Receive free IPOs updates

We’ll send you a myFT Daily Digest email rounding up the latest IPOs news every morning.

Bankers and traders are hoping that a flurry of listings in the US heralds a long-awaited revival in initial public offerings after the longest downturn in decades.

Three companies started trading on Thursday after each of them raised more than $100mn in IPOs, marking the busiest day for listings since November 2021 and the latest in a series of encouraging recent milestones.

“We’ve had the longest open window [for listings] since the Fed started tightening,” said David Ludwig, head of equity capital markets at Goldman Sachs. “While we don’t expect markets or issuance to improve in a straight line, I am optimistic that volumes across products will increase during the back half of the year and we think IPO volumes will normalise in 2024, absent any . . . shocks.”

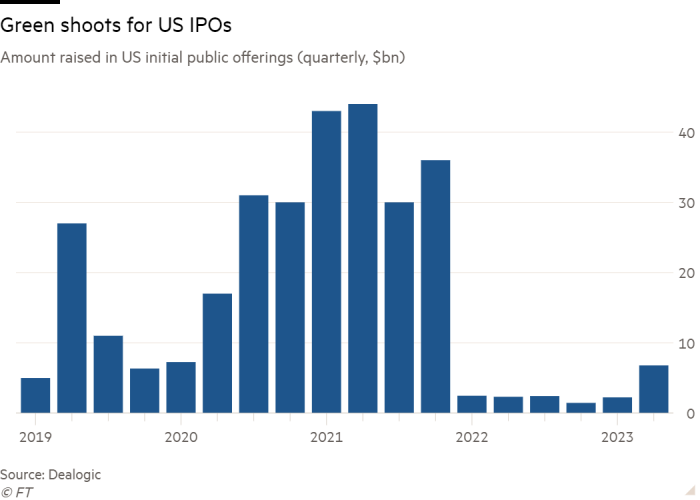

Volumes are way off the high-water mark of 2021, when companies raised $25bn in a single month, but there has still been a marked improvement from a low base over the past few months. Excluding special purpose acquisition companies, IPOs in the US raised almost $7bn in the second quarter, according to Dealogic data, more than double the amount amassed in each of the preceding five quarters.

The uptick in IPO activity comes during a strong period for stock markets, which has helped the performance of some new listings. Johnson & Johnson’s consumer arm Kenvue has traded well since completing a near-$4bn listing in May, and restaurant chain Cava this month enjoyed the strongest opening-day share price “pop” in nearly two years.

“We think that broke the logjam and a lot of companies we talk to privately are now really looking to get into the market,” said Ari Rubenstein, chief executive of trading firm GTS, which acted as Cava’s designated market maker.

A sharp reduction in volatility is also helping. The S&P 500 clocked just 12 daily moves of more than 1 per cent in the past three months, compared with 29 times in the first quarter, and the Vix index — a proxy for expectations of future market swings — fell to its lowest level since before the coronavirus pandemic.

“With the Vix remaining at muted levels, the overhang of the debt ceiling lifted, and the 2023 IPO class [outperforming the broader market], sentiment is clearly improving,” said Jim Cooney, head of Americas equity capital markets at Bank of America.

That is a brighter picture than in Europe which, despite some recent signs of life, is being largely overshadowed by the US in the battle to attract listings.

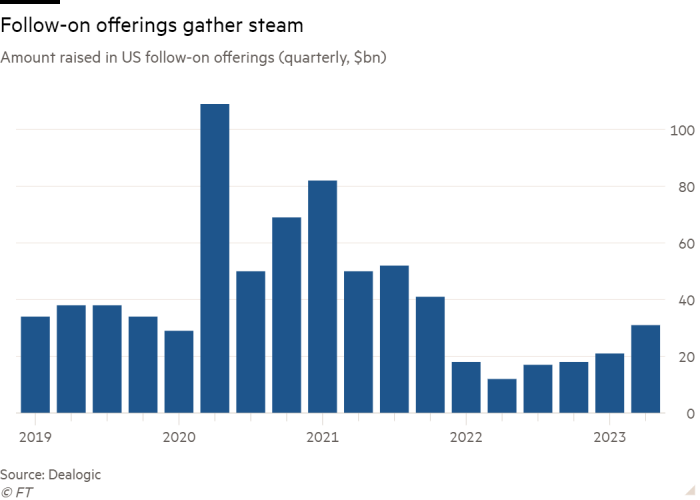

The recent jump in US IPOs follows a steadier pick-up in the less risky ends of equity capital markets. Follow-on deals — when previously-listed companies or their shareholders sell large chunks of shares — rose for the fifth consecutive quarter to $31bn, up 158 per cent year on year.

Despite the positive signs, however, executives are wary of getting carried away. Although bankers expect another window for deals after the US Labor Day holiday in September, most echo Ludwig’s view that it will take until late this year or into 2024 for activity to normalise — and even that assumes that no recession, interest rate moves or any other shock derails markets in the meantime.

Pete Giacchi, who leads Citadel Securities’ floor trading team at the New York Stock Exchange, said he was “cautiously optimistic” about the outlook, but said the balance of power was with investors rather than IPO candidates.

“Any time you are seeing $1bn raised in a week, you can see the market is open, [but] companies might have to take a different valuation to what they would have got a few years ago,” he said.

Investors are also continuing to avoid the sorts of fast-growing but heavily lossmaking companies that dominated the listings market in 2020 and 2021.

“There’s clearly been a regime change in terms of what the public markets are willing to underwrite,” said Greg Rice, a partner at Boston Consulting Group who advises IPO candidates. “Three years ago they were willing to underwrite businesses that weren’t going to be profitable for 10 years. Now they’re not.”

Even profitable groups must work hard to win over investors. Thrift store chain Savers Value Village raised $400mn, more than it had initially planned, but the two smaller deals that also started trading on Thursday had more lukewarm receptions.

Fidelis Insurance Group and Kodiak Gas Services both sold shares below their initial target range and dipped on their first day of trading.

“It’s a choppy market,” said Kodiak chief executive Mickey McKee. “Investors want a bigger discount [for a new listing] than traditionally they might, but it’s not a disappointment — this is a starting point for a long game.”

Fidelis chief Dan Burrows was similarly sanguine, noting that “the IPO market generally is tight . . . [but] we’re very confident that we can show outperformance over time.”

For some, the fact the deals could get done at all is a sign of how far conditions have improved. In contrast to low-risk carve-outs such as Kenvue, all three of Thursday’s deals included payments to private equity backers, and Fidelis involved an unusual corporate structure that Burrows said investors would need time to familiarise themselves with.

“It’s constructive to see difficult deals get done,” said BofA’s Cooney. “Even though some processes have lacked momentum, the ability to price these transactions is certainly a positive.”