For the past week, Belarusian president Alexander Lukashenko has revelled in being at the centre of events after he helped broker the truce that ended the Wagner militia’s mutiny against the Kremlin.

State controlled media have gone out of their way to herald the achievement. “The peacemaker of Slavic civilisation,” said one Belarus news anchor: “The hero of Russia,” gushed a Russian TV analyst.

The reality is a lot more prosaic. The deal, the importance of which was also played up by the Kremlin, “does not mean he’s a master negotiator, but he did benefit from the right place, right time,” says Rosemary Thomas, a former British ambassador to Belarus. But for now Lukashenko is “delighted to be seen as an indispensable actor on the world stage and sell this for all it’s worth”.

The opportunity to pose as a mediator could not have come at a better time for Lukashenko. During his three decades in power, he has argued that he could combine loyalty to Moscow while also safeguarding his country’s sovereignty. Belarus, he insists, can be close to Russia without becoming completely dependent.

But that claim has come to appear increasingly thin — especially to his domestic critics, who accuse him of being a puppet of Russian president Vladimir Putin. Lukashenko’s reliance on Moscow was underlined in 2020 when he had to ask Putin to help his brutal crackdown on pro-democracy demonstrators following his re-election.

Putin used Belarus as a launch pad for last year’s all-out attack on Ukraine and Lukashenko recently agreed to host Russian tactical nuclear missiles in the country.

“Without Putin, Lukashenko will not survive,” says exiled opposition leader Sviatlana Tsikhanouskaya.

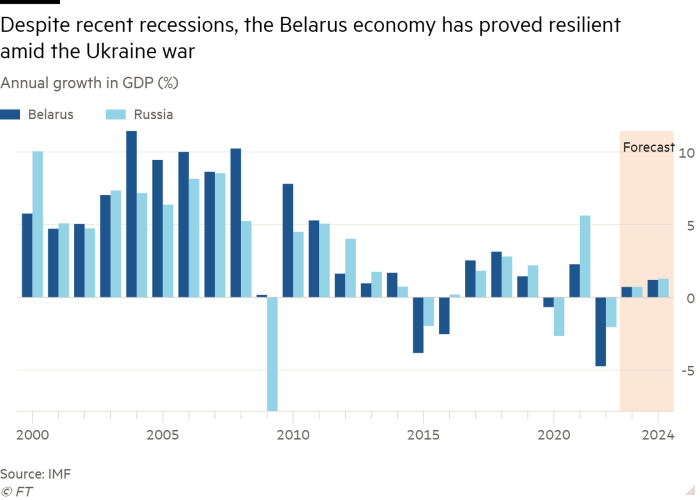

The risk of outright dependency now hangs over the economy. Belarus has displayed unexpected resilience under tough western sanctions, but that has come as a result of assistance from Moscow, both direct and indirect.

The economy is on track to grow this year by around 3.3 per cent — the same as in 2019, before the pandemic halted world trade — says Dzmitry Kruk, an economist at Beroc, a think-tank now based in Vilnius in Lithuania, which is home to a large Belarusian diaspora.

As part of the bargain reached last week to call off the mutiny, Wagner boss Yevgeny Prigozhin has been allowed to take refuge in Belarus. The probable payback for Lukashenko’s role in the negotiations is that Putin will expand Russia’s financial lifeline to Belarus, estimated by Kruk to have already surpassed $3bn since last year, including a debt restructuring agreement.

“I guess it’s a short-term success story in as far as there’s not been the deep recession that could have come after the war began,” Kruk says. “Lukashenko always seemed to understand that dependence on Russia was dangerous, but he has now chosen this as the lesser of two evils, although I really think Russia is as risky for him as democratic transition.”

Finding replacement parts

Just how heavily the Belarusian economy has had to lean on Russia is evident at Bobruiskagromash, the state-owned maker of agricultural machinery.

The company used to import the vacuum pumps it uses in its tractor trailers from Battioni Pagani in Italy, until they got caught up in the EU’s ban on exports that could potentially be used by the military against Ukraine. Now, says marketing director Vladimir Daineko, Bobruiskagromash uses pumps made in Russia.

“After last year’s sanctions, it took us six to 10 months to work out how to replace all the parts that we need, but we’ve managed,” says Daineko. “What doesn’t kill you makes you stronger.”

The unwavering support that Lukashenko has offered Putin during the war has only added to the country’s economic isolation. Western governments placed new sanctions on Belarus after denouncing Lukashenko’s 2020 re-election as fraudulent.

The following year Minsk was slapped with further sanctions after forcing a Ryanair flight destined for Lithuania to land in Belarus in order to arrest an anti-Lukashenko activist on board, while more sanctions followed the invasion of Ukraine. The most recent sanctions have come from the UK, which in June banned imports from Belarus of commodities including rubber, wood and gold.

But Bobruiskagromash is only one example of how the Belarus economy has been able to absorb the blow of sanctions.

Belagromech, the state agricultural engineering centre, now makes copies of cylinders and alternators which were previously shipped from Ukraine. For the western parts that it still needs, “we’re using a lot more private sellers from Kazakhstan and Uzbekistan,” says Belagromech’s head engineer Vladimir Golomako. These intermediaries add 15 per cent to costs, he estimates, but price controls ensure that Belarusian manufacturers only pass on a 5 per cent price increase to buyers.

Moscow supplies Minsk with crude oil and gas on preferential terms. Minsk has stopped publishing detailed trade statistics, but Lev Lvovskiy, another Beroc economist, estimates Belarus earned $1.7bn last year from selling Russian oil, some through intermediaries in the United Arab Emirates. Lvovskiy’s research is based partly on comments from regional officials: “In my experience the regime keeps many secrets, but what is published or said is true.”

Lukashenko has made a rhetorical virtue of the closer links with Russia, talking about a common fatherland that stretches from Brest — near the Belarus border with Poland — to Vladivostok.

Imperial Russia has been reintroduced into accounts of Belarus’s history and the Belarusian Latin alphabet is being replaced with Russian-language text on street signs in Minsk. Lukashenko’s administration has become “a new driver of Russification,” according to the latest Belarus tracker study, sponsored by Germany’s Friedrich Ebert Foundation.

Some officials in Minsk also wax lyrical about rebuilding an economic bloc resembling the Soviet Union, minus the Baltic states. Aliaksandr Yarashenka, a former deputy economics minister, recalls how his father moved the family from Ukraine to take part in the reconstruction of devastated Minsk after the second world war. “I then saw the Soviet Union, a huge country, getting destroyed, so I’ve seen much worse times than now,” he says.

There has been a clear economic cost to Lukashenko’s tight embrace of Putin. At least 2,000 companies have left Belarus since he crushed demonstrations in 2020, according to the Association of Belarusian Business Abroad.

Many engineers joined this exodus, and those still in Minsk now worry either about getting drafted into the army or losing jobs tied to western customers. A software developer explains that his French client, telecom company Transatel, is increasingly employing Belarusians who resettled in Poland. “I could also work in Poland, but my life is here as long as I can keep my job,” he says. “Everything is just now more uncertain.”

However, the IT sector is helping Russia’s military industrial complex, notably supplying semiconductors from an industry that once powered the Soviet Union’s Lunokhod moon rovers in the 1970s. Well after the Berlin Wall had fallen, Lukashenko kept the country’s semiconductor industry on a lifeline, as part of his promotion of a Soviet-modelled planned economy.

“Like with other state-owned enterprises, Lukashenko kept making semiconductors whether there was demand or not, because it’s also his way to pay salaries to those who support him,” says Aliaksandr Alesin, a Minsk military analyst.

Alesin says Moscow is investing $350mn in Belarusian semiconductor company Integral, as part of its latest subsidy programme. “Putin needs to win the war, but he also wants to make Belarus an example of successful and peaceful integration in order to draw more countries into union with Russia rather than China,” Alesin says.

Counterbalancing Russia

Lukashenko has made some efforts to counterbalance the economy’s reliance on Russia. The Belarus leader is trying to forge closer ties with China and other partners such as Iran, two nations he visited in March. But although China is building a new embassy in Minsk, its interest in Belarus is not comparable to Russia’s.

When China’s president Xi Jinping visited Great Stone industrial park near Minsk in 2015, it was presented as a milestone in China’s Belt and Road infrastructure initiative. Instead, China’s Covid lockdown halted investments before Ukraine’s war then punctured Beijing’s hopes of making Belarus a gateway to the EU. A park designed to host 100,000 residents by 2030 has so far only got 3,500, according to Yarashenka, who is now Great Stone’s administrator.

Still, Great Stone says current occupants doubled income in the first quarter — again helped by Moscow, since more than 80 per cent of the China-sponsored park’s exports now go to Russia. “European brands left a lot of niches in Russia that we can fill, also more cheaply than if you transport from Turkey or other places,” says another Great Stone official, Kirill Koroteev.

Great Stone lost Swiss bus maker Hess and German logistics company Duisburger Hafen, but Yarashenka warns against concluding that all westerners are leaving. “Some European companies don’t want to be known to be here because it could hurt them or mean more sanctions,” he says.

At an agricultural trade show, some Belarusian companies displayed Chinese rather than Russian substitution equipment. TTZ, which sells drones, replaced its US supplier Trimble with China’s CHC Navigation. TTZ’s owner, who declined to be named, praises Trimble’s technology but says that “it took a lot of work to partner with Trimble, and I won’t try again even if sanctions stop”.

But lack of access to western financial markets is also pushing companies towards Russia. Western international lenders stopped financing Belarus and the European Bank for Reconstruction and Development is trying to exit three Belarusian shareholdings, notably Alivaria, a brewer owned by Carlsberg. Minsk-based Priorbank recently stopped clients from getting money transfers from the west, amid pressure on the bank’s Austrian owner Raiffeisen to also abandon Russia.

Still, at least two local banks — Gazprom’s Belgazprombank and BSB — continue to facilitate western transfers and officials who attended a banking conference in Minsk presented growing financial integration inside the Commonwealth of Independent States and with neighbours such as Turkey as a buffer against sanctions, echoing a claim made by Moscow.

More than half of international transfers in and out of Belarus have switched to “new currencies”, mostly Russian roubles and Chinese renminbi, says Nikolay Luzgin, chair of the association of Belarusian banks: “There were problems last year with international payments, but now it’s better.”

Nurlan Baibosunov, a senior finance official in Kyrgyzstan, says post-Soviet nations have achieved a level of financial co-operation over the past year that would have required a decade without the pressure of sanctions.

“I think sanctions are having a very good impact because western companies have left and our own companies can step in with our own systems, our software and local processes,” says Baibosunov.

The very few western companies still manufacturing in Belarus have been caught between trying to comply with sanctions and the potential lure of the Russian market. At its factory outside Minsk, Swiss train maker Stadler cut its workforce to 200 from a peak of 1,600. Stadler relocated 300 workers to its Polish subsidiary, but most scrambled to join other companies, some helping Moscow’s war.

“Russia is on the military path, so there are new work opportunities for Belarusian civil engineers,” says Dmitry Logashin, head of project management at Stadler Minsk.

Logashin compares the sanctions to “losing our arms and legs”, particularly after a bumper 2021, when his factory thrived while foreign competitors halted production during lockdowns to stop a pandemic that Lukashenko decided to ignore.

Without western components such as cables since last year, Stadler halted some production. The train factory is finishing three orders — from Italy, Serbia and Azerbaijan — and then relying on a €2.3bn contract to make sleeper carriages for Kazakhstan. Stadler transferred some contracts to Poland, also because customers in Slovakia and Norway worried about a public backlash for ordering from Belarus.

“The sanctions are our bible, we have a strong reputation to keep and we don’t want work from Russia, but that’s not the same for everybody here and many companies have turned to Russia,” says Logashin.

Tougher sanctions?

One objective of the sanctions was to punish Lukashenko for helping Putin. But with Minsk moving ever closer into Moscow’s orbit, there is a debate among western governments about what to do next.

Tsikhanouskaya, the opposition leader, insists the west must toughen sanctions, as well as demand an immediate withdrawal of Russian troops from Belarus. Having Wagner mercenaries in Belarus also threatens regional security, she says, and shows “the role of Belarus is growing”.

She also sounds dumbfounded by the west’s “non-clear response” to Lukashenko welcoming Russian nuclear warheads, as well as by how western officials recently discussed with her who might replace Lukashenko if he dies, following a health scare in May. “Democratic countries don’t have any specific plan for what they would do next,” she says.

Some European diplomats in Minsk understand her concerns. “We keep looking back at what went wrong in 2020 rather than preparing for the future, although we’re now much nearer to the parliamentary elections of 2024 and the next presidential ones of 2025,” says one.

Despite this debate, a number of EU nations are also lobbying to soften a ban on potash, of which Belarus is a major exporter, which they believe could help contain global food price inflation. But Lithuania, which stopped Belarusian potash from entering its Klaipėda port, is leading the drive for stricter sanctions instead.

Yauheni Preiherman, founder of the Minsk Dialogue think-tank, argues that sanctions policy does not have a clear purpose. “Western officials change their explanations about their goals,” he says, “but if the expectation is that sanctions can force Lukashenko to make concessions or turn 180 degrees, that’s a wish rather than the reality.”

But Thomas, the former ambassador, argues Lukashenko is caught in “a vicious spiral”, trying to quash any opposition within a country that already has 1,500 political prisoners while “his position becomes less and less secure because of his illegitimacy”.

In such a context, hosting trigger-happy Wagner troops also “seems mightily risky”, she argues. Whatever happens next, Lukashenko “will never be forgiven by his people for more or less selling away the sovereignty of Belarus.”