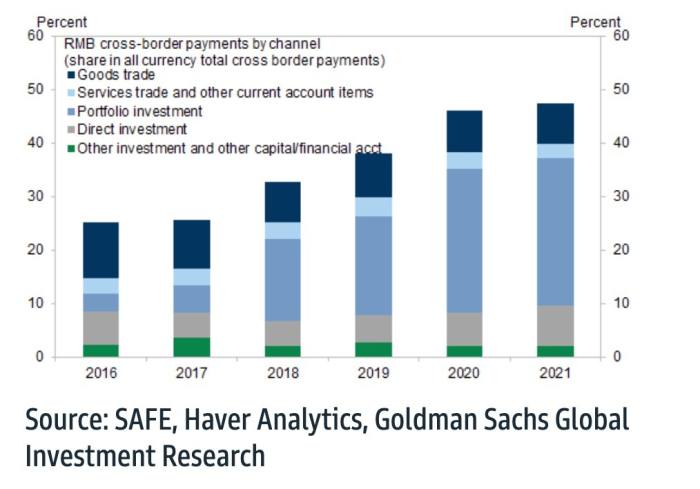

The share of renminbi-settled trade in Chinese goods and services has climbed by 5.8 percentage points over the past decade to almost 20 per cent.

But Goldman notes that the overall increase in the currency’s share in China’s cross-border payments has been mostly driven by more active foreign trading of RMB-denominated securities (thank you index inclusion!)

When it comes to the “store of value” part of being Kind Of A Big Deal, the renminbi also remains a dud. Only 0.7 per cent of international bonds are denominated in the Chinese currency. Its share of global central bank reserves has trebled since 2016 to about 3 per cent, but this is still only roughly Canadian dollar levels.

And as much as people bang on about the US “weaponising” the dollar, does anyone reeeally feel more comfortable that Beijing would never use financial policy leverage? If so we have a Spac to sell you.

Anyway, you can read the full GS report here. It goes a lot more in depth into all the various issues.

Further reading:

Dollar 🙁

Dollar 🙂

A (very short) history of global reserve currencies

Crude indicators for dollar’s dominance